Compare Equipment Finance from 50+ Australian Lenders

Finance the machinery, vehicles and technology your business needs without tying up cash. Compare tailored quotes in minutes with no impact on your credit score.

5.0 rating

Equipment Finance Made Simple

Upgrade, replace or expand your business equipment with structured finance solutions. Designed for Australian businesses across transport, construction, healthcare, retail and more.

Borrow With Confidence

Typical amounts from $5,000 to $5 million+

Flexible Terms

Repay over 1 to 10 years

Fast Approval

Funding often within 24–72 hours

Secured by Equipment

Asset-backed loans with sharper pricing

Wide Range of Assets

Machinery, vehicles, IT systems, medical tools and more

Tax & Cash Flow Benefits

Potential deductions for interest and depreciation

How Equipment Finance Works

We match your application with lenders who specialise in business equipment loans, so you can invest without draining cash flow.

Apply online in minutes

Share your business details and the equipment you need.

Get matched offers

Receive tailored quotes from multiple Australian lenders.

Choose your loan

Compare rates, terms and repayment structures that suit your cash flow.

Get approved & funded

Approval and settlement often within 24–72 hours.

A quick guide to equipment finance

Equipment finance helps Australian businesses acquire or upgrade the tools and machinery they need without large upfront payments. Instead, repayments are spread over time, preserving working capital for wages, stock, or expansion.

Loans are generally secured against the equipment, making approvals faster and terms more competitive. Terms can run from 1 to 10 years, with options for balloons, residuals or seasonal structures.

Almost any business asset can be financed — from construction machinery, commercial vehicles and IT systems to medical devices, hospitality equipment and office fit-outs. Whether you’re modernising operations, replacing outdated tools, or scaling production, equipment finance provides a practical, tax-effective solution.

For many businesses, the key benefit is flexibility: you get access to essential equipment immediately, while repayments align with the revenue it generates.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of equipment finance

Here are the most common equipment finance structures available in Australia:

What can I use equipment finance for?

Equipment finance can fund a wide range of business needs:

Construction Machinery

Excavators, loaders, cranes and other heavy equipment for building and civil works.

Commercial Vehicles

Cars, vans, trucks and utes for transport, logistics and service businesses.

Manufacturing Tools

CNC machines, 3D printers and production lines for manufacturing and fabrication.

Technology & IT Systems

Computers, servers, networking, and software upgrades.

Medical Equipment

Diagnostic machines, surgical tools and patient monitoring systems.

Hospitality & Retail

Commercial kitchens, refrigeration, POS systems and shop fit-outs.

Agricultural Equipment

Tractors, harvesters and irrigation systems for farm operations.

Renewable Energy Systems

Solar panels, battery storage and other sustainable technology.

Case Study

Leah Johnson, Brisbane Fabrication Co.

Expanding Capacity with Equipment Finance

Industry: Manufacturing

Challenge: Production bottlenecks caused by ageing machinery and limited output capacity.

Solution: A 7-year chattel mortgage secured against a new CNC machine and supporting tools.

Leah runs a fabrication workshop in Brisbane. Orders were growing, but her outdated machinery couldn’t keep up with demand. Through Emu Money, she secured equipment finance for a state-of-the-art CNC machine with a 7-year chattel mortgage. Repayments were structured monthly to align with customer invoices. The new machine doubled production speed, reduced downtime, and allowed Leah to expand into new contracts while keeping cash flow predictable.

How much can I borrow with equipment finance?

Equipment finance in Australia typically ranges from $5,000 for smaller purchases to $5 million+ for large-scale machinery or vehicle fleets. Borrowing limits depend on the type, age and value of the equipment, as well as your financial profile.

Lenders generally offer up to 100% of the purchase price for new equipment, and 80–90% for used assets. Because the equipment itself serves as collateral, approvals are faster and terms more competitive than unsecured loans.

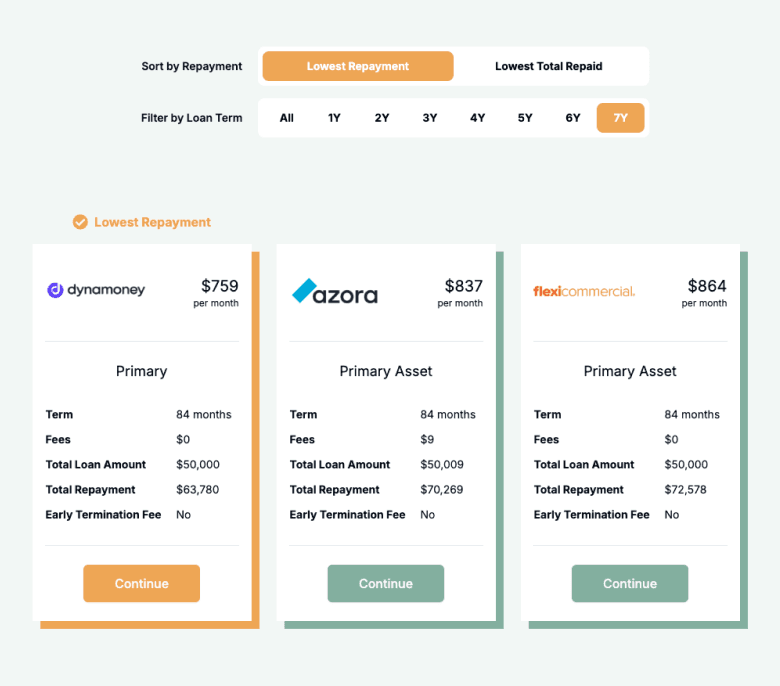

Equipment Finance Repayment Calculator

Estimate repayments and total cost. Adjust the loan amount, term and rate to plan before you apply.

Balance over time

Am I eligible for equipment finance?

Eligibility is straightforward since the equipment is used as collateral. Lenders assess turnover, bank statements and repayment history when reviewing applications.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Operating a registered business with ABN

Able to provide recent bank statements

GST registered (often required for larger loans)

How to apply for equipment finance

Apply online in minutes and get instant quotes from multiple lenders. Select the option that best fits your needs, upload documents, and receive funding in 24–72 hours.

Documents you may need:

ABN and GST registration details

Photo ID (driver’s licence or passport)

Recent bank statements

Supplier invoice or quote for the equipment

How to save money on equipment finance

Saving money on equipment finance starts with comparing multiple lenders. Shorter terms reduce total interest but increase repayments, while longer terms ease cash flow but increase total cost.

Watch for hidden costs like establishment, documentation or early termination fees. Where cash flow allows, make additional repayments to cut down interest. Align repayment schedules with customer invoicing cycles for smoother management.

Understanding equipment finance options

Equipment finance products differ in structure. Here are the main features to consider:

Security: Asset-backed

Most equipment loans are secured against the asset itself. This reduces risk for lenders, supports higher borrowing limits, and provides more competitive interest rates compared to unsecured products.

Personal Guarantee

Some lenders request a director or owner guarantee alongside the asset security. This adds an extra layer of protection for the lender and may unlock sharper pricing.

Term & Balloon

Loan terms usually range from 1 to 10 years. Adding a balloon or residual payment can reduce repayments, but a lump sum must be settled or refinanced at term end.

Interest Structure

Most facilities are fixed-rate, giving predictable repayments. Some lenders offer variable rates, which may start lower but can rise over time. Choose based on risk appetite.

Fees & Charges

Look out for establishment, documentation, account keeping and early payout fees. Factoring in all charges ensures you know the true cost of financing your equipment.

Repayment Frequency

Repayments can be scheduled weekly, fortnightly, monthly or seasonally. Matching repayments with your cash inflows helps avoid stress and supports smoother cash flow.

Testimonials

Verified Review

We had an excellent experience working with Stevette Gelavis from Emu Money. She was absolutely outstanding—providing clear and comprehensive information from the very beginning and demonstrating professionalism, fairness, and genuine helpfulness throughout the process. After having disappointing experiences with other loan providers who quoted us unreasonably high rates, Stevette secured us a much better rate. Thank you, Stevette, for your exceptional service and for restoring our confidence in loan providers. You’re doing a fantastic job!

Indu

Verified Review

⭐⭐⭐⭐⭐ The process with Emu Money has been fantastic — completely stress-free and very professional. Their document requirements were clear and straightforward, with everything explained step by step. Once we submitted our paperwork, the response was quick, and the whole process was easy to follow. We’re very happy with the experience and highly recommend Emu Money for any commercial loan needs

Pratik P.

Verified Review

Peter was very quick, responsive and easy to deal with. Great experience, and we're picking up our new car tomorrow!

Olivia F.

Verified Review

Stevie was amazing she made the entire process smooth, not stressful and easy everything she requested wasn’t hard to complete, she worked around me she gave me advice or what to look for in a car she shared some good places to find a car she shared her experience with insurance she was amazing and went above and beyond. It isn’t always easy sharing things with someone when it comes to your personal affairs but she made me feel welcome to share you have a start worker and I really do believe she deserves a pay bonus

Tania W.

Verified Review

Absolutely couldn’t have gone smoother without the expertise of Stevie helping us through the process

Gayle B.

Verified Review

Brad provided excellent guidance throughout the entire loan process, making it much easier for me to achieve my financial goals. His expertise and support were invaluable, and I'd highly recommend him to anyone looking for a reliable finance broker.

Marlon

Frequently Asked Questions

Equipment Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.