Compare Holiday & Travel Loans from 50+ Australian Lenders

Finance flights, stays, tours and spending money with clear, fixed repayments that fit your itinerary.

5.0 rating

Plan Now, Pay Over Time

Spread trip costs with fast decisions, fair terms and predictable repayments.

Borrowing Range

Typical amounts $3,000 to $30,000+

Fixed Repayments

1 to 5 year terms for certainty

Fast Approvals

Same-day outcomes possible for complete files

Secured or Unsecured

Sharper rates with security; flexible with unsecured

Direct-to-Provider

Optional payments to travel agents or tour operators

Any Trip Type

International, domestic, road trips or staycations

How it works

We match your profile to lenders who fund travel so you can book with confidence.

Apply online in 3 minutes

Share your itinerary, budget and timing. No lengthy forms.

See matched options

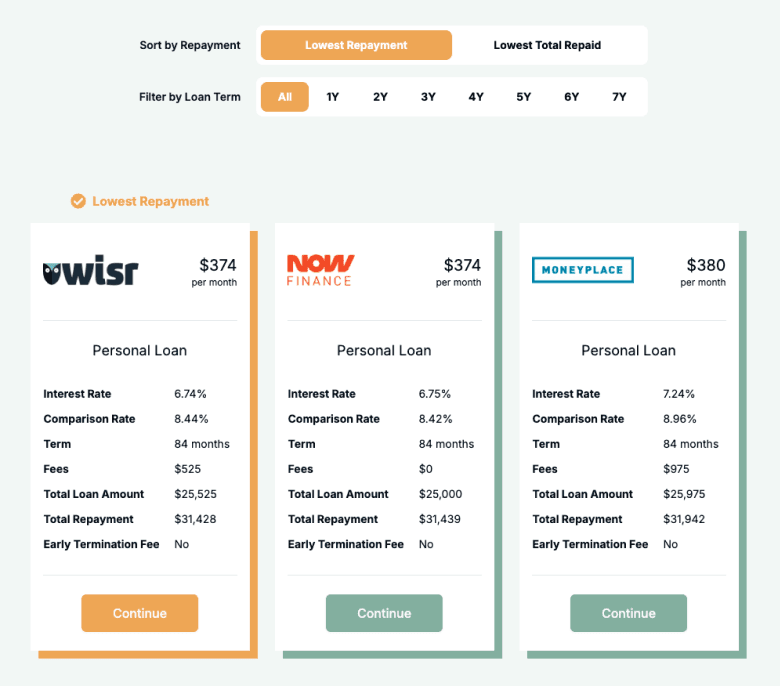

Compare secured vs unsecured, terms, fees and comparison rates.

Upload documents

Provide ID, income evidence and bank statements for assessment.

Settle & start booking

Funds to you—or direct to airlines, hotels or tour providers.

A quick guide to holiday loans

Holiday or travel loans are personal loans used to spread the cost of flights, accommodation, tours and spending money into predictable repayments. They’re ideal for big trips, family visits or last-minute travel when you’d rather not drain savings or rely on high-interest credit cards.

Choose unsecured for speed and flexibility, or secured (e.g., using a car) for sharper pricing or higher limits. Compare offers and check the comparison rate to understand true cost. Align the term to your travel timeline and post-trip budget so repayments stay comfortable when you return.

Want to skip ahead?

Explore the sections below to plan and fund your trip smartly.

Types of holiday loans

Pick a structure that fits your itinerary and budget:

What can I use a holiday loan for?

Holiday loans can cover most trip-related costs—before you go and while you’re away:

Flights & Transport

Book international or domestic airfares, trains and ferries. Optional direct payments to providers can secure early-bird fares.

Accommodation

Hotels, resorts, holiday rentals or multi-stop stays. Bundle deposits and balances into one clear repayment.

Tours & Experiences

Guided tours, theme parks, adventure activities and museum passes. Pay in advance without stretching cash flow.

Car Hire & Road Trips

Hire cars, campervans, fuel and toll budgets rolled into the same facility for simpler planning.

Travel Insurance

Include comprehensive cover so you’re protected against cancellations, delays and medical costs.

Spending Money & Extras

Meals, events, luggage, SIMs and prepaid travel cards—fund the finishing touches for a smoother trip.

Case Study

Aisha & Tom

Europe on a clear budget

Challenge: Multi-country itinerary with deposits due months in advance.

Solution: Unsecured holiday loan over 3 years with direct tour payments.

Aisha and Tom in Melbourne planned a five-week Europe trip with flights, rail passes and small-group tours. Using Emu Money, they compared matched options and chose an unsecured loan with fixed repayments and optional direct-to-provider payments. They locked in early-bird deals, avoided credit card interest and returned home with one predictable repayment and a clear end date.

How much can I borrow with a holiday loan?

Typical loan sizes range from $3,000 to $30,000+, depending on destination, trip length and your income and commitments. Secured options may allow higher limits and sharper pricing; unsecured loans prioritise speed and flexibility. Lenders check recent bank-statement conduct and overall serviceability to set sensible limits so post-holiday repayments remain manageable.

Holiday Loan Repayment Calculator

Estimate repayments before you book. Adjust amount, term and rate to see how it fits your budget.

Balance over time

Am I eligible for a holiday loan?

Eligibility focuses on affordability and income stability. Stronger credit and clean recent bank statements can unlock sharper pricing. Secured options may help if you’re seeking a larger limit for long or multi-stop trips.

You may be eligible if you are:

An Australian resident aged 18+

Employed, self-employed or receiving acceptable income

Able to show serviceability via bank statements

Meeting minimum credit criteria (score/history)

Borrowing for bona fide travel purposes

How to apply for a holiday loan?

Complete a quick online application and upload documents. We’ll compare offers across secured vs unsecured options and arrange settlement to your account or directly to providers so you can book sooner.

Documents you may need:

Photo ID (driver’s licence or passport)

Recent bank statements (3–6 months)

Payslips or income verification

Itinerary, quotes or booking holds

Asset details if offering security

How to save money on a holiday loan

Compare interest and fees—use the comparison rate to judge true cost. Shorter terms reduce total interest but raise monthly repayments; longer terms ease cash flow but cost more overall. Consider direct-to-provider payments to secure early-bird deals and avoid card interest. Borrow only what you need and check early-repayment policies so you can pay it off faster if extra funds arrive.

Example: Term impact — $12,000 at 12.49% p.a. (approx.):

| Term | Approx. Monthly Repayment | Total Interest (approx.) |

|---|---|---|

2 years (24 mths) | $566 | $1,584 |

3 years (36 mths) | $400 | $2,400 |

5 years (60 mths) | $270 | $4,200 |

Understanding holiday loan options

Structures and features affect flexibility and cost. Key options include:

Secured vs Unsecured Loans

Secured loans (often against a car) may allow larger limits and lower rates but put the asset at risk if repayments are missed. Unsecured loans are faster and flexible, usually at higher rates.

Fixed vs Variable Rates

Fixed rates lock in predictable repayments. Variable rates can change with the market—potential savings if rates fall, risk if they rise.

Direct-to-Provider Payments

Some lenders pay airlines, agents or tour companies at settlement, helping you lock in fares and ensure funds are used as intended.

Early Repayment Flexibility

Look for extra repayments and early payout with low or no penalty so you can clear the balance sooner and save on interest.

Rate-for-Risk Pricing

Sharper pricing goes to stronger profiles. Improving bank-statement conduct and reducing other debts before applying can help.

Testimonials

Verified Review

Just the best organiser and extremely helpful 👌. Strongly recommend!!!

Cleo C.

Verified Review

Rachel Connors from Emu Money was absolutely amazing from start to finish. Her dedication and fast approach made sure everything ran smoothly. She knew all the answers to any questions, and made sure she kept me informed during the whole process. Would highly recommend Rach for all your finance needs.

jennifer s.

Verified Review

S. B.

Verified Review

I couldn't be happier with the service I received! Robyn made the whole car finance process so simple and stress free. She explained everything clearly, kept me updated the whole way through, and went above and beyond to find me the best deal. I honestly didn't think it would be this smooth, but she took care of all the hard work and I was in my new car before I knew it. Highly recommend to anyone looking for finance.

harry b.

Verified Review

Peter was very quick, responsive and easy to deal with. Great experience, and we're picking up our new car tomorrow!

Olivia F.

Verified Review

I got my car loan approved within very short period of time , Bindia is very cooperative and friendly, and always gives right financial advice. Highly recommended.

ankur p.

Frequently Asked Questions

Holiday Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.