Compare Unsecured Business Loans from 50+ Australian Lenders

Access funds without pledging collateral. Get real personalised quotes in minutes with no impact on your credit score.

5.0 rating

Unsecured Business Loans Made Simple

Get fast working capital without using property or business assets as security. Ideal for SMEs, sole traders and growing businesses that need speed, flexibility and certainty.

Borrow With Confidence

Typical amounts from $5,000 to $500,000

Flexible Terms

Loan terms from 3 months up to 5 years

Fast Approval

Funding possible within 24 hours

No Collateral Needed

Access finance without pledging assets

Tailored Pricing

Rates from 9.95% matched to your profile

Any Business Purpose

Use for growth, cash flow or unexpected costs

How it works

We match your application to unsecured options from 50+ Australian lenders so you can compare and choose with confidence.

Apply online in 3 minutes

It takes only three minutes to enter your details so we can match you with our panel of lenders. No lengthy questions.

Get your quote

Our Lender Match technology matches you with quotes from multiple lenders, so you can pick the best product for your circumstances.

Upload documents

Once you’ve chosen your preferred quote, we’ll let you know what documents are required to complete your application.

Get approved

Get approved and receive funds within 24 hours.

A quick guide to unsecured business loans

An unsecured business loan is a type of finance that gives your business access to capital without needing to provide assets such as property, vehicles, or equipment as security. This makes them especially attractive to Australian SMEs, sole traders, and startups that may not have significant collateral—or prefer not to put their assets at risk.

Because the lender carries more risk, unsecured loans are priced according to your business’s financial health. Lenders typically assess monthly turnover, profitability, cash flow stability, and both business and personal credit scores before approving an application. The stronger your financial profile, the better the rate and loan terms you can expect.

The key advantage is speed and flexibility: approvals can happen in hours and funds are often available within 24 hours, allowing you to act quickly on opportunities or manage short-term cash flow challenges. Unsecured loans can be used for almost any business purpose—whether that’s hiring staff, stocking up on inventory, funding marketing campaigns, or consolidating debts into one manageable repayment.

The trade-off is that interest rates may be higher than secured loans, and borrowing amounts are generally capped at lower levels (often $5,000 to $500,000). However, for many businesses, the convenience of fast access to funds without risking assets far outweighs these costs.

In short, unsecured business loans give Australian businesses the ability to stay agile—providing a simple, fast and practical way to fund growth, cover expenses, and keep operations running smoothly.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of unsecured business loans

Unsecured funding comes in a few flavours. Here are common unsecured options you can compare:

What can I use an unsecured business loan for?

With no collateral required, unsecured loans give you the flexibility to fund almost any business purpose:

Working Capital

Use an unsecured business loan to cover payroll, rent, utilities, and supplier invoices. Perfect for Australian SMEs needing flexible finance to maintain steady cash flow and keep operations running smoothly.

Business Expansion

Access funds to open a new site, launch a product, or enter a new market. Unsecured loans give Australian businesses the flexibility to grow without risking property or assets as collateral.

Equipment & Technology

Upgrade business machinery, vehicles, IT software, or infrastructure with unsecured finance. This allows Australian SMEs and sole traders to stay competitive, improve productivity, and embrace new technology without upfront costs.

Marketing & Advertising

Invest in digital advertising, social media, or local marketing campaigns. Unsecured business loans help Australian businesses reach new customers, build brand awareness, and drive revenue growth without collateral requirements.

Inventory Purchase

Purchase stock in bulk, prepare for seasonal demand, or secure supplier discounts with unsecured business loans. A flexible option for Australian retailers and wholesalers who need quick access to working capital.

Hiring & Training

Unsecured loans can fund recruitment, wages, and staff training programs. Ideal for Australian businesses wanting to expand their workforce or upskill existing employees without tying up property or equipment as security.

Debt Consolidation

Streamline multiple business debts into one manageable repayment. Australian SMEs use unsecured loans to simplify cash flow, reduce admin stress, and potentially lower interest costs without risking collateral.

Renovations & Upgrades

Refresh business premises, modernise fit-outs, or upgrade customer areas with an unsecured loan. Australian cafés, retailers, and service businesses often use this finance to enhance customer experience and drive growth.

Emergency Funding

Cover unexpected expenses, urgent repairs, or cash flow shortfalls. Unsecured business loans give Australian SMEs a safety net, providing fast access to funds without collateral during critical times.

Case Study

Maya Chen, Harbour & Grind Café

Keeping the Doors Open with a Fast Unsecured Loan

Industry: Hospitality

Challenge: Cash flow squeeze from rising supplier costs and delayed invoices.

Solution: A 12-month unsecured term loan approved and funded within 24 hours.

Maya runs a busy café and faced a sudden spike in supplier prices at the same time a large corporate catering invoice was paid late. With wages due and a new espresso machine on order, cash flow was tight. She applied online and received multiple unsecured loan offers within hours. Choosing a 12-month option with weekly repayments meant no collateral was required and cash flow stayed predictable. When the outstanding invoice cleared, Maya made extra repayments and finished the loan early—without disrupting service or growth plans.

How much can I borrow with an unsecured business loan?

In Australia, unsecured business loans typically range from $5,000 to $500,000. Your borrowing power depends on turnover, profitability, bank statement history and credit profile. Because no collateral is pledged, lenders place more weight on recent cash flow and overall stability. Unsecured pricing may be higher than secured options, but the trade-off is speed, simplicity and access without risking property or business assets.

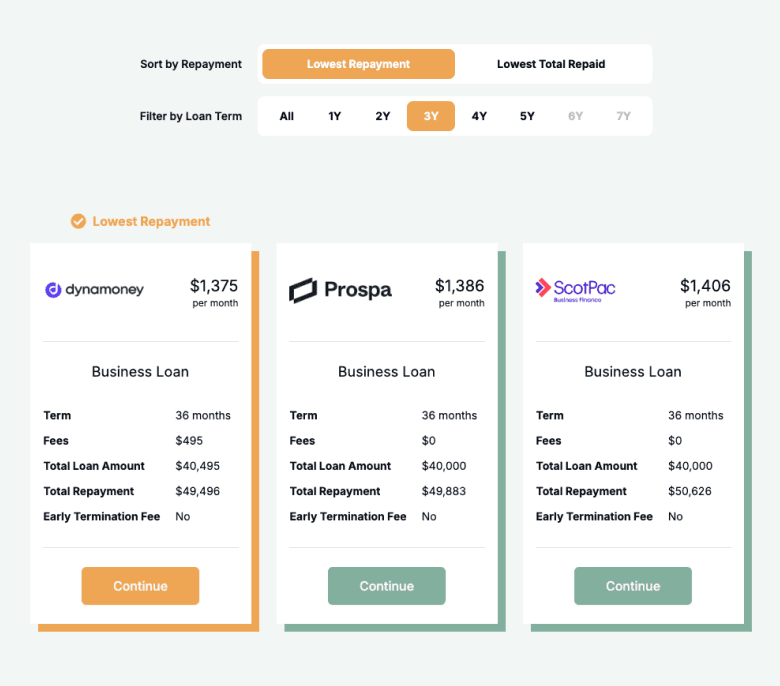

Unsecured Business Loan Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term and interest rate to plan cash flow before you apply.

Balance over time

Am I eligible for an unsecured business loan?

Eligibility is stricter than for secured loans as no collateral is provided. Lenders look at credit history, time trading, monthly turnover and bank statement health. Strong, consistent cash flow improves approval odds and pricing.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Operating for at least 6 months

Minimum monthly turnover of $5,000

Registered for GST (in most cases)

How to apply for an unsecured business loan?

Complete a quick online application and get instant quotes from our 50+ lender panel. Choose your preferred option and we’ll guide you through documentation and settlement. Funding can often be arranged within 24 hours.

Documents you may need:

ABN and GST registration details

Photo ID (passport or driver’s licence)

Recent business bank statements

Evidence of income and expenses

How to save money on an unsecured loan

Saving money on an unsecured business loan starts with understanding how loan terms, interest rates, and repayment schedules affect the total cost. A shorter loan term usually means higher individual repayments but less interest paid overall, helping you save thousands over the life of the loan. Longer terms can reduce each repayment, which supports cash flow, but the extra time means you’ll pay more in total interest.

Another way to save is by comparing offers from multiple lenders, as rates and fees can vary widely between providers. Checking for hidden costs such as establishment fees, early repayment penalties, or ongoing account charges ensures you know the true cost of borrowing. If your business cash flow is strong, making additional repayments or paying off the loan early can also reduce interest costs—though always check your agreement to confirm whether fees apply.

Finally, aligning your repayment frequency (weekly, fortnightly, or monthly) with your revenue cycle can help reduce stress and avoid late payment fees. Planning ahead and choosing the right loan structure for your situation ensures you get the funding you need while keeping overall costs as low as possible.

Example: Choose a shorter term to save money — $50,000 at 9.95% p.a.:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

12 months | $4,395 | $52,736 |

24 months | $2,306 | $55,346 |

36 months | $1,612 | $58,039 |

48 months | $1,267 | $60,813 |

60 months | $1,061 | $63,667 |

Understanding unsecured loan options

Unsecured business loans come in many forms, and understanding how they work can help you choose the right product for your business with confidence. Because no collateral is required, lenders place greater weight on your turnover, cash flow, and credit profile when assessing risk. Each loan option—whether fixed-term, revolving, or tied to a personal guarantee—has its own benefits and drawbacks. By comparing features such as interest structure, fees, repayment schedules, and eligibility, Australian businesses can find the loan that balances flexibility with affordability, ensuring funding supports both immediate needs and long-term growth.

Security: No Collateral

Unsecured business loans don’t require property, vehicles, or equipment to be pledged as collateral, making them ideal for Australian SMEs and sole traders without significant assets. Instead, lenders rely on your business’s financial health, turnover, and credit history to assess risk. This flexibility provides fast access to funds without tying up valuable assets, though it often results in stricter lending criteria and higher interest rates compared to secured loans.

Personal Guarantee

Although unsecured loans don’t require collateral, many Australian lenders request a personal guarantee from business owners or directors. This means you are personally liable if the business can’t meet repayments. While it reduces the lender’s risk, it allows small businesses, startups, and sole traders to access finance without pledging business assets. Always review the implications before signing to ensure it aligns with your financial risk tolerance.

Term: Fixed vs Revolving

Unsecured loans in Australia are typically offered as fixed-term products, ranging from 6 to 60 months, with set repayments until the balance is cleared. Some lenders also provide revolving facilities such as overdrafts or business lines of credit, which allow ongoing access to funds up to a set limit. Fixed terms provide repayment certainty, while revolving terms offer flexibility, making them suitable for managing seasonal or short-term cash flow needs.

Interest Structure

Most unsecured business loans are offered at a fixed interest rate, giving businesses predictable repayment schedules and helping with budget planning. While variable rates exist, they are less common in Australia due to the higher risk profile of unsecured lending. A fixed rate ensures repayments remain stable, but businesses should always compare lenders to find the most competitive offer, as interest rates can vary widely based on credit profile and turnover.

Fees & Charges

Beyond interest rates, Australian unsecured loans can include establishment fees (often 1%–4% of the loan amount), direct debit fees for each repayment, and sometimes early termination charges if you repay ahead of schedule. Some lenders also charge ongoing account management or service fees. Reviewing all costs upfront ensures you understand the true cost of borrowing and helps you avoid unexpected expenses that can impact business cash flow.

Repayment Frequency

Unsecured business loans in Australia can be repaid daily, weekly, fortnightly, or monthly depending on the lender and product type. Aligning repayment frequency with your cash flow cycle—such as weekly for retail or monthly for professional services—can help manage liquidity and reduce stress. Choosing the right repayment schedule ensures your business stays on track financially while minimising the risk of late payment fees and unnecessary strain on cash flow.

Testimonials

Verified Review

I applied for a car loan with the help of Emu Money a week ago, and the process was very fast and easy. There was no stress at all, as everything was taken care of by Krish, who managed my application from start to finish. He was very easy to communicate with and clearly explained the entire process and what was required from me. He was also quick to provide updates throughout. I would definitely recommend Emu Money to anyone looking for a smooth and hassle-free loan experience.. Thank you Krish.

Saritha A.

Verified Review

Rachel Connors from Emu Money was absolutely amazing from start to finish. Her dedication and fast approach made sure everything ran smoothly. She knew all the answers to any questions, and made sure she kept me informed during the whole process. Would highly recommend Rach for all your finance needs.

jennifer s.

Verified Review

We just got our truck loan they are very supportive and Eujin guide us in really good way we are happy with service really appreciate EUJIN cheers

Lky 2.

Verified Review

Emu Money does a really good job when it comes to their services. It was pretty easy and smooth, less stressful, quick, Cristal clear, very friendly, to the point...etc I would highly recommend them for anyone My agent was Eujin who made my dream come true with what I wanted achieved. Thanks heaps and all the very best. Regards Lankesh

Lankesh S.

Verified Review

Robyn has been brilliant to work with. Made everything easy from the start and explained the details of the loan in depth before submitting the application. Called Robyn Monday morning to discuss possible loan for car and drove my new car home Thursday afternoon with a finance rate better than what the car dealer was offering. Would highly recommend Robyn and emu money for future loans

Patrick B.

Verified Review

I would like to highly recommend Eujin from Emu Money for the excellent service provided during my loan process. His guidance, professionalism, and clear communication made the entire experience smooth and stress-free. I truly appreciate his support and would confidently recommend Emu Money to anyone seeking loan assistance.

Chathushka H.

Frequently Asked Questions

Unsecured Business Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.