Compare Boat Finance from 50+ Australian Lenders

Tinnies, runabouts, bowriders, fishing boats and yachts—line up sharp rates and repayments you can plan around.

5.0 rating

Boat Finance Made Simple

Get on the water sooner and keep your savings for fuel, gear and weekends away. We’ll help you choose a loan that fits your budget and the boat you want.

Borrow With Confidence

Typical amounts from $5,000 to $150,000+

Flexible Terms

1 to 7-year options so repayments feel comfortable

Fast Approvals

Eligible applications can be assessed quickly

New or Used

Dealer, broker or private sale supported

Fixed Repayments

Lock in predictable monthly instalments

Bundle Extras

Electronics, trailer, safety gear and insurance can often be included

How it works

Compare offers in minutes, choose your lender and organise settlement without the run-around.

Apply online in minutes

Tell us about you, the boat and your budget.

See matched options

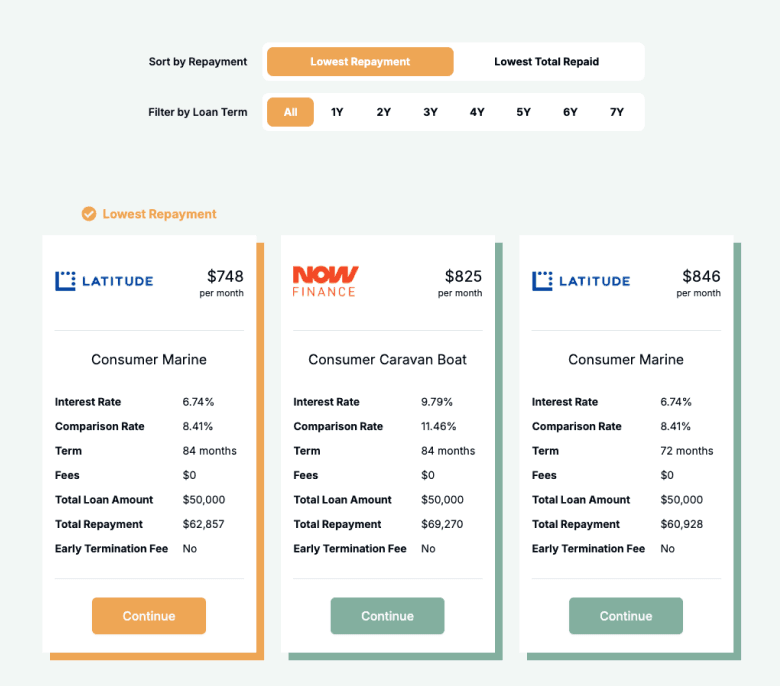

Compare secured vs unsecured and fixed vs variable side by side.

Upload documents

ID, proof of income and recent bank statements are usually enough.

Settle & launch

We coordinate payment with the seller so pickup and registration are smooth.

A quick guide to boat finance

A boat loan lets you buy now and pay it off over 1–7 years—so you can spend summer on the water, not waiting on savings. Most borrowers choose a secured loan using the boat as collateral for sharper pricing; unsecured options add flexibility when needed.

Your rate and limit depend on income, credit history and the boat’s age/value. Newer or well-kept boats often unlock better pricing and longer terms, while older hulls can still be financed with slightly different limits. The right structure keeps repayments comfortable and your boating plans afloat.

Want to skip ahead?

Jump to the section you need.

Types of boat loans

Choose a structure that fits how you buy and how you plan to repay:

What can you use a boat loan for?

Finance the boat—and the gear that makes days on the water safer and more fun.

New Boat Purchase

Runabouts, bowriders, cabin cruisers, centre consoles or RIBs—finance the model that suits your waters.

Used Boat Purchase

Buy pre-owned from a dealer, broker or private seller with terms suited to age and value.

Fishing Setups

Outfit a tinny or offshore rig with sounder/GPS, electric motor, livewell and rod storage.

Wake & Ski Boats

Spread the cost of inboards, towers, ballast and wetsound upgrades.

Sailboats & Trailer Sailers

Finance sails, rigging refresh, safety gear and trailer upgrades.

Repairs & Refurbs

Cover repowers, electronics, upholstery, gelcoat and major servicing.

Trailer & Tow Gear

Include trailer, winch, tie-downs and tow bar so you’re launch-ready.

Safety & Essentials

Bundle PFDs, flares, VHF, EPIRB/PLB, anchors and covers into one repayment.

Mooring & Storage Costs

Some lenders allow marina/yard fees, rego and insurance to be included.

Case Study

Sam & Jess

Sam & Jess upgrade to a family bowrider without draining savings

Challenge: Sam and Jess wanted a late-model bowrider with a wake tower and updated electronics, but they preferred steady repayments over a big upfront hit.

Solution: A secured, fixed-rate loan over 5 years financed 90% of the purchase price, with the sounder/GPS and safety kit bundled at settlement.

After comparing offers through Emu Money, Sam and Jess locked in a competitive fixed rate and rolled the essentials into the same facility. One predictable repayment made weekend launches easy—no budget surprises.

How much can you borrow?

Boat loans typically range from $5,000 to $150,000+. Your limit depends on income, credit profile and vessel age/value. Newer boats and higher-value rigs can qualify for larger limits; older boats can still be financed with slightly shorter terms or lower maximum LVRs.

Terms generally run 1–7 years. Shorter terms mean higher monthly repayments but less interest overall; longer terms keep repayments lower but increase total interest paid. We’ll help you find the balance that fits your plans.

Boat Loan Repayment Calculator

Estimate repayments before you commit. Adjust amount, rate, term and balloon to see what fits your budget.

Balance over time

Are you eligible for boat finance?

Lenders want to see that repayments fit comfortably alongside your other bills. They’ll review your income, employment stability, credit history and recent bank statements. The boat matters too—newer or well-maintained vessels often attract sharper pricing and longer terms, while older hulls may have shorter terms or lower maximum LVRs. If your credit isn’t perfect or you’re self-employed, specialist lenders may still have options.

You may be eligible if you are:

An Australian resident aged 18+

Earning a regular income (PAYG or self-employed)

Able to provide payslips or bank statements

Buying an eligible new or used boat from a dealer, broker or private seller

How to apply for a boat loan

Apply online in a few minutes, upload your documents and we’ll match you with lenders. Pick your offer and we’ll handle settlement with the seller so pickup, registration and insurance are seamless.

Documents you may need:

Driver’s licence or passport

Recent payslips or bank statements

Employment/ABN details if self-employed

Vessel details (HIN/VIN, invoice/quote) + trailer details if applicable

How to save money on a boat loan

Look beyond the headline rate. Secured loans usually price sharper than unsecured. A balloon payment can lower your monthly cost but leaves a lump sum at the end—set it to a level that aligns with expected resale value. Newer boats and clean histories often qualify for better pricing. Bundle electronics, trailer and safety gear at settlement so they’re financed at the same competitive rate, and always check fees and early-repayment policies to avoid surprises.

Example: Balloon impact — $60,000 over 60 months at 8.79% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $1,240 | Highest monthly cost |

10% ($6,000) | $1,116 | Lower monthly cost |

20% ($12,000) | $992 | Balance of cost vs cash flow |

30% ($18,000) | $868 | Lowest monthly cost; plan to clear balloon |

Boat loan options explained

These features shape cost and flexibility—pick what suits how you use your boat:

Secured vs Unsecured

Secured uses the boat as collateral for sharper rates. Unsecured can be faster and more flexible but usually costs more.

Fixed vs Variable

Fixed keeps repayments steady; variable can move with market rates—potential savings if rates fall, higher costs if they rise.

Balloon Payments

Lower monthly repayments by deferring a lump sum to the end—have a plan to pay, refinance or sell.

Early Repayment Flexibility

Some lenders allow extra repayments or early payout with little/no penalty, helping you save interest.

Fees & Charges

Check establishment, monthly and exit fees—the true cost is rate + fees + time.

Testimonials

Verified Review

Brad was great quick and simple no headaches. just simple process and was done in quick time frame. cant thank him enough.

Danny D.

Verified Review

We just got our truck loan they are very supportive and Eujin guide us in really good way we are happy with service really appreciate EUJIN cheers

Lky 2.

Verified Review

It's nice, quick and easy to get a new equipments through Emu Money. Big thanks to Brad for his great assistance.

Marvin Y.

Verified Review

I would like to highly recommend Eujin from Emu Money for the excellent service provided during my loan process. His guidance, professionalism, and clear communication made the entire experience smooth and stress-free. I truly appreciate his support and would confidently recommend Emu Money to anyone seeking loan assistance.

Chathushka H.

Verified Review

Robyn was amazing the way she went through each step made it so easy to understand and having a joke along the way it was like chatting to a mate well done Robyn winner

Steve G.

Verified Review

⭐⭐⭐⭐⭐ The process with Emu Money has been fantastic — completely stress-free and very professional. Their document requirements were clear and straightforward, with everything explained step by step. Once we submitted our paperwork, the response was quick, and the whole process was easy to follow. We’re very happy with the experience and highly recommend Emu Money for any commercial loan needs

Pratik P.

Frequently Asked Questions

Boat Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.