Compare Commercial Property Loans from 50+ Australian Lenders

Finance the purchase, development or refinancing of offices, warehouses, retail or industrial properties with tailored loan options.

5.0 rating

Commercial Property Loans Made Simple

Tailored finance solutions for purchasing, developing or refinancing commercial property. Suitable for investors and businesses looking to secure long-term growth.

Borrow Big

Loans from $100,000 up to $50 million+

Flexible Terms

1 year to 30 year repayment options

Investment Ready

Designed for property investors and business owners

Lower Rates

Competitive pricing for secured commercial property loans

Range of Uses

Purchase, refinance, develop or upgrade properties

Tailored Structures

Term loans, interest-only or lines of credit

How it works

We match your application with commercial property lenders suited to your project or investment goals.

Apply online

Submit property details, loan purpose and financial information.

Get matched

Our Lender Match technology connects you with offers from Australia’s top lenders.

Provide documentation

Financial statements, tax returns and property valuations help finalise approval.

Settle and invest

On approval, funds are released to purchase, refinance or develop your property.

A quick guide to commercial property loans

Commercial property loans are designed to help Australian businesses and investors purchase, refinance or develop offices, warehouses, retail outlets and industrial facilities. With higher borrowing limits and flexible structures, these loans are secured against the property being purchased or developed.

Banks, credit unions and specialist lenders offer commercial loans in various formats—term loans, lines of credit, and interest-only facilities—tailored to different business needs. They provide the essential capital to expand operations, invest in assets, and build long-term wealth through property ownership.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of commercial property loans

Choose from different loan structures depending on your property plans:

What can I use a commercial property loan for?

Commercial property loans provide flexibility for business and investment purposes:

Purchasing Commercial Real Estate

Acquire offices, retail outlets, warehouses or industrial facilities for your business or investment portfolio. A commercial property loan helps you secure prime locations and build long-term equity while spreading the cost over manageable repayments.

Property Development

Finance the construction of new premises or large-scale renovations to existing properties. Development loans cover costs such as land purchase, building works and fit-outs, helping you bring projects to life and increase property value.

Refinancing Existing Loans

Replace an existing facility with a more competitive one, lowering repayments or extending terms. Refinancing can also unlock equity, reduce interest costs, and consolidate multiple loans into one manageable facility.

Expanding Business Premises

Upgrade or extend your current site to meet business growth. Commercial property finance supports extensions, fit-outs, and new facilities to help you service more customers and boost productivity without cash flow strain.

Investment Purposes

Grow your portfolio by purchasing properties that generate rental income and appreciate in value over time. Commercial property loans give you access to leveraged investment opportunities in high-demand locations and sectors.

Equity Release

Tap into the equity tied up in existing commercial property to fund other ventures. Released funds can be redirected into working capital, acquisitions or further property investments while maintaining ownership of the original asset.

Property Portfolio Diversification

Broaden your exposure across multiple property types such as retail, office and industrial assets. Using finance strategically allows you to balance risk and return across different sectors of the property market.

Upgrades and Improvements

Fund refurbishments, modernisation or energy-efficient improvements to increase tenant appeal and property value. Commercial property loans can cover fit-outs, technology upgrades and compliance works.

Land Acquisition

Purchase land for future development or long-term investment. Land loans can provide the capital to secure prime sites before development approval or construction begins.

Business Relocation

Move your business to a site that better supports your operations and growth. A commercial property loan provides the financial backing to secure and fit out new premises tailored to your needs.

Case Study

Sarah Lin, LogiFast Freight Solutions

Investing in a New Warehouse

Industry: Logistics

Challenge: Limited space and rising rental costs were constraining growth.

Solution: A 15-year commercial property loan with interest-only repayments for the first 2 years.

Sarah operates a logistics business that had outgrown its leased warehouse. Rising rents and space limitations were impacting profitability. With a commercial property loan secured through Emu Money, Sarah purchased a larger warehouse with interest-only repayments in the first two years, easing cash flow. The investment increased efficiency, reduced rental expenses, and gave the business a valuable appreciating asset.

How much can I borrow with a commercial property loan?

Loan sizes typically range from $100,000 to over $50 million in Australia. The amount depends on property type, valuation, loan-to-value ratio (LVR) and your financial position. Standard LVRs range from 60%–80% of property value. Lenders will also assess cash flow, rental income potential, credit history and overall debt position before determining borrowing capacity.

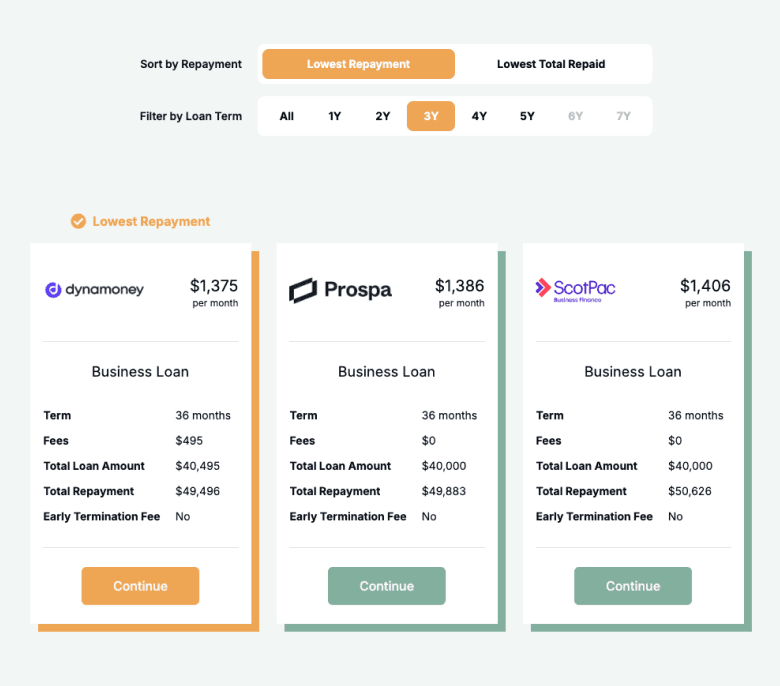

Commercial Property Loan Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term and interest rate to plan cash flow before you apply.

Balance over time

Am I eligible for a commercial property loan?

Eligibility varies by property type and lender criteria. Borrowers generally need to provide financials, demonstrate serviceability and offer a deposit or equity contribution. Stronger businesses or prime investment properties may access sharper rates and higher LVRs.

You may be eligible if you are:

An Australian citizen, resident or registered business

Able to provide a 20–40% deposit or existing equity

Trading profitably or with verifiable rental income

Providing financial statements and tax returns

Purchasing, refinancing or developing commercial property

How to apply for a commercial property loan?

Start with an online application including property and financial details. We’ll match you with lenders and help organise valuations and credit assessment. Approval depends on serviceability, LVR, and property type. Larger facilities may involve more detailed due diligence but can still settle quickly with the right preparation.

Documents you may need:

ABN and GST details

Photo ID (driver’s licence or passport)

Business financial statements and tax returns

Property details and valuation reports

Lease agreements (if investment property)

Business plan or development proposal (if applicable)

How to save money on a commercial property loan

Commercial property loans are significant commitments, so structuring them well saves money over time. Compare lenders on both rate and loan-to-value ratio, as small differences impact overall cost. Consider whether fixed or variable rates suit your situation—fixed provides certainty, while variable may be cheaper short term.

Interest-only periods can ease cash flow during development or initial investment, but cost more long term. Making extra repayments or negotiating flexible redraw facilities can reduce interest and improve liquidity. Always review fees—application, valuation, and break fees—to ensure the true cost of borrowing is transparent.

Understanding commercial property loan options

Lenders provide different structures depending on your strategy and needs:

Standard Commercial Loan

A traditional term loan secured against the property with principal and interest repayments. Suitable for long-term investments with predictable cash flow.

Interest-Only Loan

Repay only interest for a set period before principal begins, easing short-term cash flow—commonly used for development or initial investment stages.

Low-Doc Commercial Loan

Designed for self-employed or businesses without full financials. Usually capped at lower LVRs and higher rates to offset lender risk.

Line of Credit

Ongoing access to funds secured against property equity. Draw and repay as needed for working capital, expansions or opportunistic investments.

Testimonials

Verified Review

Brad was amazing to deal with — he went above and beyond in helping us with our funding needs. I highly recommend him to anyone!

ROJO C.

Verified Review

Brad was great from start to finish made the process very easy. Would have no hesitation in using emu money again. Thanks again Brad.

Toni B.

Verified Review

Peter was fantastic! Incredible responsive, provided clear instructions, and got us a very competitive rate. The whole process was so easy from start to finish. Can’t recommend Peter and Emu Money highly enough!

Katharina K.

Verified Review

I would like to highly recommend Eujin from Emu Money for the excellent service provided during my loan process. His guidance, professionalism, and clear communication made the entire experience smooth and stress-free. I truly appreciate his support and would confidently recommend Emu Money to anyone seeking loan assistance.

Chathushka H.

Verified Review

I had an excellent experience with Emu Money. Robyn was fantastic – professional, approachable, and genuinely easy to deal with from start to finish. She explained everything clearly, made the whole process stress-free, and went above and beyond to ensure I was comfortable with each step. It's rare to find someone so reliable and efficient. I'd highly recommend Emu Money, and especially Robyn, to anyone looking for great service and peace of mind

Cruize W.

Verified Review

Highly recommend, process was simple and quick! very nice fella Jackson 🤝🏼

Shayshay K.

Frequently Asked Questions

Commercial Property Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.