Compare Home Renovation Loans from 50+ Australian Lenders

Upgrade kitchens, bathrooms, extensions and outdoor spaces with clear, fixed repayments tailored to your budget.

5.0 rating

Refresh, Extend, Improve

Finance upgrades with fast decisions, fair terms and repayments that fit your cash flow.

Borrowing Range

Typical amounts $5,000 to $75,000+

Fixed Repayments

1 to 7 year terms for certainty

Fast Approvals

Same-day outcomes possible for complete files

Secured or Unsecured

Sharper rates with security; flexible with unsecured

Direct-to-Supplier

Optional payments to builders or vendors at settlement

Green Upgrades Ready

Solar, insulation, efficient HVAC and windows eligible

How it works

We match your profile to lenders that fund home improvements—so projects can start sooner.

Apply online in 3 minutes

Share your plans, quotes and budget. No lengthy forms.

See matched options

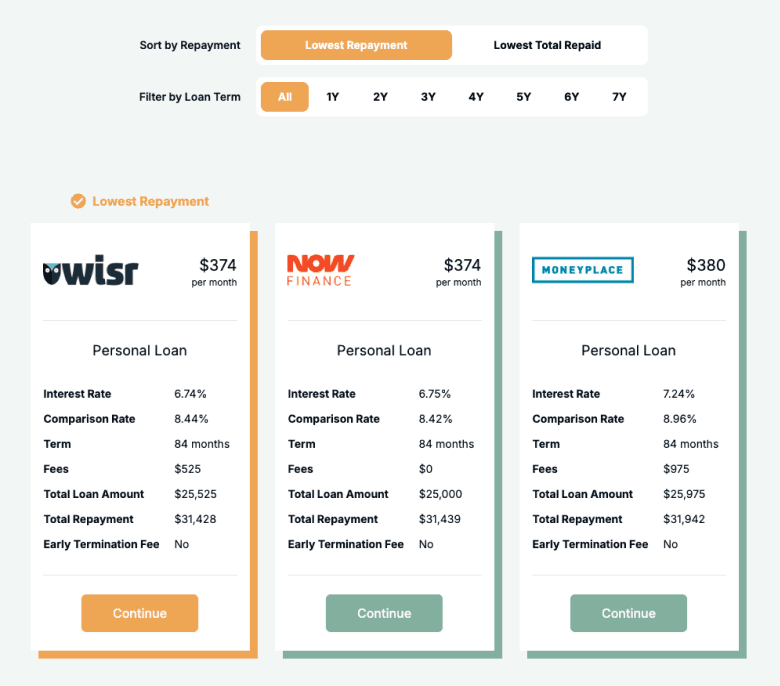

Compare secured vs unsecured, terms, rates and fees side by side.

Upload documents

Provide ID, income evidence and bank statements for assessment.

Settle & pay trades

Funds to you or direct to builders/suppliers so work can begin.

A quick guide to home renovation loans

Home renovation loans are personal loans used to fund upgrades and repairs—like kitchens, bathrooms, landscaping, roofing, extensions and energy-efficiency improvements. They spread project costs into predictable repayments, helping you avoid draining savings or juggling multiple credit cards.

You can choose unsecured for speed and flexibility, or secured (e.g., against a car) for sharper pricing or higher limits. Comparing offers—and checking the comparison rate—helps you understand total cost. Align the term to your project timeline and expected value uplift for a smart balance of cash flow and cost.

Want to skip ahead?

Jump to the section that best fits your project.

Types of home renovation loans

Pick a structure that suits your project scope and budget:

What can I use a renovation loan for?

Renovation loans can fund essential repairs and value-adding upgrades across your home:

Kitchen Remodels

Cabinetry, benchtops, appliances and layout changes to modernise your most-used space and improve resale appeal.

Bathroom Upgrades

New tiling, fixtures, waterproofing and ventilation to refresh older bathrooms and add value.

Roofing & Structural Repairs

Fix leaks, replace roofing or address foundational issues before they become bigger problems.

Extensions & Conversions

Add a bedroom or convert an attic/garage to gain liveable space without moving.

Outdoor & Landscaping

Decks, pergolas, fencing and landscaping to lift street appeal and everyday enjoyment.

Energy-Efficiency Upgrades

Solar panels, battery, double glazing, insulation and efficient HVAC to cut bills and boost comfort.

Major Repairs & Remediation

Address water damage, mould remediation or electrical rewiring for safety and compliance.

Pools & Entertaining Areas

Install a pool or upgrade outdoor kitchens and paving for year-round entertaining.

Case Study

Sofia & Marco

Kitchen upgrade without the cash squeeze

Challenge: Needed to replace an outdated kitchen and fix a leaking roof.

Solution: Unsecured renovation loan over 5 years with direct-to-supplier payments.

A family in Melbourne wanted a modern kitchen but also had urgent roof repairs. Through Emu Money they compared options and chose an unsecured renovation loan with a fixed rate and no monthly fee. Funds were split—some paid directly to the roofing contractor and the rest for cabinetry and appliances—leaving one predictable repayment and a clear end date.

How much can I borrow with a renovation loan?

Typical loan sizes range from $5,000 to $75,000+, depending on project scope, income stability and overall commitments. Secured options can unlock higher limits and sharper pricing; unsecured options prioritise speed and flexibility. Lenders review quotes and recent bank-statement conduct to size the facility sensibly so repayments remain manageable.

Home Renovation Loan Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term and rate to plan your project before you apply.

Balance over time

Am I eligible for a renovation loan?

Eligibility centres on affordability, income stability and a clear project plan with quotes or invoices. Stronger profiles or secured options can access sharper pricing and higher limits.

You may be eligible if you are:

An Australian resident aged 18+

Employed, self-employed or receiving acceptable income

Able to show serviceability via bank statements

Meeting minimum credit criteria (score/history)

Borrowing for bona fide home improvement purposes

How to apply for a renovation loan?

Complete a quick online application and upload documents. We’ll compare offers across secured vs unsecured and coordinate settlement—either to your account or directly to trades and suppliers.

Documents you may need:

Photo ID (driver’s licence or passport)

Recent bank statements (3–6 months)

Payslips or income verification

Quotes or invoices from builders/suppliers

Asset details if offering security

How to save money on a renovation loan

Compare rate and fees—use the comparison rate for true cost. Stage your project where possible so you only borrow what you need, when you need it. Shorter terms reduce total interest, while longer terms ease monthly cash flow. Consider secured options if you’re comfortable offering collateral for sharper pricing, and check early-repayment policies so you can pay it down faster without penalty.

Example: Term impact — $40,000 at 10.99% p.a. (approx.):

| Term | Approx. Monthly Repayment | Total Interest (approx.) |

|---|---|---|

3 years (36 mths) | $1,308 | $7,088 |

5 years (60 mths) | $869 | $12,140 |

7 years (84 mths) | $689 | $18,888 |

Understanding renovation loan options

Structure and features affect price, flexibility and project control. Key options include:

Secured vs Unsecured Loans

Secured loans (often against a car) may allow larger limits and lower rates but put the asset at risk if repayments are missed. Unsecured loans are faster and flexible, usually at higher rates.

Fixed vs Variable Rates

Fixed rates lock in predictable repayments; variable rates can move with the market and may save money if rates fall—but could rise.

Direct-to-Supplier Payments

Pay builders or vendors at settlement to secure materials and lock in work schedules, ensuring funds are used as intended.

Staged Drawdowns

For multi-phase projects, staged drawdowns let you access funds in steps, reducing interest on unused amounts.

Early Repayment Flexibility

Look for extra repayments and early payout with low or no penalty so you can clear the balance sooner and save on interest.

Rate-for-Risk Pricing

Sharper pricing goes to stronger profiles. Improving bank-statement conduct and reducing other debts before applying can help.

Testimonials

Verified Review

Dealing with Ryan has been excellent from start to finish ! Quick response no questions in answered great experience all round

Daniel W.

Verified Review

I've worked with Brad from Emu Money a few times now, and I highly recommend. Brad is very responsive to emails (even when on holiday in Fiji), keeps me up to date and gets everything organised very quickly. Brad spoke directly with my supplier and they figured everything out. I won't hesitate to work with Brad again.

Christine F.

Verified Review

S. B.

Verified Review

Rachel Connors from Emu Money was absolutely amazing from start to finish. Her dedication and fast approach made sure everything ran smoothly. She knew all the answers to any questions, and made sure she kept me informed during the whole process. Would highly recommend Rach for all your finance needs.

jennifer s.

Verified Review

Straight to the point and super friendly, got off the phone with Peter late one afternoon and midday the next day the money has hit my account. Incredible service and super helpful

Tyler R.

Verified Review

Robyn has been brilliant to work with. Made everything easy from the start and explained the details of the loan in depth before submitting the application. Called Robyn Monday morning to discuss possible loan for car and drove my new car home Thursday afternoon with a finance rate better than what the car dealer was offering. Would highly recommend Robyn and emu money for future loans

Patrick B.

Frequently Asked Questions

Home Renovation Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.