Compare Van Finance from 50+ Australian Lenders

Get the van you need sooner — from family movers to camper conversions — with flexible repayments that fit your budget.

5.0 rating

Van Finance Made Simple

From road trips to work runs, van finance helps you spread the cost and keep your cash flow steady.

Borrow With Confidence

Loan amounts typically range from $5,000 to $100,000+

Flexible Terms

Choose 1 to 7 years depending on your budget

Quick Approvals

Get a decision fast and hit the road sooner

New or Used Vans

Finance available for dealer, auction or private sales

Fixed Repayments

Know exactly what’s due each month with fixed terms

Fit For Any Purpose

Family vans, camper vans, trade vehicles or mobile businesses

How it works

Applying for van finance is quick and straightforward — compare lenders and pick the option that works best for you.

Apply online in 3 minutes

Share your details, the van you’re looking at, and your budget.

Get matched offers

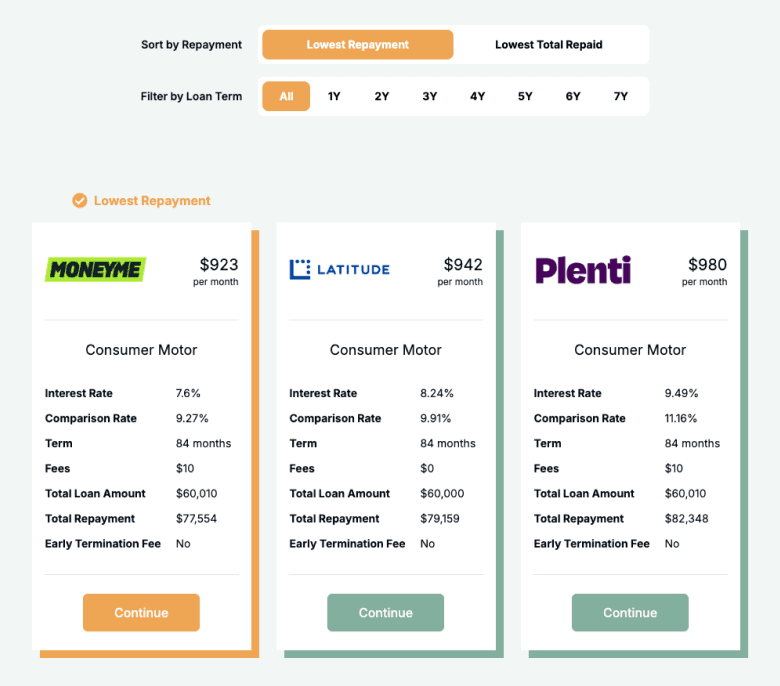

See side-by-side loan options, including secured, unsecured, fixed and variable.

Upload documents

Proof of income, ID and bank statements are usually enough.

Settle & drive away

We arrange settlement so you can collect your van without hassle.

A quick guide to van finance

A van can be one of the most versatile vehicles you’ll own — perfect for growing families, road trips, or even starting a mobile business. With van finance, you don’t have to save up the full amount. Instead, you borrow what you need and repay it in instalments that fit your budget.

Lenders look at your income, credit profile and the type of van you’re buying. Newer models often unlock better rates and longer terms, while used vans are still financeable with slightly different conditions. Either way, the right loan helps you get the van you want now without draining your savings.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of van loans

There are different ways your van loan can be structured — here are the most common:

Secured Car Loan

A car loan secured against the vehicle you're purchasing, offering competitive rates and terms for both new and used cars.

Pros

- Lower interest rates due to vehicle security

- Higher loan amounts available

- Longer repayment terms possible

Cons

- Vehicle serves as collateral - risk of repossession

- Restrictions on selling the vehicle during loan term

- Comprehensive insurance typically required

Best For

Car buyers seeking the lowest possible rates who are comfortable securing the loan against their vehicle. Perfect for new and used car purchases with competitive terms.

Unsecured Personal Loan

A personal loan that doesn't require collateral, based on your creditworthiness and ability to repay, offering flexibility for various purposes.

Pros

- No collateral required - no risk to personal assets

- Quick approval and funding process

- Flexible use of funds for any purpose

Cons

- Higher interest rates than secured loans

- Stricter credit requirements

- Lower maximum loan amounts available

Best For

People who need flexible funding for any purpose without risking their assets. Ideal for debt consolidation, home improvements, holidays, and old or exotic vehicles.

Fixed Rate Car Loan

A secured car loan with a fixed interest rate that remains constant throughout the loan term, providing predictable monthly payments.

Pros

- Predictable monthly payments with fixed interest rates

- Protection against interest rate increases

- Easier budgeting and financial planning

Cons

- Cannot benefit from interest rate decreases

- Typically higher initial rates than variable loans

- Less flexibility in payment structure

Best For

Budget-conscious borrowers who want predictable monthly payments and protection against interest rate increases. Ideal for first-time car buyers or those on fixed incomes.

Variable Rate Car Loan

A secured car loan with an interest rate that can fluctuate with market conditions, potentially offering savings when rates decrease.

Pros

- Can benefit from interest rate decreases

- Often lower initial rates than fixed loans

- More flexible loan features available

Cons

- Monthly payments can increase with rising rates

- Uncertainty in budgeting due to rate fluctuations

- Risk of significant payment increases

Best For

Financially savvy borrowers who can handle payment fluctuations and want to capitalise on falling interest rates. Great for those with stable income who expect rates to drop.

What can you use van finance for?

Van finance can be tailored to almost any lifestyle or need — from family to business and everything in between.

Family Transport

Finance a safe, comfortable van with enough space for kids, relatives and all the gear that comes with them.

Camping & Road Trips

Get a camper van or converted van for weekend escapes, cross-country adventures and long holidays.

Sports & Hobbies

Tow surfboards, mountain bikes, or bulky hobby gear with a van designed for adventure.

DIY & Projects

Haul tools, timber or furniture for renovations, side projects or weekend jobs.

Pet Transport

Choose a van that lets you transport pets comfortably and securely.

Event Transport

Finance a van that fits group outings, wedding parties or local events.

Accessible Vehicles

Buy or convert a wheelchair-friendly van to give yourself or a loved one more freedom and independence.

Travel & Tourism

Purchase a spacious van for exploring Australia with family or friends, with comfort and freedom on the road.

Mobile Businesses

Fit out a van as a food truck, mobile salon or pop-up retail store and hit the road.

Case Study

Luke & Sarah

Luke & Sarah turn a camper van plan into weekend reality

Challenge: Luke and Sarah wanted a camper van for family trips but preferred to keep their savings for fuel, park fees and the unexpected.

Solution: A secured, fixed-rate 5-year van loan funded 90% of the purchase price, with a simple fit-out (bed platform and fridge) bundled at settlement.

Emu Money compared lenders and they picked a flat monthly repayment that fit neatly into the family budget. No big deposit, pickup the same week, child seats clipped in and the first campsite booked—savings intact and no bill shock.

How much can you borrow with van finance?

Van loans typically range from $5,000 to $100,000+. The amount you can borrow depends on your income, credit history and the type of van you’re buying. Newer vans and camper conversions may be eligible for larger limits, while older vans might come with slightly shorter terms.

Loan terms generally run from 1 to 7 years, giving you flexibility to choose between higher monthly repayments with less interest overall, or lower monthly repayments spread over more time.

Van Finance Repayment Calculator

Estimate your repayments before you apply. Adjust the loan amount, interest rate, term and balloon to see what works for your budget.

Balance over time

Are you eligible for van finance?

Lenders will want to see that you can manage the loan without financial stress. They’ll look at your income, employment stability, credit history and recent bank statements. The van itself also matters — newer models often unlock lower rates and longer terms, while older vans are still financeable but may come with tighter conditions.

If you’re self-employed or have a less-than-perfect credit score, don’t worry — there are lenders who can work with your situation and still help you secure finance.

You may be eligible if you are:

An Australian resident over 18

Earning a regular income

Able to show bank statements or payslips

Looking to buy a new or used van from a dealer or private seller

How to apply for van finance

Applying is straightforward. Complete a short online form, upload your documents, and we’ll match you with lenders. Once you choose the right option, we’ll coordinate settlement so you can pick up your van without hassle.

Documents you may need:

Driver’s licence or passport

Recent payslips or bank statements

Employment details

Van details (invoice, rego, VIN or quote)

How to save money on van finance

The right loan structure makes all the difference. Secured loans usually offer lower rates, while unsecured loans give you more flexibility if you don’t want the van tied to the loan. Balloons can lower your monthly repayments but leave a lump sum at the end — plan ahead for this. Choosing a newer van can help secure sharper pricing. Always check fees and see if extras like rego or accessories can be rolled into the loan to save on out-of-pocket costs.

Example: Balloon impact — $40,000 over 60 months at 8.29% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $815 | Highest monthly cost |

10% ($4,000) | $733 | Lower monthly cost |

20% ($8,000) | $652 | Balance of cost vs cash flow |

30% ($12,000) | $570 | Lowest monthly cost; plan ahead to clear balloon |

Van finance options explained

Here are the key features that can shape your repayments and flexibility:

Secured vs Unsecured Loans

A secured loan uses the van as collateral, usually giving you a lower rate. An unsecured loan can be faster but often costs more.

Fixed vs Variable Rates

Fixed rates lock in steady repayments, while variable rates move with the market — which can save you money or increase costs.

Balloon Payments

Reduce monthly costs by deferring a lump sum to the end of the loan. Just make sure you’ll be able to pay it off, refinance or sell.

Early Repayment Flexibility

Some lenders let you pay extra or settle early without penalty, helping you save interest.

Fees & Charges

Always look beyond the rate — account-keeping fees, establishment fees and exit costs all add to the total cost.

Testimonials

Verified Review

Erin was amazing. Nothing was too much trouble for her to help a less than tech savvy guy navigate the application. Fast and simple process with a great outcome. And she sounds nice on the phone. Haha.

Chris S.

Verified Review

I was so lucky to have had Evette as my broker through emu money, from the very first phone call Evette was amazing, so prompt and professional keeping me updated on the whole process of the application for finance for my new car, I highly recommend Evette!!!

Kaila B.

Verified Review

S. B.

Verified Review

I had such a great experience with Evette when sorting out my car loan. She made the whole process really easy and stress-free, was always quick to answer any questions, and genuinely cared about getting me the best outcome. Super friendly and professional. I'd happily recommend Evette to anyone looking for a car loan!

Dillon F.

Verified Review

Brad was great from start to finish made the process very easy. Would have no hesitation in using emu money again. Thanks again Brad.

Toni B.

Verified Review

I found Erin through facebook and I would recommend her to everyone she's professional, Erin was very knowledgeable about different lander's and helped me secure a great rate for my car loan, Erin was always available to answer my questions and kept me updated throughout the entire process and she's honest and reliable I would give her more than 5 stars if I could I highly recommend Erin

Nasratullah

Frequently Asked Questions

Van Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.