Compare Business Lines of Credit from 50+ Australian Lenders

Access flexible revolving funds with interest only on what you use. Get real personalised quotes in minutes with no impact on your credit score.

5.0 rating

Business Line of Credit Made Simple

Tap into a pool of funds whenever you need it. Only pay interest on what you draw, giving your business flexibility to handle cash flow gaps, seasonal demand and growth opportunities.

Flexible Credit Limits

From $5,000 up to $1,000,000

Revolving Facility

Redraw funds as you repay

Fast Access

Draw funds instantly when needed

Pay Interest Only on What You Use

Save costs by borrowing strategically

Flexible Use

Cover cash flow, inventory, payroll, or emergencies

Ongoing Access

Unlike term loans, funds remain available within your limit

How it works

We connect your business with revolving credit options from 50+ Australian lenders so you can choose the right facility for your needs.

Apply online in 3 minutes

Enter your details to see line of credit options matched to your business. No long forms.

Get your quote

Our Lender Match technology compares multiple lenders to find credit limits and rates that fit your profile.

Access your funds

Once approved, your credit facility is ready to draw from whenever you need funds.

Repay and redraw

As you make repayments, your available balance resets—keeping funds on standby for future needs.

A quick guide to business lines of credit

A business line of credit is a revolving facility that allows you to draw, repay, and redraw funds within your approved limit—much like a credit card, but often with higher limits and lower interest rates. This flexibility makes it a powerful tool for Australian SMEs, sole traders, and growing businesses that need on-demand access to capital.

Unlike a traditional business loan that provides a one-off lump sum, a line of credit keeps funds available for whenever you need them. You only pay interest on the amount you draw, which makes it more cost-effective if you borrow strategically. Lenders typically assess turnover, trading history, profitability, and both business and personal credit scores before approving a facility.

The biggest advantage is control: you can use funds to cover short-term working capital needs, bridge seasonal gaps, purchase inventory, or act quickly on opportunities. Repayments replenish your balance, giving you ongoing access to funds without reapplying.

The trade-off is that lines of credit may come with higher fees than secured term loans, and lenders may require stronger financials or a personal guarantee. However, for many businesses, the convenience and flexibility far outweigh these costs. In short, a business line of credit is like having a safety net—ready to catch cash flow dips or fuel growth whenever you need it.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

What can I use a business line of credit for?

Because funds revolve, a business line of credit gives you the flexibility to cover a wide range of business purposes:

Working Capital

Cover payroll, rent, utilities, and supplier invoices. A line of credit provides quick access to funds for ongoing operations.

Inventory Purchases

Buy stock in bulk, prepare for seasonal demand, or secure supplier discounts with a revolving facility that can be redrawn as you repay.

Equipment & Repairs

Purchase or repair essential equipment without waiting for cash flow. Repay as business income allows, then redraw if needed.

Managing Cash Flow

Bridge income gaps during seasonal downturns or while waiting for invoices to be paid. Lines of credit smooth out cash flow volatility.

Emergency Fund

Keep a safety net for unexpected costs or urgent repairs. Funds are always available within your limit, giving peace of mind.

Business Expansion

Access funds to open new locations, boost marketing, or expand services without committing to a lump-sum loan.

Hiring & Training

Recruit and onboard staff or run training programs with flexible access to finance that matches your payroll cycle.

Renovations & Upgrades

Refresh your premises, upgrade facilities, or modernise equipment using a revolving credit facility that you can repay over time.

Marketing & Advertising

Run targeted campaigns, boost online visibility, or test new channels with funds you can dip into when needed.

Debt Consolidation

Use a line of credit to consolidate higher-interest debts into one manageable repayment at potentially lower cost.

Case Study

Sarah Mitchell, Bay Homewares

Staying Ahead with a Business Line of Credit

Industry: Retail

Challenge: Seasonal cash flow pressure from bulk stock purchases ahead of peak periods.

Solution: A $150,000 revolving line of credit that allowed ongoing access to funds.

Sarah owns a homewares store that experiences sharp spikes in demand before Christmas. To prepare, she needed to order inventory months in advance, which placed pressure on her cash flow. By securing a $150,000 business line of credit, Sarah could draw funds when stock orders were due and repay them once sales rolled in. The flexibility to redraw without reapplying meant she could continue managing seasonal peaks confidently year after year.

How much can I borrow with a business line of credit?

In Australia, business lines of credit typically range from $5,000 up to $1,000,000 depending on turnover, profitability, and credit profile. Lenders place weight on recent bank statements, trading history, and overall financial stability when setting limits. Because lines of credit are revolving facilities, repaying funds restores your available balance, giving ongoing access without needing to reapply. While credit limits can be substantial, lenders expect evidence that your business can responsibly manage repayments. Responsible borrowing ensures your line of credit remains a useful safety net rather than a financial burden.

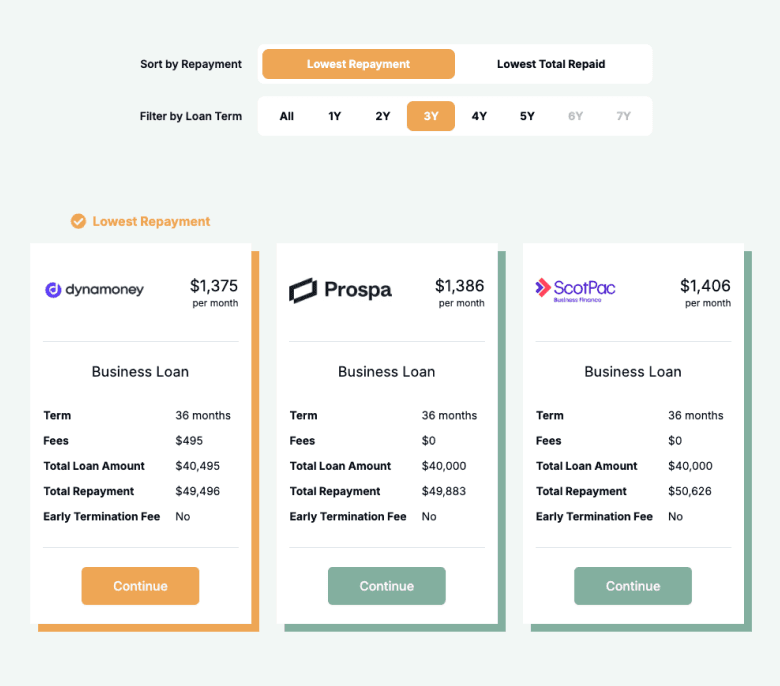

Business Line of Credit Repayment Calculator

Estimate interest costs and repayments. Adjust the amount, term and interest rate to plan cash flow before you apply.

Balance over time

Am I eligible for a business line of credit?

Eligibility is similar to unsecured loans but often stricter due to the revolving nature of the facility. Lenders assess your financial health, trading history, and repayment capacity closely. Strong turnover and healthy cash flow increase your approval chances.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Trading for at least 12 months

Minimum monthly turnover of $10,000

Registered for GST

How to apply for a business line of credit?

Complete a quick online application and we’ll compare line of credit options from our 50+ lender panel. Once approved, you can access funds directly and use them whenever required. Many facilities can be established in just days.

Documents you may need:

ABN and GST registration details

Photo ID (passport or driver’s licence)

Recent business bank statements

Evidence of income and expenses

How to save money on a business line of credit

Saving money on a business line of credit comes down to how you use it. Because you only pay interest on what you draw, borrowing strategically helps keep costs low. Avoid treating the facility as free cash flow—always have a plan for repayments.

Comparing multiple lender offers is also critical, as credit limits, fees, and rates vary widely. Look for hidden costs such as annual facility fees, transaction charges, or penalties for late repayments. If your business has strong cash flow, repaying quickly after drawing funds reduces the interest charged and keeps the facility ready for future needs.

Finally, align your use of the line of credit with revenue-generating activities. For example, using it to purchase inventory you know will sell is smarter than covering long-term expenses. This ensures the credit works for you, not against you.

Understanding line of credit options

Business lines of credit in Australia can differ significantly by structure, fees, and eligibility. Comparing these features ensures you select the right facility for your business.

Secured vs Unsecured

Some lenders require property, vehicles, or other assets as collateral to reduce risk, while others offer unsecured lines of credit based on turnover and credit history. Secured facilities may allow higher limits or lower rates.

Personal Guarantee

Even if unsecured, many lenders will request a personal guarantee. This means directors or owners may be personally liable if the business defaults.

Revolving Facility

Funds become available again as you repay, offering ongoing access without reapplying. This differs from fixed-term loans, where you repay until the balance is cleared.

Interest & Fees

You only pay interest on what you draw. However, many lenders charge annual or monthly facility fees, transaction charges, or drawdown costs. Always review the full fee schedule.

Repayment Flexibility

Most lenders allow flexible repayment schedules. Choosing to repay faster reduces total interest paid, while minimum repayments keep cash flow steady.

Limit Reviews

Lenders may review your facility annually to reassess turnover, cash flow, and repayment history. Strong performance can increase your limit, while poor performance may reduce it.

Testimonials

Verified Review

Matt and the team were excellent in helping me understand all my finance options and were able to save me a great deal in interest. Thanks team!

Ryan K.

Verified Review

We just got our truck loan they are very supportive and Eujin guide us in really good way we are happy with service really appreciate EUJIN cheers

Lky 2.

Verified Review

We had an excellent experience working with Stevette Gelavis from Emu Money. She was absolutely outstanding—providing clear and comprehensive information from the very beginning and demonstrating professionalism, fairness, and genuine helpfulness throughout the process. After having disappointing experiences with other loan providers who quoted us unreasonably high rates, Stevette secured us a much better rate. Thank you, Stevette, for your exceptional service and for restoring our confidence in loan providers. You’re doing a fantastic job!

Indu

Verified Review

Brad provided excellent guidance throughout the entire loan process, making it much easier for me to achieve my financial goals. His expertise and support were invaluable, and I'd highly recommend him to anyone looking for a reliable finance broker.

Marlon

Verified Review

Every problem that occurred during the approval process Evie found a solution. Anyone looking for a financial solution needs to have Evie on their side

Pat F.

Verified Review

Robyn was very professional in her mannerism in organising us our loan . Robyn was always polite .. She kept us up to date and informed on the development of our loan even after hours as it was hard for us to speak to her during work hours . Very helpful when your not tec savy I would highly recommend Robyn to anyone needing to deal with Emu Loans and will definitely recommend her to friends and family . Keep up the great work Robyn You are a true inspiration to you job Karen Grimston

karen c.

Frequently Asked Questions

Business Line of Credit FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.