Compare Merchant Cash Advances from 50+ Australian Lenders

Access fast funding repaid via a share of your card sales. Perfect for businesses with strong EFTPOS or online transactions needing quick cash flow support.

5.0 rating

Merchant Cash Advances Made Simple

An MCA is not a traditional loan—it’s an advance on future sales. Receive a lump sum upfront, then repay through a percentage of daily or weekly card transactions. Flexible, fast and collateral-free.

Quick Funding

Access from $5,000 to $300,000 fast

Flexible Repayments

Pay back via a share of future card sales

No Collateral

Funding based on sales volume, not assets

Short-Term Solution

Best for businesses with strong turnover needing short-term cash flow

Credit-Friendly

Available even with imperfect credit history

Any Business Purpose

Cover stock, marketing, payroll or urgent expenses

How it works

Repayments adjust to your sales volume—higher in busy periods and lighter during slow weeks.

Apply online

Provide your average monthly EFTPOS or online sales details.

Get approved

Lenders assess turnover and offer a lump sum advance based on future card sales.

Receive funds

Money is deposited quickly—sometimes within 24 hours.

Repay automatically

A percentage of daily or weekly card sales is deducted until the advance is settled.

A quick guide to merchant cash advances

A merchant cash advance gives you a lump sum upfront in exchange for a share of future credit and debit card sales. Unlike loans, there’s no fixed repayment schedule—deductions happen automatically based on turnover.

This makes MCAs attractive for Australian businesses with strong card transaction volumes such as cafés, retailers, and service providers. They’re fast, flexible and don’t usually require collateral—but costs are higher than traditional loans, so they’re best for short-term needs with clear returns.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

What can I use a merchant cash advance for?

MCA funds can be used for almost any short-term business purpose:

Working Capital

Cover everyday costs like wages, rent and utilities with funding tied to your sales cycle.

Inventory & Stock

Buy seasonal stock or bulk inventory quickly without draining cash flow.

Equipment Upgrades

Purchase or lease new equipment and repay as your revenue flows in.

Marketing & Growth

Launch advertising campaigns and repay from increased sales.

Renovations & Expansion

Refresh your premises or fund expansion into new locations.

Cash Flow Gaps

Bridge shortfalls caused by slow-paying customers or seasonal fluctuations.

Emergency Expenses

Cover urgent repairs or unforeseen costs without long approval delays.

Debt Consolidation

Replace multiple obligations with one streamlined repayment tied to turnover.

Case Study

Daniel Costa, Costa’s Kitchen

Fast Funding with a Merchant Cash Advance

Industry: Hospitality

Challenge: Unexpected equipment breakdown during peak trading period.

Solution: A $50,000 MCA repaid via 15% of daily EFTPOS sales.

When the refrigeration system failed at his busy restaurant, Daniel needed urgent funding. A merchant cash advance gave him $50,000 upfront within 48 hours, repaid automatically as a share of daily card sales. This allowed him to replace equipment quickly, keep trading, and repay stress-free as revenue flowed in.

How much can I access with a merchant cash advance?

In Australia, MCAs typically range from $5,000 to $300,000 depending on your card turnover. Lenders advance a percentage of your average monthly sales—often between 50% and 100%.

Repayments adjust automatically to sales, so in slower months you pay less and during peak periods you pay more, aligning obligations with revenue.

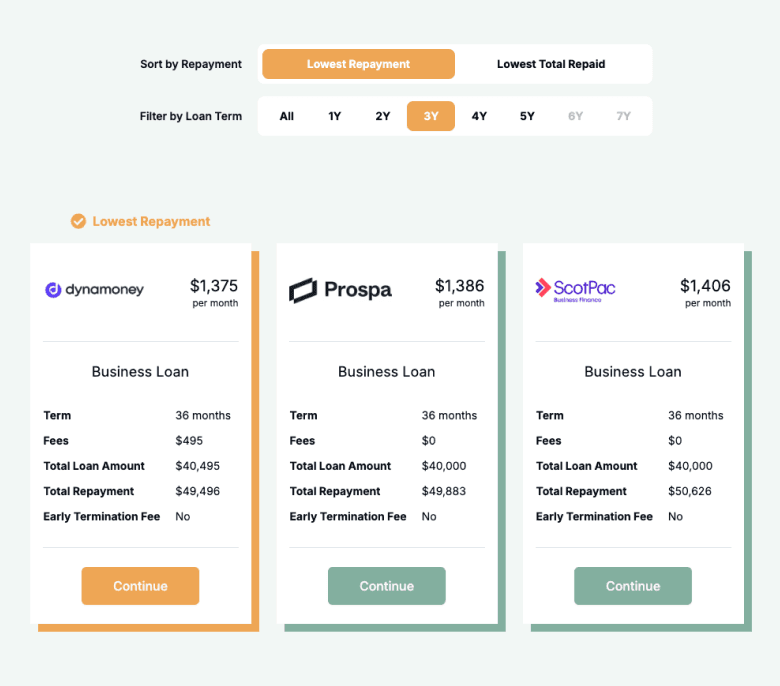

Merchant Cash Advance Calculator

Estimate how much you could access based on average monthly EFTPOS or online card sales.

Balance over time

Am I eligible for a merchant cash advance?

Eligibility depends mainly on card sales volume rather than assets or credit history. MCAs are well-suited to retailers, cafés, hospitality and eCommerce businesses with steady turnover.

You may be eligible if you are:

An Australian business with regular card transactions

Trading for at least 6 months

Average monthly EFTPOS or online sales over $5,000

Able to provide merchant facility or sales statements

How to apply for a merchant cash advance?

Apply online with your ABN and card sales history. We’ll match you with MCA providers who assess turnover and repayment capacity. If approved, funds are usually deposited within 1–3 business days.

Documents you may need:

ABN details

Photo ID (driver’s licence or passport)

Merchant facility statements

Business bank statements

How to save money with a merchant cash advance

MCAs are more expensive than traditional loans, so minimising costs is key. Compare factor rates and fees across lenders, as charges can vary widely. Use advances only for short-term needs that generate fast ROI, like stock purchases or campaigns. Paying off early can sometimes reduce fees—check your agreement carefully before committing.

Understanding merchant cash advance options

Merchant cash advances are structured differently to traditional loans. Repayment, fees, and flexibility vary depending on your agreement with the provider:

Holdback Percentage

Repayments are automatically deducted from a set percentage of your daily or weekly EFTPOS/credit card sales. The higher the percentage, the faster you repay, but the greater the impact on daily cash flow.

Factor Rate vs Interest Rate

MCAs use a factor rate instead of an interest rate. This is a fixed multiplier on the borrowed amount, meaning the total repayment cost is known upfront. While predictable, it can work out more expensive than standard loans.

Fixed vs Variable Terms

Some providers fix the repayment duration based on projected sales, while others let it vary depending on turnover. Variable terms give flexibility during slow months but can extend the repayment period.

Early Repayment Policies

Certain MCA providers allow early repayment without penalty, while others still require the full factor rate to be paid regardless. Always confirm the policy if you expect strong sales growth or want flexibility.

Testimonials

Verified Review

Gabe H.

Verified Review

Brad has been absolutely amazing to work with to help with financing for our business! The process was very simple, well explained and Brad went out of his way to provide updates - highly recommended!

Karn P.

Verified Review

Theodore G.

Verified Review

I had such a great experience with Evette when sorting out my car loan. She made the whole process really easy and stress-free, was always quick to answer any questions, and genuinely cared about getting me the best outcome. Super friendly and professional. I'd happily recommend Evette to anyone looking for a car loan!

Dillon F.

Verified Review

I had the pleasure of working with Ryan to secure a car loan. He made the process run smoothly from beginning to the end. Highly recommend Ryan with his dedication and excellent communication. Thank you again Ryan!

Toefiliga C.

Verified Review

It's nice, quick and easy to get a new equipments through Emu Money. Big thanks to Brad for his great assistance.

Marvin Y.

Frequently Asked Questions

Merchant Cash Advance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.