Compare Medical Equipment Finance from 50+ Australian Lenders

Acquire the medical equipment your practice needs without draining cash flow. Get real quotes in minutes with no impact on your credit score.

5.0 rating

Medical Equipment Finance Made Simple

Finance diagnostic machines, surgical tools, dental chairs and more. Flexible terms designed for Australian doctors, dentists, specialists, and healthcare providers.

Borrow With Confidence

Typical amounts from $5,000 to $500,000+

Flexible Terms

Loan terms from 1 to 7 years

Fast Approval

Funding often within 24–48 hours

Secured by Equipment

Keep rates low by securing against the asset

Tax Effective

Claim deductions on interest and depreciation

Any Healthcare Purpose

From imaging to IT solutions and patient care

How Medical Equipment Finance Works

We connect you with specialist lenders that support healthcare providers, giving you fast and flexible equipment funding.

Apply online in minutes

Tell us about your practice and the equipment you need. It takes just a few minutes.

Get matched offers

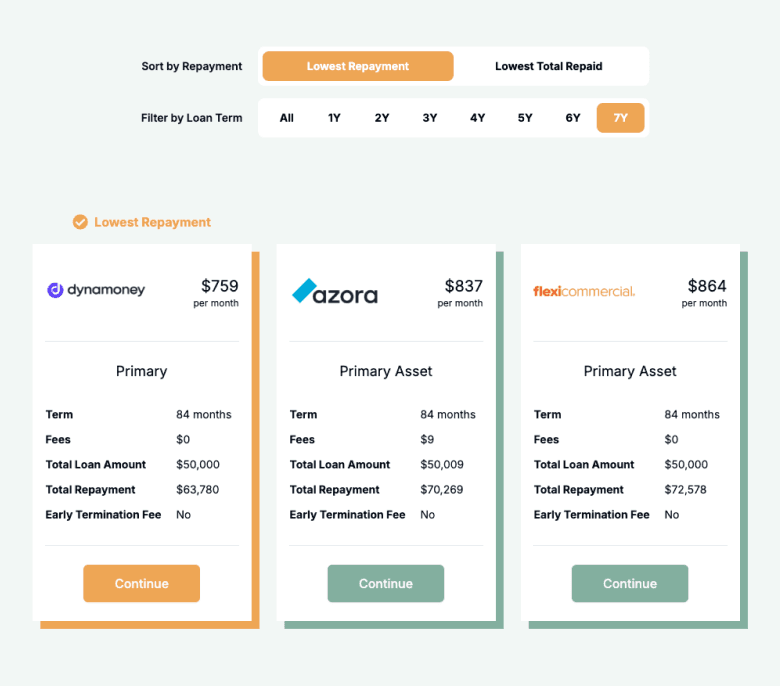

Our Lender Match technology finds quotes from multiple lenders suited to healthcare businesses.

Choose your finance option

Compare interest rates, fees and repayment terms to select the right loan for your practice.

Get approved & funded

Receive approval and funding within 24–48 hours, so you can upgrade quickly.

A quick guide to medical equipment finance

Medical equipment finance helps healthcare providers access the technology they need without paying upfront. Instead of tying up capital, repayments are spread over time to preserve cash flow for wages, rent, and patient services.

Loans are usually secured against the equipment, which allows lenders to offer more competitive rates and higher borrowing amounts. Terms often range from 1 to 7 years, and repayments can be structured to align with practice revenue cycles.

Finance can be used across many medical fields: from diagnostic imaging and surgical tools to dental chairs, physiotherapy equipment, and even software like electronic health records or telemedicine platforms.

For doctors, dentists, specialists and clinics, medical equipment finance ensures access to the latest technology, improves patient care, and supports business growth — without financial strain.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of medical equipment finance

Here are the most common medical equipment finance options available in Australia:

What can I use medical equipment finance for?

Finance can be used across a wide range of healthcare needs:

Diagnostic Imaging

Acquire X-ray machines, CT scanners, ultrasound systems and other imaging technology.

Surgical Instruments

Purchase essential surgical tools and operating theatre equipment.

Monitoring Devices

Fund patient monitors, ECG machines and other testing equipment.

Dental Equipment

Finance dental chairs, X-ray machines, and specialist instruments.

Medical Furniture

Cover the cost of examination tables, patient beds and furnishings.

Physio & Rehab

Acquire rehabilitation and physiotherapy devices such as treadmills and therapeutic tools.

Laboratory Equipment

Fund microscopes, centrifuges and analysers for diagnostic testing.

Mobile Medical Units

Finance ambulances and mobile clinics to serve remote areas.

Optical & Ophthalmic

Invest in optometry and ophthalmic equipment such as phoropters and lens edgers.

Medical IT & Software

Support electronic health records, management systems and telehealth platforms.

Case Study

Dr. Emily Tran, Bright Smiles Dental

Improving Patient Care with Finance

Industry: Dental Practice

Challenge: Outdated dental equipment impacting patient experience and efficiency.

Solution: A 5-year chattel mortgage secured against new dental chairs and imaging tools.

Dr. Emily runs a busy dental clinic in Melbourne. Her outdated equipment meant longer procedures and patient discomfort. Through Emu Money, she secured finance for new dental chairs and a digital X-ray machine using a chattel mortgage. Repayments were structured over 5 years, keeping cash flow manageable while improving service quality. The new equipment enhanced diagnostic accuracy, reduced treatment times, and improved patient satisfaction — boosting clinic growth and referrals.

How much can I borrow with medical equipment finance?

In Australia, medical equipment finance usually ranges from $5,000 for smaller devices up to $500,000+ for advanced diagnostic machines. The loan amount depends on the equipment’s purchase price, expected lifespan, and your practice’s financial position.

Because the loan is secured against the equipment, lenders are more willing to offer higher borrowing limits and better interest rates than unsecured loans.

Medical Equipment Finance Repayment Calculator

Estimate repayments and plan cash flow before applying. Adjust loan amount, term and interest rate to suit your needs.

Balance over time

Am I eligible for medical equipment finance?

Eligibility is generally straightforward as equipment is considered an income-generating asset. Lenders assess your credit profile, turnover, and practice history.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Running a registered medical, dental, or healthcare practice

Able to provide recent financials or bank statements

Hold an ABN (and GST registration if required)

How to apply for medical equipment finance

Complete a quick online application to see instant quotes from multiple lenders. Select your preferred option, submit documents, and funding can be arranged within 24–48 hours.

Documents you may need:

ABN and GST registration details

Photo ID (passport or driver’s licence)

Recent practice bank statements

Tax returns or financials (for larger loans)

How to save money on medical equipment finance

To save money, compare offers across multiple lenders as interest rates and fees vary widely. Choosing a shorter term reduces overall interest costs, though repayments are higher. Longer terms ease cash flow but increase total costs.

Check for hidden costs like establishment fees or early repayment penalties. If your practice has stable revenue, making additional repayments or paying off early can reduce interest expenses.

Finally, align repayment frequency with your patient billing cycles (weekly, fortnightly, monthly) to avoid stress and late payment fees.

Example: $100,000 financed at 7.95% p.a.:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

24 months | $4,519 | $108,463 |

36 months | $3,132 | $112,771 |

48 months | $2,454 | $117,790 |

60 months | $2,015 | $120,916 |

Understanding medical equipment finance options

Medical equipment finance comes in many forms, and understanding how they work can help you choose with confidence:

Security: Asset-backed

Most loans are secured by the equipment itself, giving lenders confidence and lowering interest rates compared to unsecured products.

Personal Guarantee

Some lenders require a personal guarantee from the doctor, dentist, or director, making you personally responsible if repayments aren’t met.

Term: Fixed vs Revolving

Most medical finance is offered as fixed-term loans (1–7 years). Some leases allow ongoing use with end-of-term options.

Interest Structure

Fixed rates are common, giving predictable repayments. Variable rates exist but are less common in healthcare lending.

Fees & Charges

Check for establishment fees, ongoing charges, and early termination costs. These can vary significantly between lenders.

Repayment Frequency

Choose weekly, fortnightly, or monthly repayments. Aligning with your billing cycle (e.g., Medicare payments) helps manage cash flow.

Testimonials

Verified Review

Emu Money is fantastic! I had Evie secure my personal car loan, and throughout the whole process she was very transparent. She gave me a comprehensive breakdown of the contract and guided me through the process. She's always available to chat, and is dedicated to her clients. She even advised me about my cash out limit that I didn't think of, which would've delayed me getting my car by another day. This reminded me to go to the bank directly. Her advice helped me a lot!

Akwesi A.

Verified Review

Robyn from Emu was a pleasure to deal with and was honest in her approach and recommendations. Loan was completed in line with the expectations set.

Kerry B.

Verified Review

Stevie was amazing she made the entire process smooth, not stressful and easy everything she requested wasn’t hard to complete, she worked around me she gave me advice or what to look for in a car she shared some good places to find a car she shared her experience with insurance she was amazing and went above and beyond. It isn’t always easy sharing things with someone when it comes to your personal affairs but she made me feel welcome to share you have a start worker and I really do believe she deserves a pay bonus

Tania W.

Verified Review

We would like to thank Evette from Emu Money. We have used Evette 3 times for car and personal loans and will not use anyone else. Her commitment to her customers is second to none. Evette has always come up with a solutions even in the difficult circumstances. Her communication to us was outstanding on each occasion and made us feel at ease through the processes without judgement. Love your work !!! Jason & Karen

jason c.

Verified Review

I couldn't be happier with the service I received! Robyn made the whole car finance process so simple and stress free. She explained everything clearly, kept me updated the whole way through, and went above and beyond to find me the best deal. I honestly didn't think it would be this smooth, but she took care of all the hard work and I was in my new car before I knew it. Highly recommend to anyone looking for finance.

harry b.

Verified Review

It's nice, quick and easy to get a new equipments through Emu Money. Big thanks to Brad for his great assistance.

Marvin Y.

Frequently Asked Questions

Medical Equipment Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.