Compare Ute & Truck Finance from 50+ Australian Lenders

From dual-cab 4x4s to full-size American trucks, line up sharp rates and repayments that fit your budget.

5.0 rating

Ute and Truck Finance Made Simple

Whether you’re eyeing a Toyota HiLux, Ford Ranger, Isuzu D-MAX or a full-size RAM 1500, Ford F-150/F-250 or Chevy Silverado, we’ll help you finance it on terms that work for you.

Borrow What You Need

Typical amounts from $10,000 to $150,000+

Flexible Terms

1 to 7-year terms — set repayments to suit your cash flow

Fast Decisions

Eligible applications can be assessed the same day

New or Used

Dealer, auction or private sale supported

Predictable Repayments

Lock in fixed repayments so you always know what’s due

Towing & Fit-outs

Bull bars, tow kits, canopies and trays can often be bundled

How it works

Compare lenders without the run-around — clear offers, quick steps, and help at every stage.

Apply online in 3 minutes

Tell us about you, the ute or truck you want, and your budget.

See matched options

Compare secured vs unsecured, fixed vs variable — side by side.

Upload your documents

ID, income and recent bank statements usually do the trick.

Settle & drive

We coordinate with the lender and seller so you can pick up sooner.

A quick guide to ute and truck finance

Need a dual-cab for the family and the job site, or stepping up to a full-size truck for towing? A ute or truck loan lets you buy now and spread the cost into manageable repayments over 1–7 years. You keep your savings intact while getting the capability you want — payload, towing, 4x4, accessories — right away.

Lenders look at your income, credit history and the vehicle’s age/value to size the loan and set the rate. Newer vehicles (including RAM 1500/2500, Ford F-150/F-250 and Silverado) can unlock sharper pricing and longer terms; older models are still financeable with slightly different limits. The right structure makes the difference between a stretch and a comfortable fit.

Want to skip ahead?

Jump to the section you need.

Types of ute and truck loans

Pick the structure that fits your budget and ownership plans:

What can you use ute and truck finance for?

Tailor your finance to how you actually use your vehicle — weekday workhorse, weekend adventure or both.

Work & Trades

Finance a HiLux, Ranger, BT-50, D-MAX or Triton fitted with trays, canopies, ladder racks and drawers so you can carry tools safely and stay organised.

Family Dual-Cab

Get a safe, roomy dual-cab with ISOFIX and modern safety tech — perfect for school runs and weekend trips.

Off-Road & Touring

Step up to a 4x4 build with suspension, bull bar, tow kit and snorkel — or go full touring spec for the Big Lap.

Towing Power

Need serious tow capacity for a boat, caravan or car trailer? Consider full-size trucks like RAM 1500/2500, F-150/F-250 or Silverado.

Lifestyle & Recreation

Mountain bikes, surfboards, camping gear — set up your rig for the hobbies that make weekends worth it.

Replacement Vehicle

Upgrade from an unreliable ute into something safer, stronger and more efficient without a big upfront hit.

Case Study

Alex & Priya

Alex & Priya step up to a RAM 1500—power for the 3.5t van, payments that fit

Challenge: Towing a 3.5-tonne caravan safely meant stepping beyond their old ute, but Alex and Priya didn’t want repayments derailing the household budget.

Solution: A secured, fixed-rate 5-year loan funded 90% of a low-km RAM 1500, with tow package, brake controller and canopy bundled at settlement.

Emu Money compared multiple lenders and they chose a sharp fixed rate with one consolidated repayment. The result was a calmer, more capable tow rig and a calendar full of longer trips—no giant deposit, no surprises, and monthly costs that stay comfortably on track.

How much can you borrow?

Loan sizes typically range from $10,000 to $150,000+. New utes and full-size trucks can often be financed up to 100% of the purchase price (subject to profile and lender policy). Used vehicles are usually capped at 80–90% of value.

Terms run 1–7 years. Shorter terms mean higher monthly repayments but less interest overall; longer terms keep repayments lower but increase the total interest paid. We’ll help you find the balance that fits your budget.

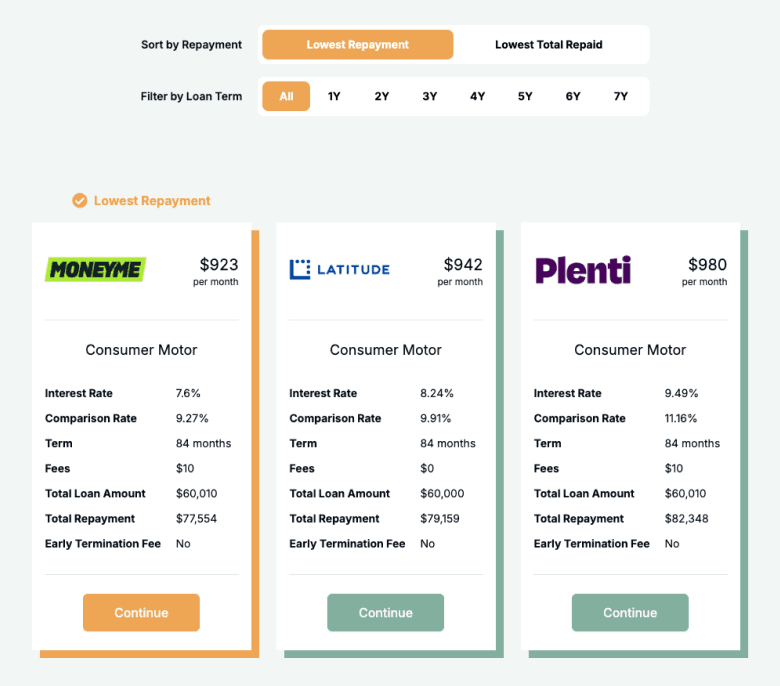

Ute and Truck Finance Repayment Calculator

Model your repayments before you apply. Adjust amount, rate, term and balloon to see what fits.

Balance over time

Are you eligible for ute and truck finance?

Lenders want to see that the repayments fit comfortably alongside your other bills. They’ll consider your income, employment stability, credit history and bank-statement health. The vehicle matters too — newer utes and trucks (including RAM, F-Series and Silverado) often attract sharper rates and longer terms, while older models may come with lower maximum LVRs and shorter terms.

If your credit isn’t perfect or you’re self-employed, there are still options. Specialist lenders may offer flexible policies so you can get into the right vehicle without unnecessary hurdles.

You may be eligible if you are:

An Australian resident aged 18+

Earning a regular income (PAYG or self-employed)

Able to provide recent bank statements or payslips

Buying an eligible new or used ute/truck from a dealer, auction or private seller

How to apply for ute and truck finance

Apply online in a few minutes, upload your documents, and we’ll do the legwork. We’ll compare lender offers, explain the differences, and manage settlement with the seller so pickup is smooth.

Documents you may need:

Driver’s licence or passport

Recent payslips or bank statements

Employment/ABN details

Vehicle details (VIN, rego, invoice/quote) — plus accessory quotes if you’re bundling fit-outs

How to save money on ute and truck finance

Look beyond the headline rate. Secured loans usually price sharper than unsecured. A balloon can cut monthly repayments but leaves a lump sum at the end — set the balloon to align with expected resale value. Newer vehicles often qualify for better pricing and longer terms. Bundle accessories (tow kits, canopy, tray, bull bar) at settlement so they’re financed at the same competitive rate. And always check fees and early-repayment policies to avoid bill-shock later.

Example: Balloon impact — $55,000 over 60 months at 8.19% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $1,121 | Highest monthly cost |

10% ($5,500) | $1,009 | Lower monthly cost |

20% ($11,000) | $898 | Balance of cost vs cash flow |

30% ($16,500) | $787 | Lowest monthly cost; plan for resale/refinance |

Ute and truck loan options explained

These features change cost, flexibility and risk — pick what suits how you use your vehicle:

Secured vs Unsecured

Secured loans use the vehicle as collateral for sharper pricing. Unsecured loans can be faster and more flexible but usually cost more.

Fixed vs Variable

Fixed keeps repayments steady. Variable can move with the market — potential savings if rates fall, higher costs if they rise.

Balloon Payments

Lower your monthly cost by deferring a lump sum to the end. Make sure resale value or savings can cover it.

Early Repayment Flexibility

Some lenders allow extra repayments or early payout with little/no penalty — a simple way to save interest.

Fees & Charges

Check establishment, monthly and exit fees. The total cost is rate + fees + how long you hold the loan.

Testimonials

Verified Review

Fantastic experience. Very seamless process, all done online and settlement was exactly when required. Highly recommend Adam. He was a pleasure to do business with on our first loan with Emu Money.

Vicki

Verified Review

I want to take this moment to highlight the outstanding service I received from Jackson in organising for the purchasing of my car. Jackson have the know-how in dealing with any customers and made my car buying experience smooth and enjoyable. He was incredibly knowledgeable about the product and I confidently made my decision because he gives me all the information I needed. He was transparent throughout and made me comfortable and informed throughout the process. I would not hesitate to recommend Jackson and the company for a fast and easy loan approval that you don't get anywhere else. Thank you Jackson and I will recommend you to all my friends and families.

Usaia R.

Verified Review

Brad was great quick and simple no headaches. just simple process and was done in quick time frame. cant thank him enough.

Danny D.

Verified Review

Ryan was Very helpful through the entire process and made everything super simple for me. Had no issues altering and changing to suit my needs throughout

Kye Z.

Verified Review

We recently had the pleasure of working with Eujin to secure a car loan, and we couldn't be more grateful for his assistance. Eujin went above and beyond to ensure we got the best possible terms. His professionalism, dedication, and willingness to help were evident throughout the entire process. Thank you, Eujin, for making this experience smooth and stress-free. Highly recommend his services!

Bstl 1.

Verified Review

All enquires answered in a prompt and professional manner. Easy company to deal with. Highly recommend.

Elaine G.

Frequently Asked Questions

Ute and Truck Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.