Compare Personal Loans from 50+ Australian Lenders

Borrow for renovations, debt consolidation, medical, weddings, travel and more—with fixed repayments and clear terms.

5.0 rating

Personal Loans Made Simple

Fast, flexible and fair—tailored to your credit profile and budget.

Borrow With Confidence

Typical amounts from $2,000 to $75,000+

Fixed Repayments

1 to 7 year terms for certainty

Fast Approvals

Same-day decisions possible for eligible profiles

Secured or Unsecured

Choose the structure that fits your rate and risk

Debt Consolidation Ready

We can pay creditors directly at settlement

Any Personal Purpose

Home upgrades, medical, weddings, travel, big-ticket buys

How it works

We match your profile to personal loan lenders so you can compare rates, terms and fees—side by side.

Apply online in 3 minutes

Share your details, purpose and budget. No lengthy forms.

See matched options

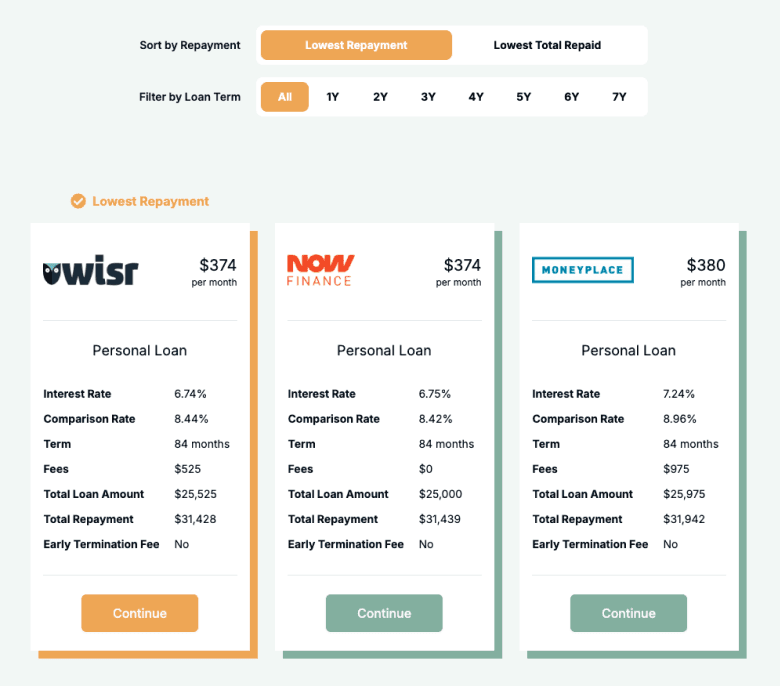

Our Lender Match shows fixed vs variable, secured vs unsecured.

Upload documents

Provide ID, income evidence and bank statements; we’ll do the rest.

Settle & get funds

Funds to your account or paid to creditors for consolidation.

A quick guide to personal loans

Personal loans help Australians spread the cost of important expenses—like renovations, medical procedures, weddings, education or consolidating multiple debts—into predictable, fixed repayments. Most loans are principal-and-interest with terms from 1 to 7 years, and pricing is based on credit profile, income stability and requested amount.

You can choose unsecured (no asset as collateral) for speed and flexibility, or secured (using a car or other asset) for access to sharper pricing. Comparing fees and the comparison rate alongside the headline rate matters. The right structure lines up repayments with your cash flow while keeping total cost down.

Want to skip ahead?

Jump to the section that best fits what you need.

Types of personal loans

Pick a structure that matches your risk, rate and repayment preference:

What can I use a personal loan for?

Personal loans cover a wide range of meaningful life expenses with clear, fixed repayments. Here are common purposes Australians choose:

Debt Consolidation

Combine multiple credit cards and personal debts into one fixed repayment. We can arrange creditor payouts at settlement, simplifying your budget and potentially lowering your overall interest costs. Consolidation can help improve cash flow and focus your repayments on clearing the balance faster.

Home Improvements

Refresh kitchens or bathrooms, install flooring, paint, or complete small structural upgrades without redrawing on your mortgage. Fixed terms help you manage costs against a defined project timeline, and you can often include quotes and materials in a single facility.

Medical & Dental

Cover elective procedures, specialist treatments, orthodontics or gap payments not fully covered by insurance. Predictable repayments let you prioritise health decisions without the stress of large up-front outlays.

Weddings & Events

From venue deposits and photography to travel and accommodation, bundle event costs into one loan with a clear end date. Some lenders allow early repayments without penalty so you can pay it down sooner if extra funds arrive.

Vehicle Repairs & Essentials

Unexpected car repairs, replacement appliances or laptops can be financed quickly to keep life moving. For older vehicles or mixed purchases, a personal loan can be faster and more flexible than a dedicated car loan.

Travel or Moving

Plan milestone trips or cover relocation costs like removalists, storage and bond. Fixed terms keep repayments steady, while approval amounts can be adjusted to match your itinerary or new-home timeline.

Case Study

Emma & Josh

Simpler budget with consolidation

Challenge: Three credit cards with rising interest and messy due dates.

Solution: Unsecured personal loan over 5 years with direct creditor payouts.

A couple in Melbourne wanted to simplify their finances after juggling three cards and a store loan. Through Emu Money they compared matched options and chose an unsecured personal loan with a fixed rate and no monthly fee. We paid their creditors at settlement, leaving them with one predictable repayment and a clear end date. Their monthly outgoings dropped, cash flow improved and the path to debt-free became straightforward.

How much can I borrow with a personal loan?

Typical loan sizes range from $2,000 to $75,000+. Limits depend on your income stability, existing commitments, credit score and the loan purpose. Secured loans can unlock higher limits and sharper pricing, while unsecured loans prioritise flexibility and speed. Lenders also assess recent bank-statement health and overall serviceability to determine a sensible maximum.

Personal Loan Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term and rate to see how it changes your budget before you apply.

Balance over time

Am I eligible for a personal loan?

Eligibility focuses on serviceability and a clear credit profile. Stable employment or consistent income, manageable existing debts and healthy recent bank statements improve approval odds. Secured loans may ask for asset details; unsecured loans rely more heavily on your credit and income strength.

You may be eligible if you are:

An Australian resident aged 18+

Employed, self-employed or receiving acceptable income

Able to demonstrate affordability from bank statements

Meeting minimum credit criteria (score/history)

Borrowing for a personal, non-investment purpose

How to apply for a personal loan?

Complete a quick online application and upload documents. We’ll compare offers across secured vs unsecured, fixed vs variable options, then coordinate settlement—either to your account or directly to creditors for consolidation.

Documents you may need:

Photo ID (driver’s licence or passport)

Recent bank statements (3–6 months)

Payslips or income evidence (or tax returns if self-employed)

Liability statements (for consolidation)

Asset details if offering security

How to save money on a personal loan

Compare more than the headline rate—fees and the comparison rate can move the true cost. Shorter terms reduce total interest, while longer terms lower the monthly repayment; choose the balance that fits your budget. If you’re consolidating debt, paying creditors at settlement avoids double interest. Consider secured options for sharper pricing if you’re comfortable offering collateral, and check early-repayment policies so you can pay it down faster without penalty.

Example: Term impact — $20,000 at 11.49% p.a. (approx.):

| Term | Approx. Monthly Repayment | Total Interest (approx.) |

|---|---|---|

3 years (36 mths) | $659 | $3,739 |

5 years (60 mths) | $440 | $6,385 |

7 years (84 mths) | $348 | $9,200 |

Understanding personal loan options

Structure and features affect price, flexibility and total cost. Here are the key options to consider:

Secured vs Unsecured Loans

Secured loans use an asset (often a car) as collateral and typically come with sharper pricing and higher borrowing limits. Unsecured loans don’t require collateral and are faster to arrange, but usually at higher rates and lower limits. Your choice depends on how quickly you need funds, rate sensitivity and comfort with offering security.

Fixed vs Variable Rates

Fixed rates lock in the same repayment for the entire term—great for budgeting and avoiding surprises. Variable rates can move with the market and may offer savings if rates fall but can increase your repayment if they rise. Some lenders allow switching or refinancing later; check fees and break-costs before committing.

Debt Consolidation Features

If you’re consolidating, look for direct-to-creditor payout at settlement to prevent further interest on old accounts. Confirm whether closing letters are required, and check that fees (e.g., balance-transfer or payout fees) are accounted for in the new loan. Aim for a term that lowers monthly cost without overly extending total interest.

Fees & Comparison Rate

Application, monthly and early-repayment fees can change the true cost. The comparison rate blends the interest rate and most fees into a single figure for a common example loan, helping you compare offers consistently. Use both the advertised rate and comparison rate when shortlisting options.

Early Repayment Flexibility

Some lenders allow extra repayments or full early payout with low or no penalty—handy if you expect bonuses or tax returns. Others charge break fees. If flexibility matters, choose a policy that lets you pay down faster without eroding savings through penalties.

Rate-for-Risk Pricing

Personal loan rates are commonly risk-based: stronger credit scores, stable employment and clean bank-statement conduct can unlock sharper pricing. Improving your profile—even slightly—may reduce your total cost. Minimising overdrafts, paying on time and lowering utilisation ahead of applying can help.

Testimonials

Verified Review

Amazing customer service experience only took short time thanks Ryan

daniel r.

Verified Review

I had an amazing experience with Wendy Fonseka from Emu Money! Wendy guided me through the refinancing of my personal loan, helping me secure a much better interest rate and significantly lower repayments. Her efficiency, reliability, and professionalism were outstanding every step of the way. I'm incredibly grateful for her support and can't recommend her highly enough. I'll definitely be spreading the word to friends and family—thank you, Wendy!

Raam G.

Verified Review

We just got our truck loan they are very supportive and Eujin guide us in really good way we are happy with service really appreciate EUJIN cheers

Lky 2.

Verified Review

Brad was great from start to finish made the process very easy. Would have no hesitation in using emu money again. Thanks again Brad.

Toni B.

Verified Review

Emu Money does a really good job when it comes to their services. It was pretty easy and smooth, less stressful, quick, Cristal clear, very friendly, to the point...etc I would highly recommend them for anyone My agent was Eujin who made my dream come true with what I wanted achieved. Thanks heaps and all the very best. Regards Lankesh

Lankesh S.

Verified Review

Robyn from Emu was a pleasure to deal with and was honest in her approach and recommendations. Loan was completed in line with the expectations set.

Kerry B.

Frequently Asked Questions

Personal Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.