Compare Machinery Finance Options from 50+ Australian Lenders

Access essential machinery and equipment without large upfront costs. Get personalised quotes in minutes with no impact on your credit score.

5.0 rating

Machinery Finance Made Simple

Finance new or used machinery with tailored options for Australian businesses. Preserve cash flow while upgrading equipment that drives efficiency and growth.

Borrow With Confidence

Amounts from $10,000 to several million

Flexible Terms

1 to 7 year loan terms available

Fast Approval

Funding often within 24–48 hours

Secured by Equipment

Lower rates when loans are backed by machinery

Industry Coverage

Construction, manufacturing, transport, healthcare and more

Tax Benefits

Potential deductions on interest and depreciation

How Machinery Finance Works

We connect you with lenders that specialise in machinery and equipment loans, so you can compare and apply with confidence.

Apply online in minutes

Enter details about your machinery purchase and business needs.

Get matched offers

Receive quotes from multiple lenders suited to your industry.

Choose your loan

Compare terms, rates and repayment options to select the best fit.

Get approved & funded

Approval and funding can occur within 24–48 hours.

A quick guide to machinery finance

Machinery finance helps Australian businesses acquire essential equipment without tying up capital. Repayments are spread over time, freeing cash for staff, operations, or growth initiatives.

Loans are usually secured against the machinery, allowing lenders to offer competitive rates and larger borrowing limits. Terms typically range from 1 to 7 years, with flexibility in repayment frequency.

Finance covers a wide range of industries: construction firms can acquire cranes and excavators, manufacturers can upgrade CNC machines, logistics companies can expand vehicle fleets, and healthcare providers can fund diagnostic systems.

For businesses of all sizes, machinery finance provides access to modern, reliable equipment that supports productivity and growth without financial strain.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of machinery finance

Here are the most common machinery finance products available to Australian businesses:

What can I use machinery finance for?

Machinery finance can be applied across a wide range of industries and equipment needs:

Equipment Purchase

Buy new or used machinery essential for your business operations.

Upgrade or Replacement

Replace ageing machinery with modern, efficient models to boost productivity.

Expansion Projects

Acquire additional equipment to support business growth and new contracts.

Technology Investments

Invest in automation, robotics, or advanced manufacturing machinery.

Construction Equipment

Fund excavators, cranes, bulldozers and other heavy machinery.

Manufacturing Equipment

Finance CNC machines, 3D printers, or full production lines.

Transportation Vehicles

Acquire trucks, vans, forklifts and other transport machinery.

Medical Equipment

Healthcare providers can finance diagnostic, imaging or surgical machines.

Agricultural Machinery

Fund tractors, harvesters, and irrigation systems for farming.

Hospitality Equipment

Purchase kitchen equipment, refrigeration, or large appliances for service businesses.

Case Study

Sanjay Patel, Brightside Constructions

Scaling a Construction Firm with Machinery Finance

Industry: Construction

Challenge: Unable to take on larger projects due to outdated and limited equipment.

Solution: A 5-year chattel mortgage secured against two new excavators and a crane.

Sanjay runs a mid-sized construction company in Queensland. He faced frequent downtime and lost contracts due to ageing equipment. Through Emu Money, he compared lenders and secured a 5-year chattel mortgage for new excavators and a crane. Repayments were structured to align with project cash flow. With modern machinery, the company improved efficiency, won larger contracts, and grew revenue significantly — while managing repayments predictably.

How much can I borrow with machinery finance?

Machinery finance in Australia typically ranges from $10,000 for smaller equipment to several million dollars for large-scale projects. The borrowing limit depends on machinery type, cost, age, and your business’s financial position.

Because the loan is usually secured against the equipment, lenders can offer higher borrowing limits and better rates than unsecured products.

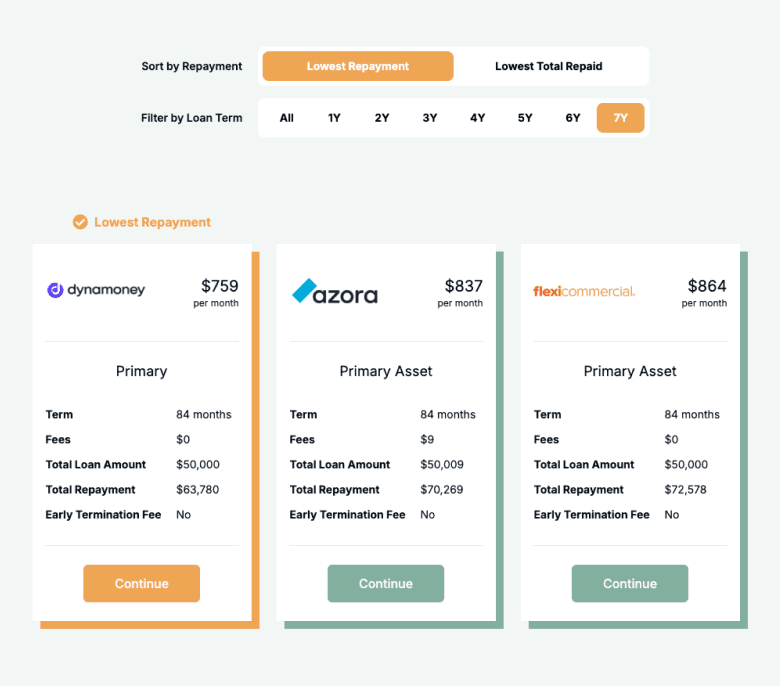

Machinery Finance Repayment Calculator

Estimate repayments and total cost. Adjust loan amount, term and rate to plan cash flow before you apply.

Balance over time

Am I eligible for machinery finance?

Eligibility depends on the machinery type and your business’s financial health. Lenders assess turnover, bank statements, and repayment history before approving applications.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Running a registered business

Able to provide recent bank statements

Hold an ABN (and GST registration if required)

How to apply for machinery finance

Apply online in minutes and get quotes from multiple lenders. Select your preferred option, upload documents, and funding is often arranged within 24–48 hours.

Documents you may need:

ABN and GST registration details

Photo ID (driver’s licence or passport)

Recent business bank statements

Tax returns or financials (for larger loans)

How to save money on machinery finance

To save on machinery finance, compare offers from multiple lenders. Shorter terms reduce interest but mean higher repayments, while longer terms ease cash flow but increase costs.

Check for establishment or early repayment fees that add to total expenses. If your business has strong revenue, making additional repayments can cut interest costs.

Align repayment schedules with your cash flow cycle to avoid late fees and financial stress.

Example: $250,000 financed at 7.95% p.a.:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

24 months | $11,281 | $270,744 |

36 months | $7,813 | $281,288 |

48 months | $6,125 | $294,000 |

60 months | $5,031 | $301,844 |

Understanding machinery finance options

Machinery finance products can differ in structure and cost. Here are key features to understand before applying:

Security: Asset-backed

Loans are usually secured against the machinery, lowering lender risk and improving rates.

Personal Guarantee

Some lenders require directors or owners to provide a personal guarantee for added security.

Term: Fixed vs Revolving

Most machinery loans are fixed-term, though revolving credit lines may be available for ongoing purchases.

Interest Structure

Fixed interest rates are common, providing repayment certainty. Variable rates are less common but possible.

Fees & Charges

Establishment fees, ongoing charges, and early termination costs can apply. Compare carefully.

Repayment Frequency

Repayments may be weekly, fortnightly or monthly. Align with your cash flow cycle for easier management.

Testimonials

Verified Review

We just got our truck loan they are very supportive and Eujin guide us in really good way we are happy with service really appreciate EUJIN cheers

Lky 2.

Verified Review

Brad has been absolutely amazing to work with to help with financing for our business! The process was very simple, well explained and Brad went out of his way to provide updates - highly recommended!

Karn P.

Verified Review

Highly recommend, process was simple and quick! very nice fella Jackson 🤝🏼

Shayshay K.

Verified Review

We recently had the pleasure of working with Eujin to secure a car loan, and we couldn't be more grateful for his assistance. Eujin went above and beyond to ensure we got the best possible terms. His professionalism, dedication, and willingness to help were evident throughout the entire process. Thank you, Eujin, for making this experience smooth and stress-free. Highly recommend his services!

Bstl 1.

Verified Review

Peter was fantastic! Incredible responsive, provided clear instructions, and got us a very competitive rate. The whole process was so easy from start to finish. Can’t recommend Peter and Emu Money highly enough!

Katharina K.

Verified Review

I made an enquiry with emu money and within 30 minute's, I had Ryan call me. He got the ball going straight away, and made everything so easy and was always keeping me updated with texts. I can not recommend this guy enough! Thanks again Ryan!

Ruairi M.

Frequently Asked Questions

Machinery Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.