Compare Ute Finance from 50+ Australian Lenders

Finance single or dual cab utes for your business with flexible structures like chattel mortgage, hire purchase, or lease. Sharp rates, fast approvals.

5.0 rating

Ute Finance Made Simple

Whether you’re a tradie, courier, or landscaper, a ute is often the backbone of your business. Finance options tailored to cash flow and asset life.

Borrow With Confidence

From $10,000 up to $150,000+ depending on profile and vehicle

Flexible Terms

1 to 7 year terms with optional balloons/residuals

Fast Approvals

Same-day approvals possible for eligible applications

New or Used

Finance available for dealer, auction, or private sales

Tax-Smart Structures

Chattel mortgage, hire purchase, lease options available

Work-Ready Fit-Outs

Can finance toolboxes, trays, racks, and signwriting

How it works

We match your application with lenders who specialise in business ute finance so you can compare options with confidence.

Apply online in 3 minutes

Share your business details, ute preference, and budget.

See matched options

Our Lender Match technology compares finance structures and rates.

Upload documents

Provide ID, ABN, and bank statements (or financials for higher limits).

Settle & collect

We liaise with the seller so you can drive away in your new ute.

A quick guide to ute finance

Ute finance helps Australian businesses and sole traders secure vehicles essential for day-to-day operations without draining cash reserves. Common structures include chattel mortgage (ownership from day one), hire purchase (ownership transfers at the end), and finance lease (use the ute during the term, with a residual).

Repayments and terms depend on turnover, credit profile, and the age/value of the vehicle. Many lenders allow balloons to lower repayments, matching costs to asset life. From construction and landscaping to courier services, the right ute finance structure ensures reliability and smooth cash flow.

Want to skip ahead?

This guide is broken into sections. Click below to skip ahead:

Types of ute finance

Choose the structure that best fits your business needs:

What can I use ute finance for?

Utes are one of the most versatile vehicles in Australia. Finance can cover work, transport, and specialist business needs.

Trades & Services

Finance dual-cab or single-cab utes with toolboxes, racks, and trays—ideal for plumbers, electricians, and builders.

Construction

Secure heavy-duty utes capable of hauling equipment, materials, and workers across worksites.

Delivery & Couriers

Get reliable vehicles to support parcel, logistics, and last-mile delivery businesses.

Landscaping & Gardening

Finance utes to transport soil, plants, and machinery, keeping jobs running smoothly.

Mobile Repairs & Maintenance

Set up fully equipped service vehicles for mobile mechanics or on-site repairers.

Fleet Expansion

Add multiple utes to your fleet to support business growth and contracts.

Case Study

Sophie T, GreenScape Landscaping

Balancing repayments with a balloon

Industry: Landscaping

Challenge: Needed a new dual-cab ute but wanted to keep repayments lean during the slower winter season.

Solution: Chattel mortgage with 60-month term and 25% balloon aligned to resale value.

A Melbourne landscaping company financed a dual-cab ute with tray and toolboxes. By structuring a balloon, they kept repayments low across the quieter months while preserving working capital for staff and supplies. The balloon is expected to be covered by resale at the end of term.

How much can I borrow with ute finance?

Typical facility sizes range from $10,000 to $150,000+ per vehicle. Limits depend on turnover, trading history, vehicle value, and your credit profile. Many lenders fund up to 100% of purchase price for new vehicles, while older models may attract shorter terms and lower LVRs.

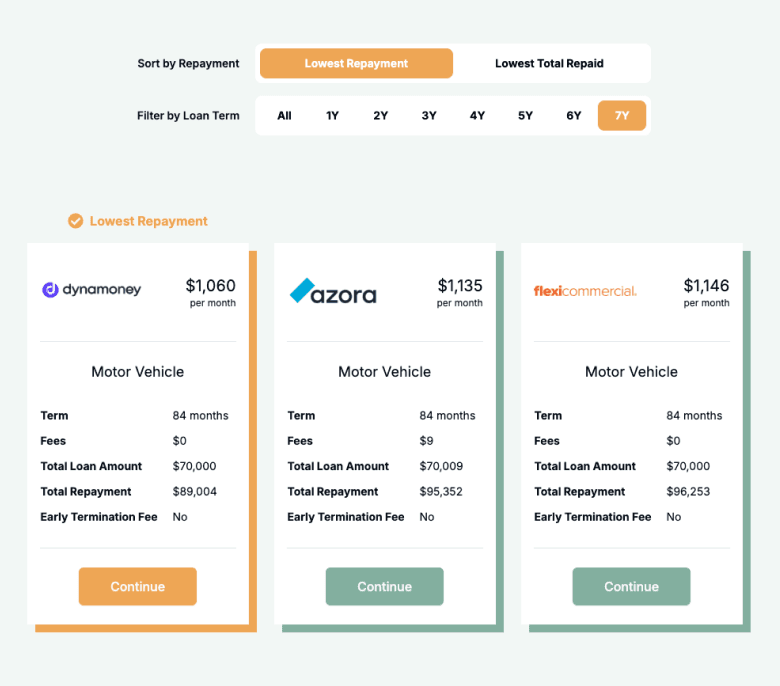

Ute Finance Repayment Calculator

Estimate repayments and total costs before you apply. Adjust amount, rate, term, and balloon to fit cash flow.

Balance over time

Am I eligible for ute finance?

Eligibility focuses on serviceability and vehicle suitability. Newer utes generally qualify for sharper pricing and longer terms. Solid bank statements and stable turnover improve approval odds.

You may be eligible if you are:

An Australian business with active ABN (GST preferred for larger limits)

Over 18 years old

Trading for at least 6–12 months (case-by-case for start-ups)

Minimum monthly turnover of $5,000–$10,000

Purchasing an eligible vehicle (single cab, dual cab, 4x4, light commercial)

How to apply for ute finance?

Complete our online application in minutes. We’ll compare offers from specialist ute lenders, then arrange settlement directly with the seller.

Documents you may need:

ABN and GST details

Photo ID (licence or passport)

Business bank statements (3–6 months)

Tax returns or BAS (for higher limits)

Vehicle details (VIN, rego, invoice or quote)

How to save money on ute finance

Compare structures (chattel mortgage vs lease vs hire purchase) as rates, tax treatment, and cash flow outcomes differ. Balloons can reduce monthly repayments but ensure they match expected resale. Financing accessories like trays and toolboxes at settlement can also be cheaper than adding them later. Newer vehicles generally qualify for sharper pricing, while avoiding unnecessary add-ons keeps total costs down.

Example: Balloon impact — $50,000 over 60 months at 8.49% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $1,027 | Highest monthly cost |

10% ($5,000) | $936 | Lower monthly cost |

20% ($10,000) | $845 | Balance of cost vs cash flow |

30% ($15,000) | $754 | Lowest monthly cost; ensure resale value covers balloon |

Understanding ute finance options

Finance for utes can be structured in different ways depending on your business needs and cash flow strategy:

Secured vs Unsecured

Most ute finance is secured against the vehicle, lowering rates. Some unsecured options exist but usually with higher costs.

Balloon/Residual Payments

Keep repayments lower by deferring a lump sum to the end. Refinance, pay out, or trade-in when due.

Fixed vs Variable Rates

Fixed rates provide repayment certainty. Variable may save money if rates fall, but add risk if they rise.

Early Repayment Flexibility

Some lenders allow early payouts or extra repayments, while others charge fees—important for fleet upgrades.

Bundled Accessories

Toolboxes, racks, trays, or signwriting can often be financed at the same rate as the ute itself.

Testimonials

Verified Review

I got my car loan approved within very short period of time , Bindia is very cooperative and friendly, and always gives right financial advice. Highly recommended.

ankur p.

Verified Review

We would like to thank Evette from Emu Money. We have used Evette 3 times for car and personal loans and will not use anyone else. Her commitment to her customers is second to none. Evette has always come up with a solutions even in the difficult circumstances. Her communication to us was outstanding on each occasion and made us feel at ease through the processes without judgement. Love your work !!! Jason & Karen

jason c.

Verified Review

Brad has been absolutely amazing to work with to help with financing for our business! The process was very simple, well explained and Brad went out of his way to provide updates - highly recommended!

Karn P.

Verified Review

Jackson helped me to get into a brand new car when no one else would consider me for a loan. Very happy with the service he provided.

jodie d.

Verified Review

Eujin was extremely easy to work with. He was respectful, clear in communication and persuasive. He works to get the best deal for his clients.

Chetan P.

Verified Review

We had an excellent experience working with Stevette Gelavis from Emu Money. She was absolutely outstanding—providing clear and comprehensive information from the very beginning and demonstrating professionalism, fairness, and genuine helpfulness throughout the process. After having disappointing experiences with other loan providers who quoted us unreasonably high rates, Stevette secured us a much better rate. Thank you, Stevette, for your exceptional service and for restoring our confidence in loan providers. You’re doing a fantastic job!

Indu

Frequently Asked Questions

Business Ute Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.