Compare Camper Trailer Finance from 50+ Australian Lenders

Forward-fold, rear-fold or hybrid—line up sharp rates and repayments that fit your budget so you can get off the grid sooner.

5.0 rating

Camper Trailer Finance Made Simple

Spread the cost of your camper trailer into manageable repayments and keep your savings for the trip itself.

Borrow What You Need

Typical amounts from $5,000 to $80,000+

Flexible Terms

1 to 7-year options to match your budget

Quick Approvals

Eligible applications can be assessed fast

New or Used

Dealer, auction or private sale supported

Fixed Repayments

Predictable instalments you can plan around

Bundle Extras

Add awnings, solar, batteries or trailer upgrades

How it works

No endless forms—just clear offers and a smooth handover.

Apply online in minutes

Share your details, the camper trailer and your budget.

See matched options

Compare secured vs unsecured, fixed vs variable—side by side.

Upload documents

ID, proof of income and recent bank statements are usually enough.

Settle & collect

We coordinate settlement so you can hitch up and head out.

A quick guide to camper trailer finance

A camper trailer loan lets you buy now and pay it off over 1–7 years—so you can plan adventures without emptying your savings. Lenders consider your income, credit history and the trailer’s age/value to size the loan and set the rate. Newer, well-kept trailers and hybrids may unlock sharper pricing and longer terms, while older models are still financeable with slightly different limits. The right structure keeps repayments comfortable and your trip plans on track.

Want to skip ahead?

Jump to the section you need.

Types of camper trailer loans

Pick the structure that fits how you buy and how you want to repay:

What can you use camper trailer finance for?

Finance the trailer—and the gear that makes camp life effortless.

New Camper Trailer

Forward-fold, rear-fold, hard-floor or hybrid—finance the setup that suits your trips.

Used Camper Trailer

Buy pre-owned from a dealer or private seller with terms that suit age and value.

Off-Grid Upgrades

Add solar, lithium batteries, DC–DC chargers, inverters and extra water tanks.

Comfort & Storage

Finance fridges, drawer systems, awnings, ensuite tents and roof racks.

Repairs & Refurbs

Spread the cost of major servicing, bearings, brakes, canvas or electrical work.

Insurance & Registration

Some lenders let you bundle on-roads and insurance into one repayment.

Towing Essentials

Include DO35 hitches, brake controllers, tow mirrors and recovery gear.

Tow Vehicle Setup

Cover GVM upgrades, suspension or tow bar installs so you’re travel-ready.

Case Study

Hannah & Corey

Hannah & Corey kit out a hybrid camper with one set-and-forget repayment

Challenge: Hannah and Corey had their eye on a hybrid camper with solar and lithium for off-grid trips, but they wanted to keep the holiday kitty intact.

Solution: A secured, fixed-rate 5-year loan covered 90% of the trailer, with the solar system, lithium batteries and awning added to the same facility at settlement.

Emu Money lined up multiple lenders, and they chose a fixed-rate option that bundled the upgrades with the trailer. One set-and-forget direct debit, a clear monthly cost, and they were heading bush the very next weekend—no bill shock.

How much can you borrow?

Most camper trailer loans range from $5,000 to $80,000+. Your limit depends on income, credit profile and the trailer’s age/value. Newer or higher-spec hybrids often qualify for larger limits; older trailers can still be financed with slightly shorter terms or lower maximum LVRs.

Terms usually run 1–7 years. Shorter terms mean higher monthly repayments but less interest overall; longer terms keep repayments lower but increase total interest paid. We’ll help you find the balance that fits your plan.

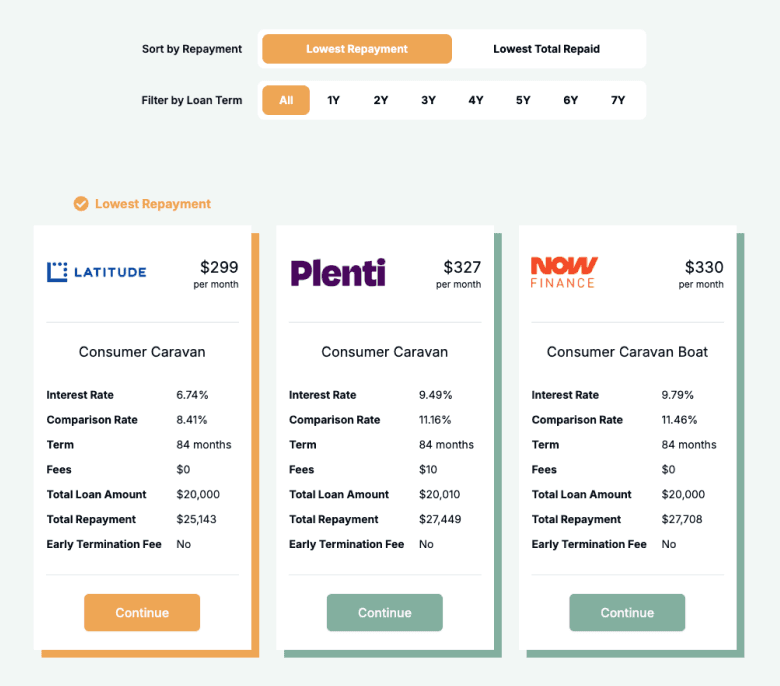

Camper Trailer Loan Repayment Calculator

Estimate repayments before you commit. Adjust amount, rate, term and balloon to plan with confidence.

Balance over time

Are you eligible for camper trailer finance?

Lenders want to see that repayments fit comfortably alongside your other bills. They’ll review income, employment stability, credit history and recent bank statements. The trailer itself matters—newer or well-maintained campers often attract sharper pricing and longer terms, while older trailers may have shorter terms or lower maximum LVRs. If your credit isn’t perfect or you’re self-employed, specialist lenders may still have options.

You may be eligible if you are:

An Australian resident aged 18+

Earning a regular income (PAYG or self-employed)

Able to provide payslips or bank statements

Buying a new or used camper trailer from a dealer or private seller

How to apply for camper trailer finance

Apply online in a few minutes, upload your documents and we’ll match you with lenders. Pick the offer that fits and we’ll handle settlement with the seller so collection day is simple.

Documents you may need:

Driver’s licence or passport

Recent payslips or bank statements

Employment/ABN details if self-employed

Trailer details (VIN/HIN, invoice or quote) + upgrade quotes if bundling extras

How to save money on a camper trailer loan

Compare more than just the headline rate. Secured loans usually price sharper than unsecured. A modest balloon can lower monthly cost, but set it to align with expected resale value. Newer trailers and hybrids often qualify for better pricing. Bundle upgrades (solar, lithium, awnings) at settlement so they’re financed at the same competitive rate. Always check fees and early-repayment policies so there are no surprises later.

Example: Balloon impact — $30,000 over 60 months at 8.59% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $619 | Highest monthly cost |

10% ($3,000) | $557 | Lower monthly cost |

20% ($6,000) | $495 | Balance of cost vs flexibility |

30% ($9,000) | $433 | Lowest monthly cost; plan to clear balloon |

Camper trailer loan options explained

These features shape cost and flexibility—choose what suits your travel plans:

Secured vs Unsecured

Secured uses the trailer as collateral for sharper pricing. Unsecured can be faster and more flexible but usually costs more.

Fixed vs Variable

Fixed locks in steady repayments. Variable can fall—or rise—with market rates.

Balloon Payments

Lower monthly repayments by deferring a lump sum to the end—have a plan to pay, refinance or sell.

Early Repayment Flexibility

Some lenders allow extra repayments or early payout with little/no penalty, helping you save interest.

Fees & Charges

Check establishment, monthly and exit fees—the true cost is rate + fees + time.

Testimonials

Verified Review

Matt @emumoney helped me get the best rate on a personal loan for our new car, and we are currently finalising sorting our business finances into one loan. Awesome service and responsive to requests.

Tim P.

Verified Review

I was completely impressed with their professionalism and customer service.. highly recommend. Special Mention to Ray thank you for assisting me in this journey

David A.

Verified Review

Brad has been absolutely amazing to work with to help with financing for our business! The process was very simple, well explained and Brad went out of his way to provide updates - highly recommended!

Karn P.

Verified Review

We would like to thank Evette from Emu Money. We have used Evette 3 times for car and personal loans and will not use anyone else. Her commitment to her customers is second to none. Evette has always come up with a solutions even in the difficult circumstances. Her communication to us was outstanding on each occasion and made us feel at ease through the processes without judgement. Love your work !!! Jason & Karen

jason c.

Verified Review

Peter was fantastic! Incredible responsive, provided clear instructions, and got us a very competitive rate. The whole process was so easy from start to finish. Can’t recommend Peter and Emu Money highly enough!

Katharina K.

Verified Review

Received a wonderful, organised & professional experience with Evette. Recommend highly her service and knowledge.

Colin B.

Frequently Asked Questions

Camper Trailer Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.