Compare Business Loans from Over 50+ lenders

Get real personalised quotes from multiple lenders in minutes with no impact on your credit score.

5.0 rating

Business Loans That Move You Forward

Looking for business funding to help you grow, pay for overheads, or consolidate debt? We'll help you find a loan that suits your situation, by matching you with products from over 50+ lenders.

Flexible Amounts

Borrow from $2,000 – $2,000,000

Custom Terms

Loan terms from 3 months to 5 years

Repay Your Way

Weekly, fortnightly or monthly repayments

Low Fixed Rates

Fixed interest rates from 7.99%

Tailored Pricing

Interest rate matched to your situation

Any Business Purpose

Can be used for any reasonable business purpose

How it works

We'll help you find a loan that suits your situation, by matching you with products from over 50+ lenders.

Apply online in 3 minutes

It takes only three minutes to enter your details so we can match you with our panel of lenders. No lengthy questions.

Get your quote

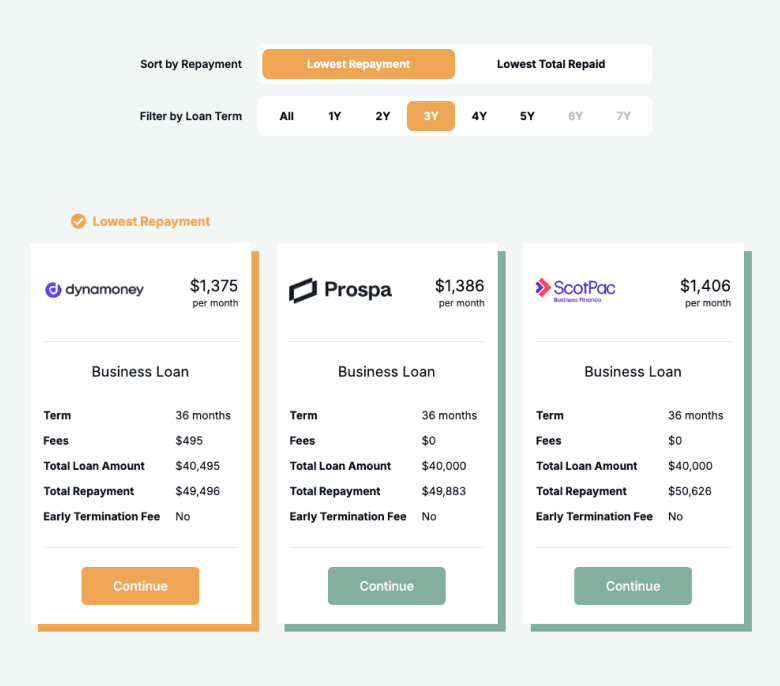

Our Lender Match technology matches you with quotes from multiple lenders, so you can pick the best product for your circumstances.

Upload documents

Once you’ve chosen your preferred quote, we’ll let you know what documents are required to complete your application.

Get approved

Get approved and receive funds within 24 hours.

A quick guide to business loans

Business loans are a form of credit provided by financial institutions such as banks or private lenders to fund various business-related expenses. The funding could be necessary for buying machinery, expanding operations, funding new projects, or simply improving cash flow. These loans are a critical financing tool for businesses of all sizes and types, including startups, SMEs, and large corporations. They come in various forms, including term loans, line of credit, invoice financing, and equipment loans. The terms and conditions, including interest rates, vary depending on the lender and the borrower's creditworthiness.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of business loans

There are several types of loans in Australia that can benefit businesses in almost any situation, whether it is for growth, overheads, debt consolidation or working capital. Each of these loan types has its unique features, advantages, and potential disadvantages. Here are the most common types of business loans:

What can I use a business loan for?

Unsecured business loans are highly flexible and can be used for a wide range of business purposes without requiring property or assets as collateral. Australian SMEs, sole traders, and startups often use these loans to purchase inventory, fund marketing campaigns, invest in new equipment or technology, hire additional staff, or cover day-to-day operational expenses. They are also commonly used to consolidate existing debts into one manageable repayment, or to bridge short-term cash flow gaps during seasonal fluctuations. Because no security is required, it’s important to plan how the funds will be allocated to ensure they drive growth, improve profitability, and strengthen your business.

Here are some of the most common reasons businesses in Australia take out unsecured finance:

Start-Up Capital

Business funding can be used to provide the initial capital needed to start a new business.

Inventory Purchase

Business funding can help cover the costs of inventory purchases, ensuring a business has products to sell.

Equipment Purchase

Whether it's machinery, IT equipment, or other tools, a loan can fund necessary equipment purchases.

Business Expansion

When a business is ready to expand, whether by opening a new location or increasing production, a loan can provide the necessary funds.

Operational Costs

Cash flow funding can help cover day-to-day operational costs such as utilities, rent, or payroll during lean periods.

Marketing and Advertising

To reach new customers and increase sales, business funding can be used to fund marketing and advertising campaigns.

Debt Consolidation

Business debt consolidation loans can be used to consolidate multiple business debts into a single, more manageable payment.

Hiring Staff

Business funding can fund the costs associated with hiring new staff, including recruitment and training.

Product Development

Business funding can fund the research, development, and launch of new products.

Emergency Funds

Business funding can provide a safety net of funds for unforeseen business expenses.

Case Study

Ben Saddaris, Saddaris Imports

Addressing Cash Flow Shortages with an Unsecured Business Loan

Industry: Wholesale

Challenge: Cash flow shortage due to late payments from customers.

Solution: Using an unsecured business loan to bridge the financial gap.

Facing a cash squeeze due to delayed customer payments, Ben risked missing new orders and eroding client trust. He turned to an unsecured business loan for a swift solution, which required no asset security and was funded within 24 hours. This timely intervention ensured Ben could restock without interrupting order fulfillment. Once the late paying customers had caught up, Ben was able to repay the loan in full, keeping their operations seamless and their client relationships intact.

How much can I borrow for a business loan?

The amount you can borrow depends on several factors. These include the loan type, your credit history, the financial health of your business, and the lender's terms and conditions. Lenders consider your business revenue, profitability, cash flow, and credit history to determine how much you can responsibly borrow and repay. A business with a strong financial track record and a solid credit rating is likely to be approved for a larger loan compared to a business with a weak financial profile. The loan type also matters. For instance, equipment loans are usually for the exact amount of the equipment being financed, while a line of credit could be for any amount up to the maximum limit set by the lender. Some lenders offer smaller loans starting from a few thousand dollars, while others can lend several million. Before applying for a loan, assess your business needs and your capacity to repay to avoid overextending your financial obligations.

Business Loan Repayment Calculator

To estimate your monthly repayments and the total cost of the loan, input the loan amount, loan term and interest rate into the calculator below. This helps you plan your budget and choose the most suitable loan options.

Balance over time

Am I eligible for a business loan?

Lenders consider several factors when assessing your eligibility against their credit criteria, including your credit score, income, debt-to-income ratio, age, residency, and required documentation. While meeting the eligibility criteria doesn't guarantee loan approval, having a good credit score, stable income, and a positive financial profile significantly improve your chances.

You are eligible to apply if you are:

Operating for at least six months

Minimum monthly turnover of $5,000

Registered for GST

Business owner is an Australian citizen or a permanent resident

Business owner is over 18 years old

How to apply for a business loan?

Apply online and get a quote instantly! We'll match your loan application with products from over 50+ Australian lenders.

Your quote will display all of the products you're eligible for, including repayment amounts, interest costs, fees or charges. You can then choose the product the best suits your needs and then we'll help you to complete the application process.

Once the full application is submitted, normal credit approval processes can take anywhere from a couple of hours up to 2 days depending on the amount of information required.

If you’re eligible, and you are happy with the initial quote, you will need to prepare documents such as:

Passport or drivers licence

Proof of income and expenses (e.g. payslips, bank statements)

Details of any current debts or other loans

How to save money on a business loan?

Saving money on a business loan can have a significant impact on a company's financial health, providing more funds for growth and operations. One key factor to consider when trying to minimise costs is the loan term.

Typically, a shorter loan term means higher repayment instalments but less interest paid over the life of the loan. For businesses with consistent cash flow that can handle larger repayments, opting for a shorter term can lead to significant savings in interest costs.

Conversely, a longer loan term often results in smaller, more manageable repayment instalments, which might be preferable for businesses wanting to maintain liquidity. However, it's essential to note that, over time, the total interest accrued on a longer-term loan can be considerably higher.

Thus, while longer terms provide immediate relief in terms of cash flow, they might lead to higher overall costs in the long run.

Here's an example of how you could save $8,624 by picking a shorter term, on a $50,000 loan with a 7.99% interest rate:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

12 months | $4,349 | $52,190 |

24 months | $2,261 | $54,267 |

36 months | $1,566 | $56,397 |

48 months | $1,220 | $58,579 |

60 months | $1,013 | $60,814 |

Understanding loan options

With various loan options available, understanding their features is crucial to making an informed decision. Whether you're contemplating the type of security you'd need, the best interest rate structure, or the most suitable repayment schedule, you should carefully understand the nuances of each option to help you chart the best course for your business.

Here are some key considerations to keep in mind:

Security: Secured or Unsecured?

Secured loans require borrowers to pledge assets as collateral, ensuring lenders can recoup losses if defaults occur, often resulting in lower interest rates and better terms. On the other hand, unsecured loans are based solely on the borrower's creditworthiness, offering no collateral requirement but typically carrying higher interest rates, smaller loan amounts, and less flexible terms. Businesses should evaluate their financial situation and goals to choose between these options, ensuring alignment with their company's operational and financial direction.

Loan Term: Fixed Term or Revolving?

Fixed term loans have set repayment durations, like 6 months or 5 years, where the entire loan plus interest is settled by the term's end. In contrast, revolving terms, commonly seen in business lines of credit or business overdraft, offer ongoing access to funds up to a defined limit, allowing businesses to draw beyond their account balance for short-term expenses. While fixed terms provide repayment certainty, revolving terms offer flexibility, letting businesses access funds as needed without seeking new loans, though careful monitoring is crucial to avoid exceeding the credit limit.

Loan Interest Rate: Fixed Rate or Variable Rate?

Unlike mortgages, loans for businesses are generally offered with a fixed rate. This means that throughout the term of the loan, the interest rate remains constant, providing businesses with predictability in their repayment schedule. On the other hand, a variable interest rate can fluctuate over time, typically tied to an index or a benchmark. While a variable rate loan might offer initial savings if market rates are low, it comes with the uncertainty of potential rate increases in the future. Before committing to either option, businesses should thoroughly review the product disclosure to understand the nuances of the rate structures and decide which aligns best with their financial strategy. If opting for a variable rate, it's essential to account for possible fluctuations during budget planning.

Fees and Charges

Understanding fees and charges associated with business finance is crucial to avoid unforeseen costs. While interest is a primary cost, lenders may charge application fees (typically $500 to $1,000), or more commonly, origination fees, which are for loan processing and range between 0% and 4% of the loan amount. Early termination fees can apply if a loan is settled ahead of its term, and may offset potential savings from early repayment. Additionally, lenders may charge direct debit fees per transaction ($2 to $4) and periodic fees for revolving term products, which could be fixed or percentage-based. If securing a loan, additional fees might apply. Thoroughly reviewing loan agreements is vital to understand the loan's true cost.

Repayment Terms

Lenders offer various repayment options to suit businesses' cash flow and operational needs, ranging from frequent daily or weekly schedules to less frequent fortnightly or monthly intervals. Many facilities feature fixed repayments, providing predictability in budgeting and ensuring businesses know the exact amount due at each interval. While this clarity aids in financial planning, it's crucial for borrowers to understand the total interest over the loan's term. Some may prioritise paying off loans quickly to minimise interest, while others might prefer longer terms for better cash flow management.

Testimonials

Verified Review

I had the absolute pleasure of working with Bindiya Patel, and I can’t thank her enough for her immense help and outstanding service throughout the entire finance process. From the very beginning, she was professional, patient, and extremely knowledgeable, guiding me through every detail with genuine care. Bindiya went above and beyond to make sure everything was handled smoothly and efficiently. Her communication was always clear and prompt, and she made what could have been a stressful process feel easy and comfortable. I truly appreciate her dedication, honesty, and the personal touch she brings to her work. I would highly recommend Bindiya Patel to anyone looking for a trustworthy and supportive finance agent. She is simply amazing at what she does!

Jananie V.

Verified Review

All enquires answered in a prompt and professional manner. Easy company to deal with. Highly recommend.

Elaine G.

Verified Review

I had the pleasure of working with Ryan to secure a car loan. He made the process run smoothly from beginning to the end. Highly recommend Ryan with his dedication and excellent communication. Thank you again Ryan!

Toefiliga C.

Verified Review

S. B.

Verified Review

Peter was very quick, responsive and easy to deal with. Great experience, and we're picking up our new car tomorrow!

Olivia F.

Verified Review

We just got our truck loan they are very supportive and Eujin guide us in really good way we are happy with service really appreciate EUJIN cheers

Lky 2.

Frequently Asked Questions

Business Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.