Compare Wedding Loans from 50+ Australian Lenders

Finance your dream day with flexible loans designed to cover venues, catering, attire, photography, honeymoons and more.

5.0 rating

Make Your Day Unforgettable

Spread the cost of your wedding with clear, fixed repayments that fit your budget.

Borrowing Range

Typical amounts $5,000 to $50,000+

Flexible Terms

1 to 7 year terms available

Fast Approvals

Some lenders provide same-day decisions

Secured or Unsecured

Choose flexibility or sharper rates with security

Covers All Costs

From deposits to honeymoons, funds are versatile

Clear Repayments

Fixed monthly instalments make budgeting easier

How it works

We connect your application with lenders who fund weddings—so you can focus on planning the big day.

Apply online in 3 minutes

Provide your details, budget and expected costs. Quick, simple and no lengthy forms.

See matched options

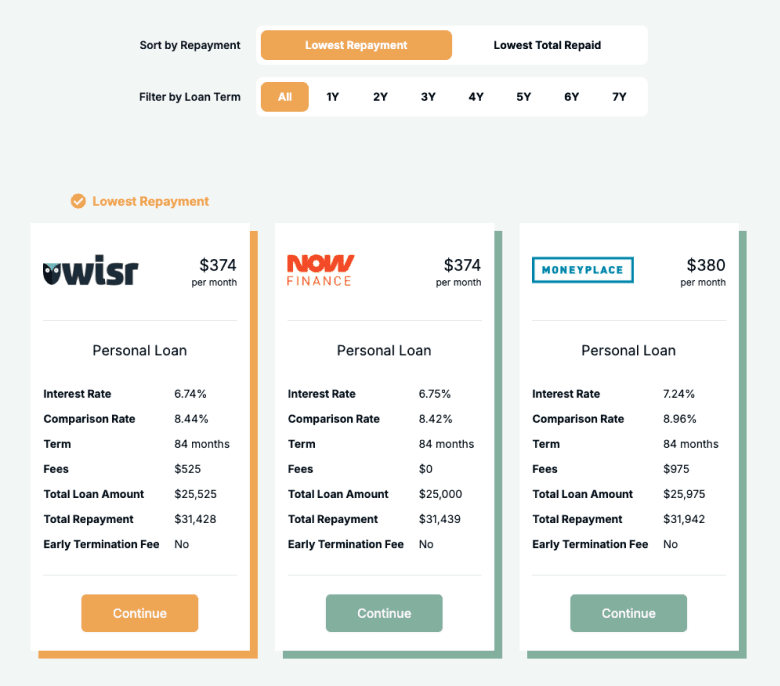

Our technology compares secured vs unsecured offers with different terms and rates.

Upload documents

Submit ID, income details and bank statements so lenders can assess affordability.

Settle & pay vendors

Funds are transferred to your account so you can pay venues, caterers and suppliers.

A quick guide to wedding loans

Wedding loans are personal loans used to finance all aspects of your big day—from venues and catering to attire and honeymoons. They help spread costs into predictable repayments, avoiding the need to dip into savings or rely on high-interest credit cards.

Loan sizes and rates depend on your income, credit profile and lender policies. You can choose secured options for larger borrowing power or unsecured for flexibility. Comparing multiple lenders ensures you find terms that keep repayments manageable while making your special day unforgettable.

Want to skip ahead?

Explore each section to find exactly what you need.

Types of wedding loans

Choose the structure that best fits your plans and budget:

What can I use a wedding loan for?

Wedding loans are versatile and can cover every aspect of your celebration, from the essentials to the finishing touches:

Venue Booking

Secure the perfect ceremony or reception space, often requiring large deposits months in advance. Loans can help cover upfront costs to lock in your dream location.

Catering & Beverages

Food and drink can account for the largest share of your budget. A loan helps spread these costs, keeping repayments predictable without draining savings.

Photography & Videography

Capture the memories with professional services. Finance packages make it easier to book quality photographers and videographers without compromise.

Wedding Attire

From dresses and suits to bridesmaid and groomsmen outfits, a loan ensures everyone looks their best without immediate financial strain.

Décor & Flowers

Fund floral arrangements, centrepieces, lighting and decorative touches that bring your theme to life, while paying costs off over time.

Entertainment & Music

Whether it’s a live band, DJ or classical quartet, loans can cover entertainment deposits and fees so your celebration has the soundtrack it deserves.

Transport & Accommodation

Hire cars, guest shuttles or book accommodation for yourself and your family. A loan keeps these logistics simple to manage.

Honeymoon

Extend the joy with a honeymoon, financed as part of the same loan. Predictable repayments mean you can relax after the big day.

Case Study

James & Mia

Dream venue within reach

Challenge: Wanted a beachfront venue but deposits were due a year in advance.

Solution: Unsecured wedding loan repaid over 2 years.

James and Mia in Sydney had their hearts set on a waterfront reception. With venue and catering deposits due well ahead of the big day, they needed a way to spread costs without overusing credit cards. Through Emu Money, they secured an unsecured wedding loan with a fixed rate. This gave them the funds to lock in vendors early, while keeping repayments manageable within their monthly budget.

How much can I borrow with a wedding loan?

Most wedding loans range from $5,000 to $50,000+, depending on your income, credit score and lender policy. Larger amounts may be available with security, while unsecured options prioritise flexibility. Borrowing power is based on affordability and overall commitments. It’s always wise to borrow only what you need—balancing your dream celebration with future financial comfort.

Wedding Loan Repayment Calculator

Estimate repayments before you commit. Adjust amount, term and rate to see how it fits your budget.

Balance over time

Am I eligible for a wedding loan?

Eligibility depends on income stability, credit history and your ability to repay. Stronger profiles may access lower rates and higher limits, while secured options can assist those with weaker credit. Lenders look closely at bank statements to ensure affordability.

You may be eligible if you are:

An Australian resident aged 18+

Employed or self-employed with regular income

Able to show serviceability via bank statements

Meeting minimum credit criteria

Borrowing for wedding or related personal purposes

How to apply for a wedding loan?

Complete our quick online form and upload supporting documents. We’ll compare multiple lenders, match you to suitable offers, and arrange settlement so you can start paying vendors and deposits.

Documents you may need:

Photo ID (driver’s licence or passport)

Recent bank statements (3–6 months)

Payslips or income verification

Quotes or invoices from vendors

Asset details (if offering security)

How to save money on a wedding loan

Plan carefully to avoid over-borrowing. Compare interest rates and fees across lenders, and check the comparison rate to reveal true cost. Shorter terms save on total interest, but longer terms reduce monthly outgoings—strike the right balance for your budget. Borrow only what you need, and consider early-repayment options so you can clear the debt sooner if funds allow.

Example: Loan impact — $30,000 at 11.99% p.a.:

| Term | Approx. Monthly Repayment | Total Interest (approx.) |

|---|---|---|

3 years (36 mths) | $995 | $5,820 |

5 years (60 mths) | $667 | $10,020 |

7 years (84 mths) | $528 | $14,472 |

Understanding wedding loan options

Different structures and features affect flexibility and cost. Here are the most common options:

Secured vs Unsecured

Secured loans require collateral and may allow larger borrowing with sharper rates. Unsecured loans don’t require assets, offering faster approval and flexibility—ideal for couples who want quick funds.

Fixed vs Variable Rates

Fixed rates provide certainty with the same repayment every month. Variable rates can change with the market and may save money if rates fall, but carry risk if they rise.

Debt Consolidation After Wedding

If you’ve used credit cards or smaller loans during planning, a wedding loan can consolidate these into one repayment after the event, lowering stress and simplifying finances.

Early Repayment Flexibility

Some lenders allow you to repay faster without penalty. This can save interest if you come into extra funds after the wedding or during your honeymoon period.

Rate-for-Risk Pricing

Your income stability, credit score and bank-statement conduct influence the rate offered. Stronger profiles access sharper pricing, so preparing your finances beforehand can improve results.

Testimonials

Verified Review

Emu Money does a really good job when it comes to their services. It was pretty easy and smooth, less stressful, quick, Cristal clear, very friendly, to the point...etc I would highly recommend them for anyone My agent was Eujin who made my dream come true with what I wanted achieved. Thanks heaps and all the very best. Regards Lankesh

Lankesh S.

Verified Review

The service and delivery was excellent Extremely understanding and caring for that matter which i find is very rare within a lot of this ground of work 10/10 recommend to go through Evette when financing something , there will be zero disappointment or let down on your end

Music

Verified Review

We just got our truck loan they are very supportive and Eujin guide us in really good way we are happy with service really appreciate EUJIN cheers

Lky 2.

Verified Review

I had Baron as my broker for a car loan, and the entire process was incredibly smooth and straightforward. All I had to do was answer a few questions and provide the necessary documents — Baron handled the rest. Before I knew it, I was finalizing the paperwork for my new car. Highly recommend — really appreciate all your help, Baron!

Donna C.

Verified Review

I applied for a car loan with the help of Emu Money a week ago, and the process was very fast and easy. There was no stress at all, as everything was taken care of by Krish, who managed my application from start to finish. He was very easy to communicate with and clearly explained the entire process and what was required from me. He was also quick to provide updates throughout. I would definitely recommend Emu Money to anyone looking for a smooth and hassle-free loan experience.. Thank you Krish.

Saritha A.

Verified Review

Brad provided excellent guidance throughout the entire loan process, making it much easier for me to achieve my financial goals. His expertise and support were invaluable, and I'd highly recommend him to anyone looking for a reliable finance broker.

Marlon

Frequently Asked Questions

Wedding Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.