Compare Secured Business Loans from 50+ Australian Lenders

Use property, vehicles or equipment as collateral to access higher loan amounts, longer terms and lower rates.

5.0 rating

Secured Business Loans Made Simple

Leverage your business or personal assets to unlock larger funding amounts and sharper pricing. Perfect for Australian SMEs seeking stability and growth.

Borrow More

Typical amounts from $10,000 to $5,000,000+

Longer Terms

From 1 year up to 10 years+

Lower Rates

Rates from 6.95% p.a. depending on security

Higher Approval Odds

Collateral reduces lender risk and boosts approvals

Flexible Use

Growth, acquisitions, property, equipment, or cash flow

Tailored Facilities

Options include term loans, mortgages and asset-backed lending

How it works

We connect you with secured loan providers who accept property, vehicles or equipment as collateral for larger, lower-cost funding.

Apply online

Tell us about your business, collateral and funding needs in a simple application.

Get matched

Our Lender Match technology connects you with secured loan options from over 50 providers.

Provide documentation

Submit bank statements, financials and details of the asset(s) you’re offering as security.

Approval & settlement

Once approved, funds are released—often faster than traditional bank processes.

A quick guide to secured business loans

Secured business loans are backed by collateral such as property, vehicles or equipment. Because the lender has recourse to seize the asset if repayments aren’t met, they carry less risk—which usually means lower interest rates, higher borrowing limits and longer terms.

These loans are ideal for established Australian businesses with valuable assets and significant funding needs. While approval can take slightly longer due to asset valuation, the trade-off is more affordable pricing and stronger borrowing power.

Secured loans can support growth, acquisitions, property purchases, refinancing or restructuring, and are a common tool for businesses planning significant investment or expansion.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of secured business loans

Different lenders accept different asset types as collateral:

What can I use a secured business loan for?

Secured loans unlock large-scale funding for many purposes:

Business Expansion

Fund new locations, larger premises, or additional production lines with confidence. Collateral-backed finance can support fit-outs, upfront lease costs, working capital for the ramp-up period, and launch marketing—so you scale capacity, meet demand, and capture growth opportunities without straining day-to-day cash flow.

Equipment & Vehicles

Purchase or upgrade machinery, vehicles, yellow goods, or specialty tools using the asset as security. Spread costs over the equipment’s useful life, preserve cash reserves, and improve productivity. Structured correctly, repayments align with revenue generated by the asset, supporting predictable budgeting and stronger ROI.

Commercial Property

Acquire, refinance, or renovate offices, warehouses, and retail spaces. Property-backed loans typically offer sharper pricing and longer terms, enabling sustainable repayments. Use funding for deposits, stamp duty, construction, or fit-outs—building equity while tailoring premises to operations and long-term growth plans.

Working Capital

Smooth cash flow during busy or seasonal periods. A secured facility can cover payroll, supplier invoices, utilities, and inventory without relying on expensive short-term credit. Lower interest and longer terms reduce pressure, helping you maintain reliable operations and negotiate better terms with key suppliers.

Business Acquisition

Buy another business, brand, or client book using property or equipment as security. Funding can cover purchase price, transition costs, integration, and initial working capital. With the right structure, you preserve liquidity, capture synergies faster, and grow market share while maintaining manageable, predictable repayments.

Debt Consolidation

Combine multiple higher-cost facilities into one secured loan with clearer terms and potentially lower interest. Simplify repayments, improve cash-flow visibility, and reduce administrative overhead. Consolidation can also extend tenor, easing monthly commitments while giving room to invest in growth or stabilise operations.

Restructuring

Reorganise operations, refinance existing obligations, or reset your capital structure. A secured facility can provide runway to execute efficiency programs, renegotiate supplier arrangements, and invest in systems—supporting profitability improvements while maintaining service levels and protecting relationships with customers and staff.

Inventory Expansion

Purchase bulk stock ahead of peak seasons or to secure early-payment discounts. Lower secured rates help reduce landed cost per unit, improving margins. With adequate working capital, you can hold optimal inventory levels, shorten lead times, and meet demand surges without missed sales or backorders.

Technology Upgrades

Invest in core systems—ERP, POS, cybersecurity, networking—or major software and hardware refreshes. Spreading costs via a secured facility preserves cash while lifting reliability, data visibility, and productivity. Improved infrastructure underpins better customer experience, smarter decisions, and long-term competitiveness.

R&D Investment

Fund research, prototyping, certifications, and pilot production. Secured finance can underwrite multi-stage development timelines, allowing you to validate concepts, meet compliance requirements, and position products for commercial launch—without compromising day-to-day liquidity or delaying other critical business priorities.

Case Study

Arun Patel, Precision Metals Pty Ltd

Expanding with a Secured Loan

Industry: Manufacturing

Challenge: Strong demand but limited capital to purchase new machinery.

Solution: A 5-year secured loan using equipment and property as collateral.

Arun runs a small manufacturing plant supplying parts to construction companies. Orders were climbing but production bottlenecks meant lost opportunities. By securing a $750,000 facility against his factory and equipment, he purchased new machinery and expanded capacity. The investment paid off within 18 months, doubling output and boosting revenue, all with manageable repayments at a lower rate than an unsecured loan.

How much can I borrow with a secured business loan?

In Australia, secured business loans typically start from $10,000 and can extend into the millions. The amount depends on the value of the collateral and the lender’s loan-to-value ratio (LVR), often 70%–80% of the appraised asset value. For example, a $500,000 property at 75% LVR could secure a $375,000 loan.

Beyond collateral, lenders assess cash flow, credit history and trading history to determine affordability. Larger, longer-term loans are more achievable when backed by strong financials and a solid business plan.

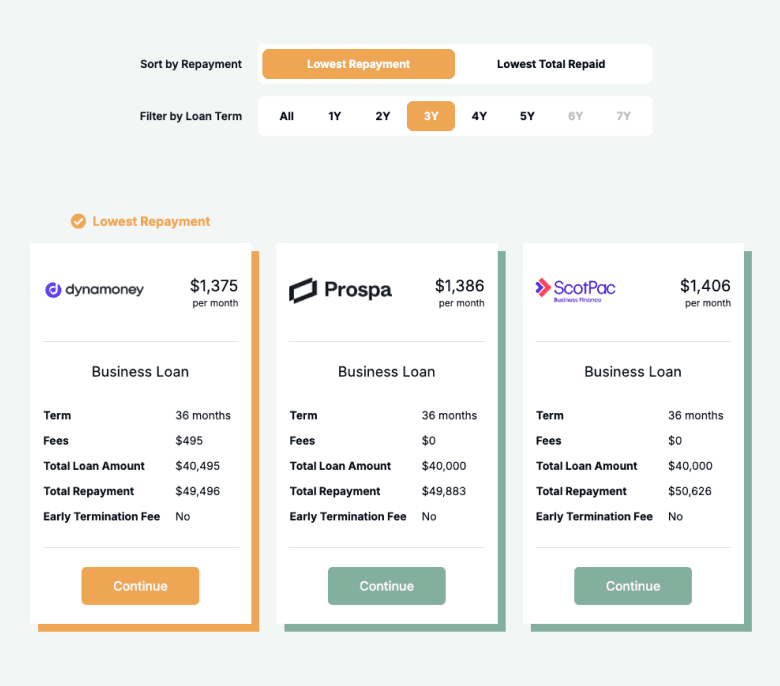

Secured Business Loan Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term and interest rate to plan cash flow before you apply.

Balance over time

Am I eligible for a secured business loan?

Eligibility is stronger than for unsecured loans thanks to collateral, but lenders still assess serviceability and credit history. The quality, type and value of the security offered are key factors.

You may be eligible if you are:

An Australian business with eligible collateral (property, vehicles, equipment)

Over 18 years old

Trading for at least 6–12 months

Able to demonstrate steady turnover and repayment capacity

Willing to register security on the asset

How to apply for a secured business loan?

Apply online with details of your business and the asset you’re offering as collateral. We’ll match you with multiple lenders and guide you through valuations, documentation and settlement. Larger facilities may require more detailed financials, but approvals can still be achieved quickly.

Documents you may need:

ABN and GST details

Photo ID (driver’s licence or passport)

Business bank statements and financials

Collateral details and valuation reports

Tax returns and BAS for larger amounts

How to save money on a secured business loan

The main savings come from using high-quality collateral—property and real estate usually attract the lowest rates and longest terms. Compare multiple lenders, as LVRs and fees differ.

Choose a term that balances affordability and total cost. Longer terms reduce repayments but increase total interest paid. If cash flow allows, making additional repayments or paying down early can cut costs—check for exit or break fees first.

Bundling multiple needs (e.g., property, equipment, and working capital) into one secured facility can also simplify repayment and reduce overall interest versus multiple smaller loans.

Understanding secured loan options

Secured business loans can be tailored with different structures depending on the asset pledged, repayment style, and flexibility required:

Property-Backed Loans

Commercial or residential property can be used as collateral, unlocking higher borrowing amounts and sharper interest rates. These loans are well-suited for larger, long-term funding needs.

Equipment-Backed Loans

Vehicles, machinery, or technology can serve as security. This option aligns repayments with the working life of the asset and helps free up working capital for other needs.

Loan-to-Value Ratio (LVR)

Lenders typically advance 70–80% of the asset’s value. A higher LVR may require stronger financials or additional security, while a lower LVR can improve approval speed and terms.

Fixed vs Variable Rates

Secured loans may be structured with fixed repayments for certainty or variable rates for potential savings if market rates drop. The choice depends on your risk profile and cash flow strategy.

Early Repayment & Exit Costs

Some secured loans allow early repayment or refinancing, but others carry break fees. Checking these terms upfront helps avoid surprises if you plan to repay early or restructure finance.

Testimonials

Verified Review

Eujin was extremely easy to work with. He was respectful, clear in communication and persuasive. He works to get the best deal for his clients.

Chetan P.

Verified Review

I got my car loan approved within very short period of time , Bindia is very cooperative and friendly, and always gives right financial advice. Highly recommended.

ankur p.

Verified Review

Peter was very quick, responsive and easy to deal with. Great experience, and we're picking up our new car tomorrow!

Olivia F.

Verified Review

It's nice, quick and easy to get a new equipments through Emu Money. Big thanks to Brad for his great assistance.

Marvin Y.

Verified Review

Amazing customer service experience only took short time thanks Ryan

daniel r.

Verified Review

Brad was great, honest, responsive and on the ball, thanks for your help :)

Chantelle F.

Frequently Asked Questions

Secured Business Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.