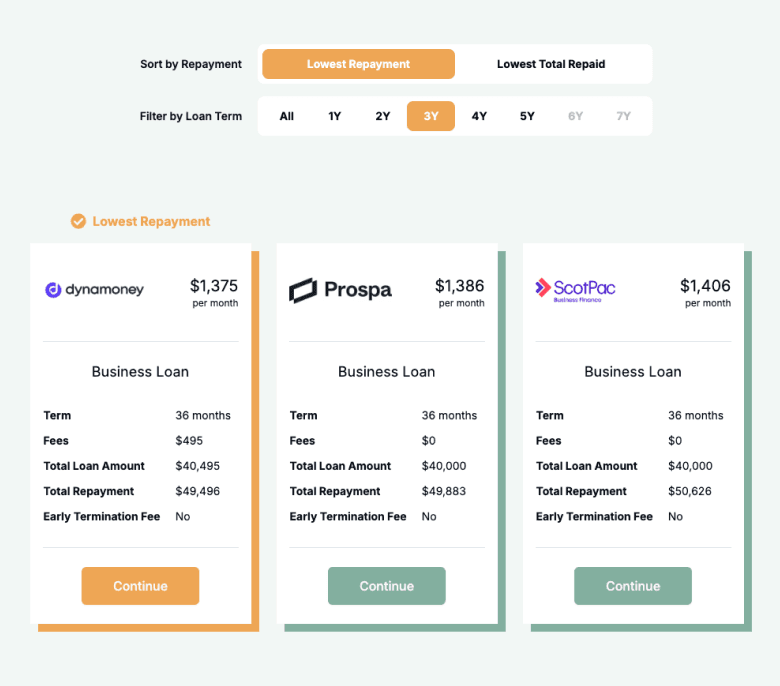

Compare Small Business Loans from 50+ Australian Lenders

Fuel growth, smooth cash flow and invest in your next step. Get real personalised quotes in minutes with no impact on your credit score.

5.0 rating

Small Business Loans Made Simple

Access flexible finance tailored to Australian SMEs and sole traders. Choose from unsecured or secured loans, lines of credit and overdrafts—built around your cash flow and goals.

Borrow With Confidence

Typical amounts from $5,000 to $1,000,000+

Flexible Terms

3 months up to 7 years

Fast Decisions

Approvals possible within 24 hours

Secured or Unsecured

Use assets for sharper pricing—or go asset-free

Tailored Pricing

Rates matched to turnover and credit profile

Any Business Purpose

Growth, equipment, stock, marketing and more

How it works

We match your application to small business loan options from 50+ Australian lenders so you can compare and choose with confidence.

Apply online in 3 minutes

Tell us about your business, turnover and funding goals. No lengthy forms.

See matched options

Our Lender Match technology compares unsecured, secured and revolving options in minutes.

Upload documents

Bank statements, IDs and financials (if needed) to finalise your application.

Get approved & funded

Fast decisions and funding—often within 24 hours for eligible applications.

A quick guide to small business loans

Small business loans help Australian SMEs access capital for growth, working capital and one-off investments. Products range from unsecured fixed-term loans to secured facilities backed by property, vehicles or equipment, along with revolving options like lines of credit and overdrafts.

Your rate and loan size are typically based on turnover, cash-flow stability, time in business and credit history. Secured loans can unlock larger amounts and sharper pricing, while unsecured loans prioritise speed and simplicity.

Used well, a small business loan is a strategic tool: bringing forward important investments—like hiring, fit-outs, marketing or inventory—so you can capture opportunity and keep operations running smoothly.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of small business loans

Choose the structure that fits your cash flow and plans:

What can I use a small business loan for?

Flexible finance you can direct to what matters most:

Working Capital

Cover payroll, rent, supplier invoices and day-to-day costs to keep operations steady.

Expansion & Fit-outs

Open a new site, renovate premises or boost capacity to meet demand.

Equipment & Vehicles

Purchase or upgrade machinery, tools, vehicles and technology to improve productivity.

Inventory & Seasonal Stock

Buy in bulk, secure discounts and prepare for peak trading periods.

Marketing & Advertising

Invest in digital campaigns, local marketing and brand building to drive sales.

Hiring & Training

Add headcount or upskill your team to accelerate growth.

Debt Consolidation

Roll multiple obligations into one manageable repayment and simplify cash flow.

Emergency Expenses

Handle unexpected repairs and costs without disrupting operations.

Technology Upgrade

Modernise software, POS and infrastructure to streamline processes.

Case Study

Sofia Nguyen, Glow & Co. Studio

From Busy to Booming with a Small Business Loan

Industry: Services

Challenge: Strong demand but cash-flow gaps holding back hiring and a shop refit.

Solution: A 36-month unsecured term loan with weekly repayments and no early payout penalties.

Sofia runs a growing hair and beauty studio. Bookings were up, but the team was stretched and the space needed a refresh. She compared options via Emu Money and chose a 36-month unsecured loan with predictable weekly repayments. Funds covered a light refit, new chairs and two new stylists. Revenue increased within months and Sofia made extra repayments to finish early—without cash-flow stress.

How much can I borrow with a small business loan?

Loan sizes typically range from $5,000 to $1,000,000+, depending on turnover, time in business, profitability, security offered and credit profile. Unsecured loans commonly cap between $5,000 and $500,000, while secured loans (e.g., property or equipment) can extend higher limits and sharper pricing.

Aim for a repayment that fits comfortably within your cash-flow—so the loan accelerates growth without adding pressure.

Small Business Loan Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term and interest rate to plan cash flow before you apply.

Balance over time

Am I eligible for a small business loan?

Eligibility varies by product and lender. Unsecured options prioritise recent bank-statement health, turnover and credit. Secured loans may require property, vehicles or equipment as collateral for larger amounts and lower rates.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Trading for at least 6 months (12+ months preferred for larger limits)

Minimum monthly turnover of $5,000–$10,000

ABN active and GST-registered (in most cases)

How to apply for a small business loan?

Complete a quick online application and get instant lender matches. Choose your preferred option and we’ll guide you through documentation and settlement. For eligible applications, funding can be arranged within 24 hours.

Documents you may need:

ABN and GST details

Photo ID (driver’s licence or passport)

Recent business bank statements

Financials for larger loans (BAS, P&L, tax returns)

Asset details if offering security

How to save money on a small business loan

Compare multiple offers—rates and fees vary widely. Secured loans often deliver lower pricing; unsecured loans trade a slightly higher cost for speed and flexibility.

Match the term to the asset life: shorter terms reduce total interest, while longer terms can ease cash-flow pressure. Align repayment frequency with your revenue cycle to avoid late fees. If your cash-flow improves, consider extra repayments or early payout—just check for break fees first.

Example: Total cost sensitivity — $75,000 at 9.95% p.a.:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

12 months | $6,593 | $79,118 |

24 months | $3,458 | $82,996 |

36 months | $2,420 | $87,129 |

48 months | $1,901 | $91,230 |

60 months | $1,591 | $95,470 |

Understanding small business loan options

Small business loans can be structured in different ways to balance cash flow needs, flexibility, and costs. Here are the main options:

Secured vs Unsecured

Secured loans require assets such as property or vehicles as collateral, offering higher limits and lower rates. Unsecured loans don’t need collateral, but usually cost more and have stricter eligibility requirements.

Fixed vs Variable Rates

Fixed-rate loans lock in predictable repayments, while variable rates can fluctuate with the market. Businesses often choose fixed for budgeting certainty, but variable rates may offer savings in a low-rate environment.

Term Length

Terms can range from 3 months to 7 years. Shorter terms reduce total interest paid but increase repayment amounts, while longer terms improve cash flow at the cost of paying more interest overall.

Repayment Flexibility

Some lenders allow weekly, fortnightly, or monthly repayments aligned with cash flow. Others may charge fees for early repayment or lump-sum contributions, so it’s important to confirm flexibility upfront.

Line of Credit vs Term Loan

Instead of a lump-sum loan, some businesses prefer a revolving line of credit. This provides ongoing access to funds up to a limit, helping cover cash flow fluctuations or ongoing expenses.

Testimonials

Verified Review

Amazing customer service experience only took short time thanks Ryan

daniel r.

Verified Review

I had the absolute pleasure of working with Bindiya Patel, and I can’t thank her enough for her immense help and outstanding service throughout the entire finance process. From the very beginning, she was professional, patient, and extremely knowledgeable, guiding me through every detail with genuine care. Bindiya went above and beyond to make sure everything was handled smoothly and efficiently. Her communication was always clear and prompt, and she made what could have been a stressful process feel easy and comfortable. I truly appreciate her dedication, honesty, and the personal touch she brings to her work. I would highly recommend Bindiya Patel to anyone looking for a trustworthy and supportive finance agent. She is simply amazing at what she does!

Jananie V.

Verified Review

I've got the best service at Emu Money and their willingness to help you out. Evette went out of her way to help assist for the desired results. I will highly recommend them to anyone. Evette's industry knowledge & service was exceptional! I highly recommend her & will definitely reach out should we need any financial services in the future. Thank you

Mazhar A.

Verified Review

I've worked with Brad for quite some time, and after 25+ years in business across Australia, I can say with confidence: professionals like him are rare, in his case, unique in the industry. Brad understands business, printers, people, and lenders better than anyone I've worked with. The advice he's given, the care he's shown, and the way he's gone above and beyond to make sure my customers get the best deal possible has made a real impact. Some of my customers haven't just grown, they have exceeded expectations. For me, that's the proof in the pudding.

Gus A.

Verified Review

S. B.

Verified Review

Brad was great from start to finish made the process very easy. Would have no hesitation in using emu money again. Thanks again Brad.

Toni B.

Frequently Asked Questions

Small Business Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.