Compare Business Car Loans from 50+ Australian Lenders

Finance cars, utes and vans for your business with sharp rates and flexible structures like chattel mortgage, hire purchase and finance lease.

5.0 rating

Business Car Loans Made Simple

Get the right vehicle finance for your ABN—new or used, dealer or private sale. Structures tailored to cash flow, tax and asset life.

Borrow With Confidence

Typical amounts from $10,000 to $500,000+

Flexible Terms

1 to 7 year terms with optional balloons

Fast Approvals

Same-day decisions possible for eligible deals

New or Used

Dealer, auction or private sellers supported

Tax-Smart Structures

Chattel mortgage, hire purchase, finance lease

Any Business Purpose

Sales reps, trades, delivery, executive vehicles

How it works

We match your application to business car lenders so you can compare rates, terms and structures with confidence.

Apply online in 3 minutes

Share your business details, vehicle info and budget. No lengthy forms.

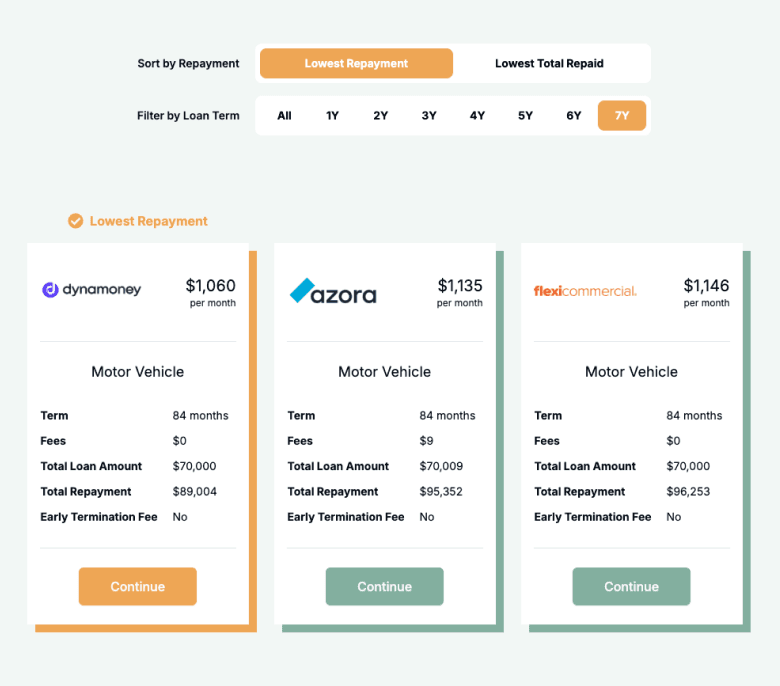

See matched options

Our Lender Match technology compares chattel mortgage, hire purchase and lease options.

Upload documents

Provide ID, ABN/GST details and recent bank statements or financials for larger limits.

Settle & collect

We arrange settlement with the seller so you can drive away sooner.

A quick guide to business car finance

Business car finance helps Australian SMEs and sole traders acquire vehicles without a large upfront hit to cash flow. Common structures include chattel mortgage (you own the vehicle from day one), commercial hire purchase (ownership transfers at the end), and finance lease (use the vehicle while making lease rentals, with a residual).

Pricing and structure depend on turnover, time in business, credit profile, and vehicle age. Optional balloons/residuals can lower repayments to match the asset’s useful life. Whether you’re buying a single ute or building a fleet, the right structure keeps cash flow smooth while preserving working capital.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of business car loans

Choose a structure aligned to tax treatment, ownership and cash flow:

What can I use a business car loan for?

Business car loans can finance a wide range of vehicles and fit-outs tailored to the needs of Australian businesses. From sales fleets and service utes to executive sedans and eco-friendly electric vehicles, lenders provide structured finance to help businesses access the right vehicles without compromising cash flow.

Company & Executive Cars

Secure sedans, hatchbacks, or SUVs for everyday business use, including executive travel, client meetings, and professional presentations. Having reliable company cars projects credibility to clients, supports efficient travel for staff, and helps businesses manage vehicle expenses through predictable repayments.

Trades & Service Vehicles

Finance utes, vans, or dual-cab vehicles fitted with canopies, toolboxes, and specialised racks. Ideal for tradies, construction firms, electricians, and plumbers who need vehicles tough enough to carry equipment and present a professional image when arriving at job sites.

Delivery & Logistics

Obtain light commercial vehicles and delivery vans to manage last-mile logistics, courier services, and eCommerce fulfilment. Business car loans help you expand delivery capacity, maintain reliable service for customers, and upgrade to vehicles that lower operating costs.

Sales Fleet

Build or expand a fleet of economical, fuel-efficient cars for your sales or service representatives. A financed fleet ensures your staff can reach customers across Australia, boosting productivity while keeping repayments aligned to revenue cycles.

Specialty Fit-outs

Customise vehicles for specific industries such as food trucks, refrigerated vans, mobile workshops, or on-site repair units. Financing allows you to roll purchase costs and modifications into one facility, spreading repayments while keeping your vehicles fully equipped for business needs.

Green Upgrades

Invest in hybrid or electric vehicles (EVs) to reduce fuel costs and meet sustainability goals. Business car loans can also finance EV chargers, accessories, and green technology upgrades—helping your business transition to eco-friendly transport with long-term savings.

Case Study

Ethan Ward, Ward Plumbing Co.

Right-sized repayments with a balloon

Industry: Trades & Services

Challenge: Needed two new utes but wanted to keep monthly costs lean during winter.

Solution: Chattel mortgage, 60-month term with a 30% balloon aligned to resale value.

A plumbing business in Melbourne replaced two ageing utes. Through Emu Money they compared options and chose a chattel mortgage with a balloon to reduce monthly repayments. The lower instalments matched seasonal cash flow, and the expected resale value covers most of the balloon at term end.

How much can I borrow with a business car loan?

Typical facility sizes range from $10,000 to $500,000+ per vehicle. Limits depend on turnover, time in business, vehicle age/value and your credit profile. Many lenders offer up to 100% of the purchase price (plus on-roads and accessories) for newer vehicles; older vehicles may have lower maximum LVRs and shorter terms.

Business Car Loan Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term, rate and balloon to plan cash flow before you apply.

Balance over time

Am I eligible for a business car loan?

Eligibility focuses on serviceability and vehicle suitability. Newer vehicles generally attract sharper pricing and longer terms. Strong bank-statement health and stable trading history improve approval odds.

You may be eligible if you are:

An Australian business (ABN active; GST for most facilities)

Over 18 years old

Trading for 6–12 months (start-ups considered case-by-case)

Minimum monthly turnover of $5,000–$10,000

Purchasing an eligible vehicle (passenger, ute, van, light commercial)

How to apply for a business car loan?

Complete a quick online application and upload documents. We’ll source multiple offers across chattel mortgage, hire purchase and lease options, then coordinate settlement with the seller.

Documents you may need:

ABN and GST details

Photo ID (driver’s licence or passport)

Business bank statements (3–6 months)

Tax returns/BAS for larger limits

Vehicle details (VIN, rego, invoice/quote)

How to save money on a business car loan

Compare structures as well as rates—chattel mortgage vs lease vs hire purchase can change cash-flow, tax treatment and total cost. A modest balloon/residual can lower repayments; just ensure the final amount aligns with expected resale value. Newer vehicles often qualify for sharper pricing. Avoid add-on fees you don’t need, and consider extras (signwriting, racks, canopies) at settlement so they’re financed at the same rate.

Example: Balloon impact — $60,000 over 60 months at 8.49% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $1,232 | Highest monthly cost |

10% ($6,000) | $1,123 | Lower monthly cost |

20% ($12,000) | $1,014 | Balance of cost vs cash flow |

30% ($18,000) | $905 | Lowest monthly cost; plan for resale to clear balloon |

Understanding business car finance options

Car finance for business vehicles can be structured in different ways, depending on how you want to manage repayments, ownership, and tax benefits. Here are the key options:

Secured vs Unsecured Loans

Most business car loans are secured against the vehicle, which reduces lender risk and delivers sharper rates. In some cases, unsecured car loans are available, offering faster approvals and flexible use of funds, but usually at higher interest rates and lower borrowing limits.

Chattel Mortgage

One of the most common structures for business car finance, a chattel mortgage gives your business ownership of the car from day one. The loan is secured against the vehicle, and repayments may be structured to maximise cash flow. GST on the purchase price may also be claimable upfront.

Finance Lease

With a finance lease, the lender owns the car and your business leases it for a set term, with the option to buy at the end. This allows you to keep capital free while accessing vehicles quickly. Lease payments are usually tax-deductible as operating expenses.

Balloon or Residual Payments

Many lenders allow balloon or residual payments at the end of the term. This lowers regular repayments and helps with short-term cash flow. At the end, you can pay out the balloon, refinance it, or upgrade the vehicle. It’s a popular structure for managing budgets and fleet turnover.

Fixed vs Variable Rates

Business car loans can be taken with either fixed or variable rates. Fixed rates provide repayment certainty, helping with budget planning, while variable rates may offer savings if market rates fall. The right choice depends on your risk tolerance and financial strategy.

Early Repayment Flexibility

Some business car loans allow you to pay off the loan early or make extra repayments without penalty, while others charge fees. Early repayment flexibility can save on interest and give you more control over your finance strategy, particularly if cash flow improves or you plan to upgrade vehicles sooner.

Testimonials

Verified Review

I had an amazing experience with Wendy Fonseka from Emu Money! Wendy guided me through the refinancing of my personal loan, helping me secure a much better interest rate and significantly lower repayments. Her efficiency, reliability, and professionalism were outstanding every step of the way. I'm incredibly grateful for her support and can't recommend her highly enough. I'll definitely be spreading the word to friends and family—thank you, Wendy!

Raam G.

Verified Review

I was completely impressed with their professionalism and customer service.. highly recommend. Special Mention to Ray thank you for assisting me in this journey

David A.

Verified Review

I've got the best service at Emu Money and their willingness to help you out. Evette went out of her way to help assist for the desired results. I will highly recommend them to anyone. Evette's industry knowledge & service was exceptional! I highly recommend her & will definitely reach out should we need any financial services in the future. Thank you

Mazhar A.

Verified Review

Peter was very quick, responsive and easy to deal with. Great experience, and we're picking up our new car tomorrow!

Olivia F.

Verified Review

We recently had the pleasure of working with Eujin to secure a car loan, and we couldn't be more grateful for his assistance. Eujin went above and beyond to ensure we got the best possible terms. His professionalism, dedication, and willingness to help were evident throughout the entire process. Thank you, Eujin, for making this experience smooth and stress-free. Highly recommend his services!

Bstl 1.

Verified Review

Emu money is fast and reliable Thanks Ryan for your help Highly recommended for your finance needs

Nabi S.

Frequently Asked Questions

Business Car Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.