Compare Van Finance from 50+ Australian Lenders

Finance cargo, crew or refrigerated vans with flexible structures like chattel mortgage, hire purchase or finance lease. Sharp rates, fast approvals.

5.0 rating

Van Finance Made Simple

From last-mile delivery to mobile services, the right van keeps work moving. Finance tailored to cash flow, kilometre use and asset life.

Borrow With Confidence

Typical amounts from $15,000 to $200,000+ depending on profile and van

Flexible Terms

1 to 7 year terms with optional balloons/residuals

Fast Approvals

Same-day decisions possible for eligible applications

New or Used

Dealer, auction or private sales supported

Tax-Smart Structures

Chattel mortgage, hire purchase, finance lease

Fit-outs & Conversions

Shelving, refrigeration, racking and signage can be included

How it works

We match your application to lenders that specialise in business van finance so you can compare options with confidence.

Apply online in 3 minutes

Share business details, the van you’re eyeing and your budget.

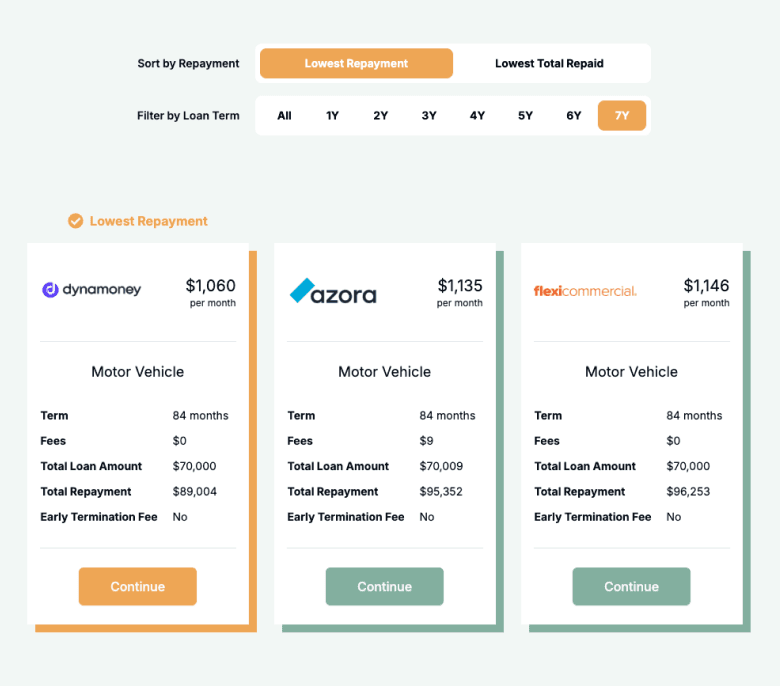

See matched options

Our Lender Match compares structures, rates and terms side-by-side.

Upload documents

Provide ID, ABN/GST and bank statements (financials for higher limits).

Settle & collect

We coordinate with the seller so you can get on the road sooner.

A quick guide to van finance

Van finance helps Australian SMEs and sole traders acquire mission-critical vehicles without a large upfront hit to cash flow. Common structures include chattel mortgage (you own the van from day one), commercial hire purchase (ownership transfers at the end) and finance lease (use the van during the term with a residual). Pricing depends on turnover, trading history, credit profile and the van’s age and kilometres. Balloons can reduce repayments to align costs with the van’s useful life. Whether you’re building a delivery fleet or converting a mobile workshop, the right structure keeps cash flow smooth while preserving working capital.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of van finance

Choose a structure aligned to tax treatment, ownership and cash flow:

What can I use van finance for?

Vans are the workhorse of Australian business. Finance can cover purchase and fit-outs for a range of industries.

Local Deliveries & Couriers

Cargo vans for eCommerce fulfilment and last-mile routes with shelving and cargo barriers.

Trades & Contractors

Crew or mid-roof vans fitted with racking, partitions and power for tools and materials.

Refrigerated Transport

Chill or freezer conversions for food, floristry or pharmaceuticals with compliant insulation.

Mobile Services

Set up mobile workshops for mechanics, locksmiths, installers or on-site maintenance.

Event & Hire

Transport AV gear, staging and signage between venues with secure storage solutions.

Tourism & Shuttle

People-mover or crew conversions for hotel, airport or tour transfers (where eligible).

Case Study

Daniel R, Parcel Pace Pty Ltd

Lower repayments with a sensible residual

Industry: Courier & Logistics

Challenge: Needed two new high-roof vans to keep up with parcel volumes without straining cash flow.

Solution: Finance lease, 48-month term with a 30% residual aligned to expected resale value.

A Sydney courier business upgraded to two late-model high-roof vans. By selecting a finance lease with a residual, they reduced monthly costs and preserved capital for hiring drivers. The expected resale value is projected to clear most of the residual at term end, keeping upgrades simple.

How much can I borrow with van finance?

Typical facility sizes range from $15,000 to $200,000+ per vehicle. Limits depend on turnover, time in business, van age/kilometres and your credit profile. Many lenders fund up to 100% of the purchase price (plus on-roads and fit-outs) for newer vans; older vehicles may attract lower LVRs and shorter terms.

Van Finance Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term, rate and balloon to plan cash flow before you apply.

Balance over time

Am I eligible for van finance?

Eligibility focuses on serviceability and vehicle suitability. Newer, lower-kilometre vans often attract sharper pricing and longer terms. Strong bank-statement health and stable trading history improve approval odds.

You may be eligible if you are:

An Australian business with active ABN (GST preferred for larger limits)

Over 18 years old

Trading for 6–12 months (start-ups considered case-by-case)

Minimum monthly turnover of $5,000–$10,000

Purchasing an eligible van (cargo, crew, people-mover, refrigerated)

How to apply for van finance?

Complete a quick online application and upload documents. We’ll source multiple offers across chattel mortgage, hire purchase and lease options, then coordinate settlement with the seller.

Documents you may need:

ABN and GST details

Photo ID (driver’s licence or passport)

Business bank statements (3–6 months)

Tax returns/BAS for larger limits

Vehicle details (VIN, rego, invoice/quote)

How to save money on van finance

Compare structures as well as rates—chattel mortgage vs lease vs hire purchase can change cash-flow, tax treatment and total cost. Choose a residual/balloon that aligns with the van’s expected resale value and your kilometres. Bundle fit-outs (shelving, refrigeration, partitions) at settlement so they’re financed at the same rate. Newer vans typically qualify for sharper pricing. Avoid unnecessary add-ons and consider total cost of ownership (tyres, servicing, fuel/energy).

Example: Balloon impact — $65,000 over 60 months at 8.49% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $1,335 | Highest monthly cost |

10% ($6,500) | $1,216 | Lower monthly cost |

20% ($13,000) | $1,097 | Balance of cost vs cash flow |

30% ($19,500) | $978 | Lowest monthly cost; plan for resale/refinance |

Understanding van finance options

Van finance can be set up to suit repayments, ownership and upgrade cycles. Here are the key choices:

Secured vs Unsecured

Most van loans are secured against the vehicle for sharper rates. Unsecured options exist but with higher costs and lower limits.

Balloon/Residual Payments

Lower monthly repayments by deferring a lump sum to the end; pay out, refinance or trade-in later.

Fixed vs Variable Rates

Fixed offers certainty for budgeting; variable may save if market rates fall but adds interest-rate risk.

Early Repayment Flexibility

Some lenders allow extra repayments or early payout; others charge break fees—check before you sign.

Fit-outs at Settlement

Shelving, refrigeration and partitions can often be included in the initial finance at the same rate.

Testimonials

Verified Review

I've worked with Brad for quite some time, and after 25+ years in business across Australia, I can say with confidence: professionals like him are rare, in his case, unique in the industry. Brad understands business, printers, people, and lenders better than anyone I've worked with. The advice he's given, the care he's shown, and the way he's gone above and beyond to make sure my customers get the best deal possible has made a real impact. Some of my customers haven't just grown, they have exceeded expectations. For me, that's the proof in the pudding.

Gus A.

Verified Review

We highly recommend Brad, he went above and beyond to assist us and kept us informed all the way through the process. 5 stars all the way!! loooking forward to working with you again when we need to purchance our next hooist or other workshop equipment!! cheers

Gregory S.

Verified Review

Eujin was extremely easy to work with. He was respectful, clear in communication and persuasive. He works to get the best deal for his clients.

Chetan P.

Verified Review

We recently had the pleasure of working with Eujin to secure a car loan, and we couldn't be more grateful for his assistance. Eujin went above and beyond to ensure we got the best possible terms. His professionalism, dedication, and willingness to help were evident throughout the entire process. Thank you, Eujin, for making this experience smooth and stress-free. Highly recommend his services!

Bstl 1.

Verified Review

Ryan was Very helpful through the entire process and made everything super simple for me. Had no issues altering and changing to suit my needs throughout

Kye Z.

Verified Review

I was dealing with Ryan and wow 💯 He Helped me all the way from start too Finsh with my application,I would definitely go through these guys again Thanks👌

Phillip U.

Frequently Asked Questions

Business Van Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.