Compare Tractor Finance Options from 50+ Australian Lenders

Get the tractors and farm machinery you need without a large upfront cost. Receive personalised quotes in minutes with no impact on your credit score.

5.0 rating

Tractor Finance Made Simple

Finance the tractors and agricultural machinery your farm needs. Flexible, affordable options designed for Australian farmers, agribusinesses and contractors.

Borrow With Confidence

Amounts from $10,000 to $500,000+

Flexible Terms

1 to 7 year loan terms available

Fast Approval

Funding possible within 24–48 hours

Secured by Tractor

Keep costs low with equipment-backed loans

Seasonal Repayments

Match payments to your farming cash flow

Any Agricultural Purpose

Purchase, upgrade or expand machinery

How Tractor Finance Works

We match your application to tractor finance options from 50+ Australian lenders so you can compare and choose with confidence.

Apply online in minutes

Provide details about your tractor purchase and business needs in a quick form.

Get your quote

Our Lender Match technology finds offers from multiple lenders that suit your situation.

Upload documents

Submit ID and bank statements to finalise your chosen loan option.

Get approved

Receive approval and funding within 24–48 hours.

A quick guide to tractor finance

Tractor finance gives Australian farmers and agribusinesses access to machinery without a heavy upfront cost. Instead of tying up working capital, you spread repayments over time, leaving funds free for wages, feed, and farm running expenses.

Most tractor loans are secured against the tractor itself, which allows lenders to offer competitive rates and higher borrowing limits. Loan terms typically run from 1 to 7 years, and seasonal repayment structures are available so repayments align with farm income cycles.

Whether you’re cropping, running livestock, or contracting, tractor finance lets you upgrade to reliable equipment that improves efficiency, productivity, and safety. Farmers can choose new or used tractors, attachments, or expand their fleet without draining reserves.

The trade-off is making sure repayments fit with cash flow, but for many Australian farmers, tractor finance balances affordability and access — ensuring you remain competitive and resilient.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of tractor finance

Here are the most common tractor finance options available to Australian farmers:

What can I use tractor finance for?

Tractor finance can be applied to many areas of farming and agribusiness:

Buy a New Tractor

Secure new equipment to improve productivity and reduce downtime.

Upgrade or Replace

Swap out old machinery for modern, fuel-efficient tractors.

Expand Operations

Add tractors to manage larger acreage or contracting jobs.

Attachments & Implements

Finance loaders, balers, ploughs, and more.

Seasonal Needs

Fund extra machinery during planting or harvesting periods.

Fleet Management

Maintain or expand a fleet for large-scale farming.

Land Preparation

Clear, till or level land ready for crops or pasture.

Livestock Operations

Support livestock feeding, fencing, and transport tasks.

Case Study

Ben Murray, Murray Farms

Boosting Productivity with Tractor Finance

Industry: Cropping Farm

Challenge: Old machinery breaking down, leading to costly delays during harvest.

Solution: A 5-year chattel mortgage secured against a new tractor with seasonal repayments.

Ben runs a cropping farm in regional NSW and struggled with unreliable equipment. Breakdowns during harvest caused lost income and stress. Through Emu Money, he compared tractor finance options and secured approval for a 5-year loan matched to his seasonal cash flow. With a modern tractor, he reduced downtime, improved efficiency, and managed repayments predictably. The new machine has paid for itself through better productivity and reduced repair costs.

How much can I borrow for tractor finance?

Tractor finance in Australia typically ranges from $10,000 for smaller or used models up to $500,000+ for large-scale or specialist machinery. Borrowing limits depend on tractor cost, age and condition, as well as your business turnover and credit profile.

Because the loan is secured against the tractor itself, lenders are often able to offer more competitive rates and higher borrowing amounts compared to unsecured loans.

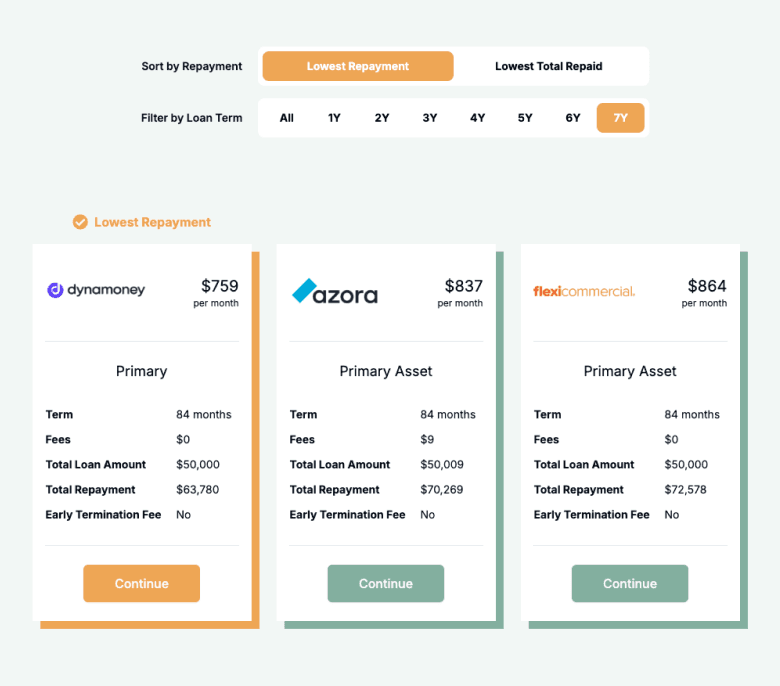

Tractor Finance Repayment Calculator

Estimate your repayments and total cost. Adjust the amount, term and interest rate to plan before applying.

Balance over time

Am I eligible for tractor finance?

Eligibility is usually straightforward since tractors are income-producing assets. Lenders assess your turnover, bank statements and credit profile to confirm affordability.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Running a registered farming or contracting business

Able to provide recent bank statements

Hold an ABN (and GST registration if required)

How to apply for tractor finance

Complete a quick online application and receive instant quotes from our panel of lenders. Choose your preferred option, upload documents, and we’ll guide you to settlement. Funding is often available within 24–48 hours.

Documents you may need:

ABN and GST registration details

Photo ID (driver’s licence or passport)

Recent business bank statements

Tax returns or financials (for larger amounts)

How to save money on tractor finance

Saving on tractor finance comes down to loan structure and comparison. Choosing a shorter term means higher repayments but less total interest, while a longer term eases cash flow but increases costs.

Comparing offers from multiple lenders ensures you find the most competitive rate and fee structure. Watch out for establishment fees, ongoing account charges, or early repayment penalties.

Seasonal repayment options are especially useful for farmers, letting you align payments with harvest or livestock cycles to avoid cash flow strain. If your business is strong, making additional repayments or paying off early can also cut down costs. Always check terms before committing.

Example: Save with a shorter term — $75,000 at 8.95% p.a.:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

24 months | $3,424 | $82,179 |

36 months | $2,378 | $85,607 |

48 months | $1,866 | $89,571 |

60 months | $1,547 | $92,812 |

Understanding tractor finance options

Different tractor finance products suit different needs. Here’s a quick guide:

Chattel Mortgage

The most common farm equipment finance option. You own the tractor upfront while the lender takes a mortgage until the loan is repaid.

Equipment Loan

Similar to a secured loan, using the tractor as collateral with fixed repayments.

Hire Purchase

Use the tractor while making instalments. Ownership transfers once the final repayment is made.

Finance Lease

The lender owns the tractor and you lease it, with an option to buy at the end of term.

Seasonal Terms

Repayment schedules that match planting or harvesting cycles to ease cash flow.

Testimonials

Verified Review

Emu Money is an excellent choice for anyone seeking a personal loan. The website is user-friendly and makes the loan process straightforward and hassle-free. I've also heard similar positive feedback from friends who have used the site. Thank you Emu!

Taz A.

Verified Review

I had an excellent experience with Emu Money. Robyn was fantastic – professional, approachable, and genuinely easy to deal with from start to finish. She explained everything clearly, made the whole process stress-free, and went above and beyond to ensure I was comfortable with each step. It's rare to find someone so reliable and efficient. I'd highly recommend Emu Money, and especially Robyn, to anyone looking for great service and peace of mind

Cruize W.

Verified Review

I've worked with Brad from Emu Money a few times now, and I highly recommend. Brad is very responsive to emails (even when on holiday in Fiji), keeps me up to date and gets everything organised very quickly. Brad spoke directly with my supplier and they figured everything out. I won't hesitate to work with Brad again.

Christine F.

Verified Review

Robyn has been brilliant to work with. Made everything easy from the start and explained the details of the loan in depth before submitting the application. Called Robyn Monday morning to discuss possible loan for car and drove my new car home Thursday afternoon with a finance rate better than what the car dealer was offering. Would highly recommend Robyn and emu money for future loans

Patrick B.

Verified Review

Emu Money does a really good job when it comes to their services. It was pretty easy and smooth, less stressful, quick, Cristal clear, very friendly, to the point...etc I would highly recommend them for anyone My agent was Eujin who made my dream come true with what I wanted achieved. Thanks heaps and all the very best. Regards Lankesh

Lankesh S.

Verified Review

⭐⭐⭐⭐⭐ The process with Emu Money has been fantastic — completely stress-free and very professional. Their document requirements were clear and straightforward, with everything explained step by step. Once we submitted our paperwork, the response was quick, and the whole process was easy to follow. We’re very happy with the experience and highly recommend Emu Money for any commercial loan needs

Pratik P.

Frequently Asked Questions

Tractor Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.