Compare Trailer Finance from 50+ Australian Lenders

Finance utility, flatbed, refrigerated and specialised trailers with flexible loan structures. Competitive rates, fast approvals, and options tailored to business needs.

5.0 rating

Trailer Finance Made Simple

From logistics fleets to farm equipment, the right trailer is essential for efficiency. Finance designed to fit cash flow, asset life and business growth.

Borrow With Confidence

From $5,000 up to $250,000+ depending on trailer type and business profile

Flexible Terms

1 to 7 year terms with optional balloons/residuals

Fast Approvals

Same-day approvals possible for eligible applications

New or Used

Finance trailers from dealers, auctions or private sellers

Tax-Smart Structures

Chattel mortgage, hire purchase, finance lease available

Customised Fit-Outs

Finance refrigerated units, shelving, hydraulic lifts or branding

How it works

We match your application to lenders that specialise in trailer finance so you can compare rates, terms and structures with confidence.

Apply online in 3 minutes

Provide your business details, trailer type and budget.

See matched options

Our Lender Match tool compares loan structures and rates side-by-side.

Upload documents

Submit ID, ABN/GST details and recent bank statements (financials for larger facilities).

Settle & collect

We arrange settlement so you can pick up or deploy your trailer faster.

A quick guide to trailer finance

Trailer finance helps Australian businesses secure essential haulage equipment without depleting working capital. Structures include chattel mortgage (ownership from day one), hire purchase (ownership transfers at end), and finance lease (use during the term, with a residual). Loan size and pricing depend on business turnover, credit profile and trailer type—whether it’s a flatbed, refrigerated, livestock or enclosed unit. Many lenders allow balloons to keep repayments affordable while aligning costs with the trailer’s useful life. Trailer finance is widely used across logistics, construction, agriculture and mobile services.

Want to skip ahead?

This guide is broken down into sections. Click below to skip ahead.

Types of trailer finance

Choose a structure aligned to ownership, tax treatment and cash flow:

What can I use trailer finance for?

Trailers support industries across Australia—from farms to freight. Finance can cover many use cases:

Logistics & Transport

Flatbed and enclosed trailers for freight, distribution and courier businesses.

Construction & Building

Haul heavy machinery, tools and building materials between sites.

Agriculture & Farming

Livestock, crop and machinery trailers designed for rugged rural use.

Event & Exhibition

Transport staging, AV gear and displays between venues with secure enclosed trailers.

Mobile Food & Retail

Finance custom-built trailers for food trucks, coffee vans or pop-up shops.

Waste & Recycling

Specialised trailers for transporting waste, recyclables or heavy bins.

Case Study

Bill H, Harrison Farms

Flexible repayments with a balloon

Industry: Agriculture

Challenge: Needed a livestock trailer upgrade without heavy upfront costs.

Solution: Chattel mortgage, 60-month term with 25% balloon aligned to resale value.

A Queensland cattle farmer financed a new livestock trailer through Emu Money. The balloon structure kept monthly repayments low while allowing working capital to be directed towards feed and farm operations. The balloon is expected to be largely offset by the trailer’s resale value at term end.

How much can I borrow with trailer finance?

Typical facility sizes range from $5,000 to $250,000+ depending on trailer type and business profile. Many lenders finance up to 100% of purchase price for new trailers (including fit-outs), while older or specialised units may attract lower LVRs and shorter terms. Pricing depends on turnover, stability and credit health.

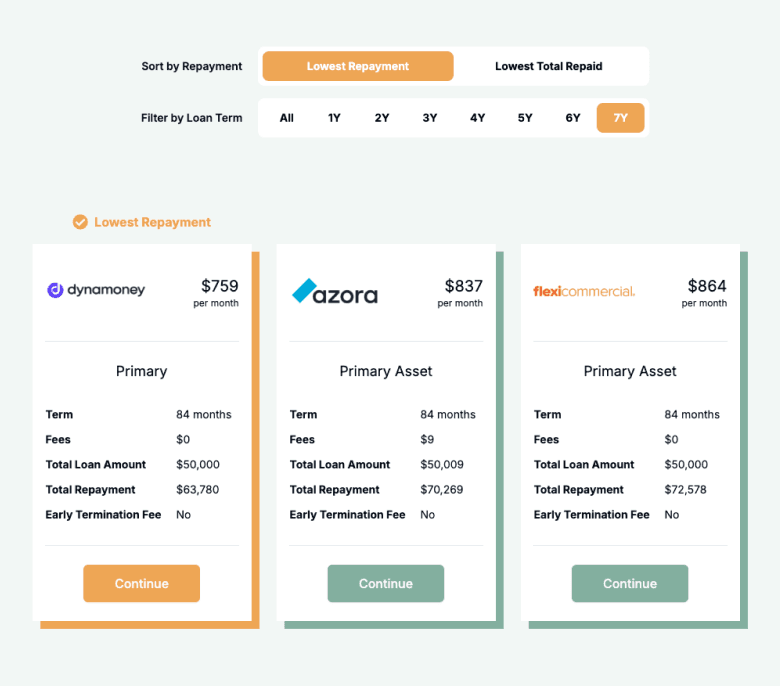

Trailer Finance Repayment Calculator

Estimate repayments and total costs before you apply. Adjust amount, term, rate and balloon to suit your budget.

Balance over time

Am I eligible for trailer finance?

Eligibility focuses on serviceability and trailer suitability. Newer and well-maintained trailers usually qualify for sharper pricing. Strong cash flow, stable turnover and clean credit improve approval odds.

You may be eligible if you are:

An Australian business with an active ABN (GST preferred for larger limits)

Over 18 years old

Trading for at least 6–12 months (start-ups considered case-by-case)

Minimum monthly turnover of $5,000–$10,000

Purchasing an eligible trailer (flatbed, enclosed, refrigerated, livestock, utility)

How to apply for trailer finance?

Apply online in minutes and upload documents. We compare multiple lenders and coordinate settlement so your trailer is ready for use quickly.

Documents you may need:

ABN and GST details

Photo ID (licence or passport)

Business bank statements (3–6 months)

Tax returns/BAS for larger limits

Trailer details (VIN, invoice, or quote)

How to save money on trailer finance

Compare loan structures as well as rates—chattel mortgage vs lease vs hire purchase can change repayments and tax outcomes. Balloons/residuals can lower monthly repayments but should align with expected resale value. Bundle accessories or modifications (hydraulic lifts, refrigeration units, branding) at settlement to finance them at the same rate. Newer trailers usually attract sharper pricing, while avoiding unnecessary add-ons reduces long-term costs.

Example: Balloon impact — $40,000 over 60 months at 8.49% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $822 | Highest monthly cost |

10% ($4,000) | $740 | Lower monthly cost |

20% ($8,000) | $658 | Balanced cost vs cash flow |

30% ($12,000) | $576 | Lowest monthly cost; resale expected to cover balloon |

Understanding trailer finance options

Trailer finance can be tailored to match ownership goals, repayment style and upgrade cycles. Key options include:

Secured vs Unsecured

Most trailer loans are secured against the trailer itself, reducing risk and interest rates. Unsecured loans exist but with higher costs.

Balloon/Residual Payments

Lower monthly costs by deferring a lump sum to the end—payout, refinance, or trade-in when due.

Fixed vs Variable Rates

Fixed rates give budgeting certainty. Variable rates may save money if market rates fall, but add risk if they rise.

Early Repayment Flexibility

Some lenders allow early payout or extra repayments; others charge fees. Check before signing if upgrades are planned.

Bundled Modifications

Custom features like refrigeration, shelving, or hydraulic lifts can often be financed alongside the trailer itself.

Testimonials

Verified Review

Eujin was extremely easy to work with. He was respectful, clear in communication and persuasive. He works to get the best deal for his clients.

Chetan P.

Verified Review

I would highly recommend Emu Money for loan purposes. Special thanks to Eujin who helped me to get the car loan within 24 hrs with no hassles at all. There services are so good.

Jiten D.

Verified Review

Erin was amazing. Nothing was too much trouble for her to help a less than tech savvy guy navigate the application. Fast and simple process with a great outcome. And she sounds nice on the phone. Haha.

Chris S.

Verified Review

I had an excellent experience with Emu Money. Robyn was fantastic – professional, approachable, and genuinely easy to deal with from start to finish. She explained everything clearly, made the whole process stress-free, and went above and beyond to ensure I was comfortable with each step. It's rare to find someone so reliable and efficient. I'd highly recommend Emu Money, and especially Robyn, to anyone looking for great service and peace of mind

Cruize W.

Verified Review

We had an excellent experience working with Stevette Gelavis from Emu Money. She was absolutely outstanding—providing clear and comprehensive information from the very beginning and demonstrating professionalism, fairness, and genuine helpfulness throughout the process. After having disappointing experiences with other loan providers who quoted us unreasonably high rates, Stevette secured us a much better rate. Thank you, Stevette, for your exceptional service and for restoring our confidence in loan providers. You’re doing a fantastic job!

Indu

Verified Review

The service and delivery was excellent Extremely understanding and caring for that matter which i find is very rare within a lot of this ground of work 10/10 recommend to go through Evette when financing something , there will be zero disappointment or let down on your end

Music

Frequently Asked Questions

Business Trailer Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.