Compare Motorbike Loans from 50+ Australian Lenders

From cruisers to dirt bikes, get on the road or trail faster with flexible repayments that suit your budget.

5.0 rating

Motorbike Finance Made Simple

Whether you’re chasing a new Harley, Yamaha, Ducati or KTM dirt bike, we’ll help you find the right loan to make it yours.

Borrow What You Need

Loan sizes typically range from $2,000 to $50,000+

Flexible Terms

1 to 7-year options depending on your budget

Quick Approvals

Get a fast decision and ride away sooner

New or Used

Dealers, auctions and private sellers supported

Fixed Repayments

Know exactly what’s due each month

Bundle Extras

Gear, accessories and insurance can sometimes be included

How it works

We take the hassle out of financing a motorbike — compare offers, pick the best, and ride away sooner.

Apply online in minutes

Tell us about yourself and the bike you’re looking at.

See matched options

Compare secured and unsecured loans side by side.

Upload documents

ID, proof of income and bank statements are usually enough.

Settle & ride away

We arrange settlement with the seller so you can collect your bike.

A quick guide to motorbike finance

A motorbike loan lets you hit the road without having to pay the full price upfront. Whether you’re after a new road bike, dirt bike, scooter or even a collector’s classic, you can borrow the funds and repay them in manageable instalments over 1–7 years.

Lenders will look at your income, credit history and the bike’s age/value to determine how much you can borrow and at what rate. Newer bikes often attract sharper rates, while used bikes are still financeable with slightly different terms. With the right loan, you can ride away now and pay it off at a pace that fits your budget.

Want to skip ahead?

This guide is broken down into sections. Click a link if you want to skip ahead.

Types of motorbike loans

Different loan structures offer different benefits — here are the common options:

What can you use a motorbike loan for?

Motorbike loans aren’t just for buying the bike — they can cover extras too.

New Bike Purchase

Finance a brand-new bike from the dealership and spread the cost over time.

Used Bike Purchase

Buy second-hand from a dealer or private seller with finance tailored to older bikes.

Dirt & Off-Road Bikes

Get the funds for a motocross or trail bike and hit the tracks or trails.

Classic & Collectors

Spread the cost of a classic or rare motorbike without draining your savings.

Upgrades & Mods

Finance custom parts, performance upgrades or cosmetic mods.

Safety Gear & Accessories

Bundle in helmets, riding gear or luggage systems as part of your loan.

Repairs & Maintenance

Cover the costs of major repairs or servicing without using your emergency savings.

Insurance & On-Road Costs

Some lenders allow registration, insurance and extras to be included in the loan.

Riding Lessons

Finance professional motorcycle training courses if you’re new to riding.

Case Study

Ethan

Ethan brings home a Ducati without raiding savings

Challenge: Ethan had his heart set on a brand-new Ducati Monster but wanted his cash buffer left alone for rego, insurance and life’s curveballs.

Solution: A secured 5-year loan on a fixed rate covered 90% of the price, with helmet, jacket and gloves bundled at settlement.

Emu Money compared lenders and Ethan picked a flat monthly cost that wrapped the bike and gear into one facility. Paperwork sorted, keys handed over, and the Monster was in his garage that evening—savings intact and no surprise expenses.

How much can you borrow with a motorbike loan?

Motorbike loans typically range from $2,000 up to $50,000+. Your limit will depend on your income, credit history, and the bike itself. Newer bikes and higher-value models may attract larger loan sizes, while older or niche bikes may come with caps or shorter terms.

Terms usually run from 1 to 7 years, giving you the choice between paying off faster with higher monthly costs or stretching repayments out to lower each instalment.

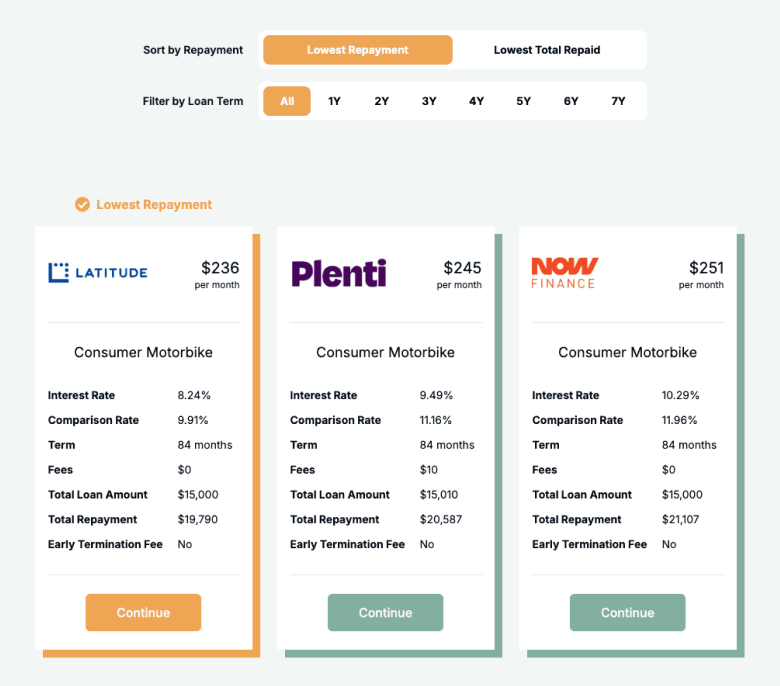

Motorbike Loan Repayment Calculator

Estimate what your repayments could look like. Adjust the loan amount, term, rate and balloon to plan ahead.

Balance over time

Are you eligible for a motorbike loan?

Lenders want to see that you can comfortably manage repayments. They’ll consider your income, credit score, employment stability and recent bank statements. The bike itself matters too — newer models usually unlock sharper pricing and longer terms. Used or older bikes may be financeable with slightly shorter terms or lower maximum amounts.

If your credit isn’t perfect or you’re new to riding, don’t stress — specialist lenders may still work with you.

You may be eligible if you are:

An Australian resident aged 18+

Earning a regular income (PAYG or self-employed)

Able to provide payslips or bank statements

Looking to buy a new or used motorbike from a dealer or private seller

How to apply for a motorbike loan

Applying is simple. Complete a quick online form, upload your documents, and we’ll match you with lenders. Once you’ve chosen your offer, we handle settlement with the seller so you can collect your bike straight away.

Documents you may need:

Driver’s licence or passport

Recent payslips or bank statements

Employment or ABN details

Motorbike details (VIN, rego, invoice or quote)

How to save money on a motorbike loan

To keep costs down, compare secured vs unsecured loans. Secured usually gives you a lower rate, while unsecured may offer more flexibility. A balloon payment can lower your monthly instalments but leaves a lump sum at the end — make sure you’ll be able to cover it. Newer bikes often qualify for sharper rates, while bundling extras like insurance, gear or mods into the loan means you pay one competitive rate instead of dipping into savings.

Example: Balloon impact — $15,000 over 48 months at 8.79% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $372 | Highest monthly cost |

10% ($1,500) | $335 | Lower monthly cost |

20% ($3,000) | $298 | Balance of cost vs flexibility |

30% ($4,500) | $261 | Lowest monthly cost; plan ahead for balloon |

Motorbike loan options explained

Here’s how different features can affect your loan:

Secured vs Unsecured Loans

Secured loans use the bike as collateral for sharper rates. Unsecured loans may be faster but usually come with higher rates.

Fixed vs Variable Rates

Fixed gives you certainty with steady repayments. Variable can save money if rates fall, but costs may rise if they increase.

Balloon Payments

Choose a lower monthly cost with a balloon at the end — just be sure you have a plan to clear it.

Early Repayment Flexibility

Some lenders let you pay extra or finish early without penalty, saving you interest.

Fees & Charges

Always check establishment, service and exit fees — they can add up to more than you think.

Testimonials

Verified Review

Emu Money is an excellent choice for anyone seeking a personal loan. The website is user-friendly and makes the loan process straightforward and hassle-free. I've also heard similar positive feedback from friends who have used the site. Thank you Emu!

Taz A.

Verified Review

Straight to the point and super friendly, got off the phone with Peter late one afternoon and midday the next day the money has hit my account. Incredible service and super helpful

Tyler R.

Verified Review

Rachel Connors from Emu Money was absolutely amazing from start to finish. Her dedication and fast approach made sure everything ran smoothly. She knew all the answers to any questions, and made sure she kept me informed during the whole process. Would highly recommend Rach for all your finance needs.

jennifer s.

Verified Review

I had Baron as my broker for a car loan, and the entire process was incredibly smooth and straightforward. All I had to do was answer a few questions and provide the necessary documents — Baron handled the rest. Before I knew it, I was finalizing the paperwork for my new car. Highly recommend — really appreciate all your help, Baron!

Donna C.

Verified Review

Thanks for all your help and dedication, it was super fast and easy to get my vehicle load approved and they found my vehicle in less then a day. smooth ans swift thanks Peter!

Barend B.

Verified Review

The process with Emu Money has been fantastic — completely stress-free. Thank you EMU Money I cannot thank the team enough. Having been given an opportunity to get a loan when my bank turned us away. The service team has been absolutely brilliant. When you've become used to waiting times of an hour or more with other companies - I don't think I have waited more than a couple of minutes for this team. Plus, their phone staff are so nice to deal with. Great job. I just had to acknowledge it.

Pardeep M.

Frequently Asked Questions

Motorbike Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.