Compare Excavator Finance from 50+ Australian Lenders

Secure the excavators your projects demand without heavy upfront costs. Get personalised quotes in minutes with no impact on your credit score and keep cash flow steady.

5.0 rating

Excavator Finance Made Simple

Finance new or used excavators with structures tailored for Australian construction, civil, mining and landscaping businesses. Preserve working capital while upgrading capability and winning bigger jobs.

Borrow With Confidence

Typical amounts from $25,000 to $1m+

Flexible Terms

1 to 7 year loan terms available

Fast Approval

Funding often within 24–48 hours

Secured by Equipment

Lower rates with asset-backed lending

Seasonal / Project Fit

Match repayments to contract cash flow

Any Excavator Type

Mini, midi, crawler, long-reach, attachments

How Excavator Finance Works

We match your application to equipment lenders across Australia, so you can compare options and fund machines quickly.

Apply online in minutes

Share your business details and the excavator you’re purchasing.

Get matched offers

See quotes from multiple lenders specialising in heavy equipment.

Choose your structure

Compare rates, terms and balloon/residual options to suit cash flow.

Get approved & funded

Approval and settlement can happen within 24–48 hours.

A quick guide to excavator finance

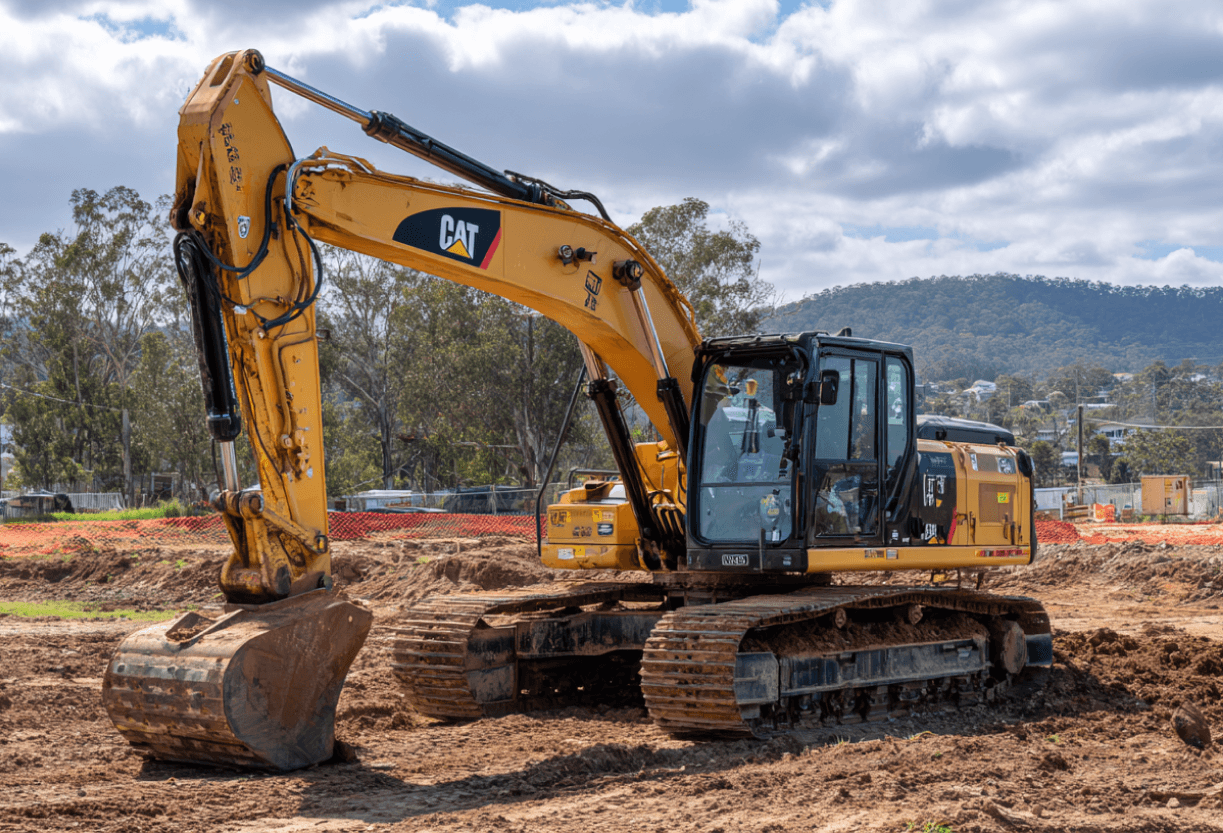

Excavator finance helps Australian contractors acquire critical earthmoving equipment without draining working capital. Rather than paying upfront, repayments are spread over time, keeping funds free for payroll, fuel, bonds, retention and bid pipeline costs.

Most facilities are secured against the excavator, which supports sharper pricing and higher borrowing limits than unsecured lending. Terms typically range from 1 to 7 years, with options to add a balloon or residual to reduce regular repayments. Repayments can be aligned to monthly cycles, seasonal slowdowns, or major project milestones.

Finance covers new and used units across brands and classes—mini/midi excavators for residential civil, through to heavy crawlers, long-reach and specialist machines for bulk earthworks, demolition and mining. Attachments such as buckets, breakers, augers and tilt-rotators can often be included.

The key is structuring the loan around your contract cadence and utilisation. With the right lender and terms, your excavator pays its way through productivity and billable hours, while predictable repayments support healthy cash flow and growth.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of excavator finance

The main products contractors compare when funding excavators in Australia:

What can I use excavator finance for?

Finance can cover machines, attachments and related project needs:

Construction & Civil

Fund machines for foundations, trenching, bulk earthworks and site prep.

Landscaping & Earthmoving

Acquire minis and attachments for tight sites, grading and drainage.

Road & Infrastructure

Scale fleets for roadworks, rail, utilities and government tenders.

Demolition

Finance high-reach units and breakers for safe, efficient demo works.

Utilities & Services

Trenching for water, sewer, comms and power installations.

Mining & Quarry

Heavy crawlers for overburden removal, loading and stockpiling.

Subdivision Works

Cut-to-fill, drainage, retaining and lot preparation.

Attachments & Transport

Include buckets, tilt-rotators, augers and sometimes delivery costs.

Case Study

Tane R., TRC Civil

Winning Bigger Civil Jobs with Excavator Finance

Industry: Civil Construction

Challenge: Missed tenders due to limited fleet capacity and rising maintenance on ageing machines.

Solution: A 5-year chattel mortgage with a 20% balloon on two new 14-tonne excavators and key attachments.

Tane owns a civil contracting business in Western Sydney. He regularly lost mid-size tenders because his single, ageing excavator couldn’t cover simultaneous sites. Through Emu Money, he compared lenders and secured a 5-year chattel mortgage for two new 14-tonne machines with quick-hitch, tilt bucket and rock breaker. The structure included a 20% balloon to keep monthly repayments down while utilisation ramped. Within three months, Tane won two council subdivision packages, improved uptime, and lifted revenue with predictable repayments matched to progress claims.

How much can I borrow with excavator finance?

In Australia, excavator finance typically ranges from $25,000 for late-model minis to $1m+ for heavy crawlers and specialist long-reach units. Borrowing limits depend on machine price, age, condition, expected life and your business profile.

Because loans are usually secured by the excavator, lenders can offer sharper pricing and higher limits than unsecured facilities, especially when utilisation and contract pipeline are strong.

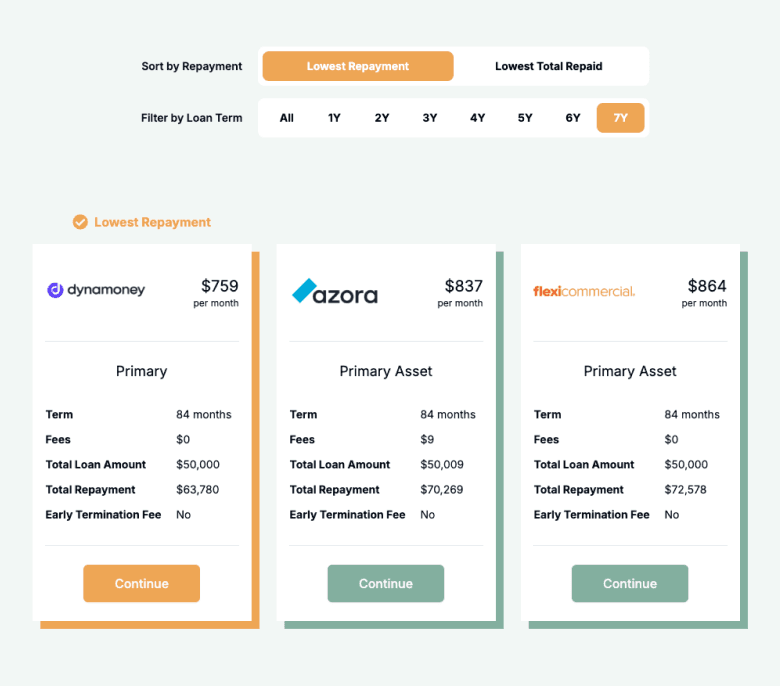

Excavator Finance Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term, rate and balloon to plan cash flow before you apply.

Balance over time

Am I eligible for excavator finance?

Most construction, civil, mining and landscaping businesses qualify provided turnover and bank statements support affordability. Asset-backed security generally simplifies approval.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Operating a registered business with ABN

Able to provide recent bank statements

GST registered (often required for larger amounts)

How to apply for excavator finance

Complete a quick online application to see quotes from multiple lenders. Choose your preferred structure, upload documents, and settlement can often be completed within 24–48 hours.

Documents you may need:

ABN and GST registration details

Photo ID (driver’s licence or passport)

Recent business bank statements

Asset quote/invoice and equipment details

How to save money on excavator finance

Compare multiple lenders as rates and fees vary widely. A shorter term or smaller balloon reduces total interest, while longer terms or larger balloons ease monthly outgoings but increase overall cost.

Bundle attachments at settlement to secure sharper pricing and avoid future unsecured add-ons. Align repayment schedules with progress claims or milestone payments to reduce cash gap risk. Check for establishment, doc or early payout fees before you sign.

Example: $180,000 financed at 7.95% p.a.:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

24 months | $8,120 | $194,879 |

36 months | $5,618 | $202,242 |

48 months | $4,406 | $211,503 |

60 months | $3,623 | $217,402 |

Understanding excavator finance options

Know the structural levers before choosing a lender or product:

Security: Asset-backed

Most excavator finance products are secured against the machine itself. This reduces risk for the lender, allowing them to offer higher borrowing limits and more competitive interest rates. Unlike unsecured loans, the excavator serves as collateral, which can make approvals faster and terms more flexible for contractors.

Personal Guarantee

In addition to the excavator being used as security, many lenders also request a personal guarantee from company directors or business owners. This means you’re personally liable if the business defaults, reducing lender risk. It’s a common requirement across construction finance, so be sure you’re comfortable with the obligations.

Term & Balloon

Loan terms typically range from 1 to 7 years. Some lenders offer balloon or residual options, which reduce regular repayments by deferring part of the balance to the end of the term. This structure helps ease monthly cash flow, though it means a larger lump sum is due at maturity.

Interest Structure

Excavator finance is most often offered with fixed interest rates, giving contractors predictable repayments and stability over the loan term. Some lenders also provide variable rates, which may start lower but can increase with market conditions. Comparing interest structures ensures you choose the right balance between stability and flexibility.

Fees & Charges

Beyond the interest rate, lenders may apply establishment fees, documentation fees, account management costs, and early termination charges. These can vary significantly between providers, so it’s important to review the fine print. Factoring in all fees helps you understand the true cost of finance and avoid budget surprises.

Repayment Frequency

Repayment schedules can be tailored to suit your business’s cash flow. Options include weekly, fortnightly or monthly instalments. Some lenders even allow repayments to align with project progress payments or seasonal work cycles. Choosing the right frequency reduces financial strain and ensures repayments fit comfortably into your revenue cycle.

Testimonials

Verified Review

I had an excellent experience with Emu Money. Robyn was fantastic – professional, approachable, and genuinely easy to deal with from start to finish. She explained everything clearly, made the whole process stress-free, and went above and beyond to ensure I was comfortable with each step. It's rare to find someone so reliable and efficient. I'd highly recommend Emu Money, and especially Robyn, to anyone looking for great service and peace of mind

Cruize W.

Verified Review

Brad was great quick and simple no headaches. just simple process and was done in quick time frame. cant thank him enough.

Danny D.

Verified Review

Robyn from Emu was a pleasure to deal with and was honest in her approach and recommendations. Loan was completed in line with the expectations set.

Kerry B.

Verified Review

⭐️⭐️⭐️⭐️⭐️ Evette is amazing. As a sole trader I struggled to get finance for a car, but she worked tirelessly to make it happen and got me a great loan. Even when delays came up with the sellers bank, she kept on top of everything until it was resolved. I am so grateful and would 100% recommend her to anyone!

Sarah S.

Verified Review

I had such a great experience with Evette when sorting out my car loan. She made the whole process really easy and stress-free, was always quick to answer any questions, and genuinely cared about getting me the best outcome. Super friendly and professional. I'd happily recommend Evette to anyone looking for a car loan!

Dillon F.

Verified Review

Robyn has been brilliant to work with. Made everything easy from the start and explained the details of the loan in depth before submitting the application. Called Robyn Monday morning to discuss possible loan for car and drove my new car home Thursday afternoon with a finance rate better than what the car dealer was offering. Would highly recommend Robyn and emu money for future loans

Patrick B.

Frequently Asked Questions

Excavator Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.