Compare Trailer Finance from 50+ Australian Lenders

From box trailers to camper trailers and horse floats, spread the cost with repayments that suit your budget.

5.0 rating

Trailer Finance Made Simple

Get the trailer you need now and pay it off over time with competitive rates and flexible terms.

Borrow With Confidence

Loan sizes typically range from $5,000 to $80,000+

Set Your Term

Choose from 1 to 7 years to match your budget

Fast Approvals

Quick decisions mean you can tow sooner

New or Used

Finance trailers from dealers or private sellers

Fixed Repayments

Lock in predictable instalments you can budget for

Any Purpose

From camping trips to moving furniture or hauling horses

How it works

We match your application with lenders who finance trailers so you can compare offers in minutes.

Apply online in 3 minutes

Tell us about yourself, the trailer and your budget.

See your options

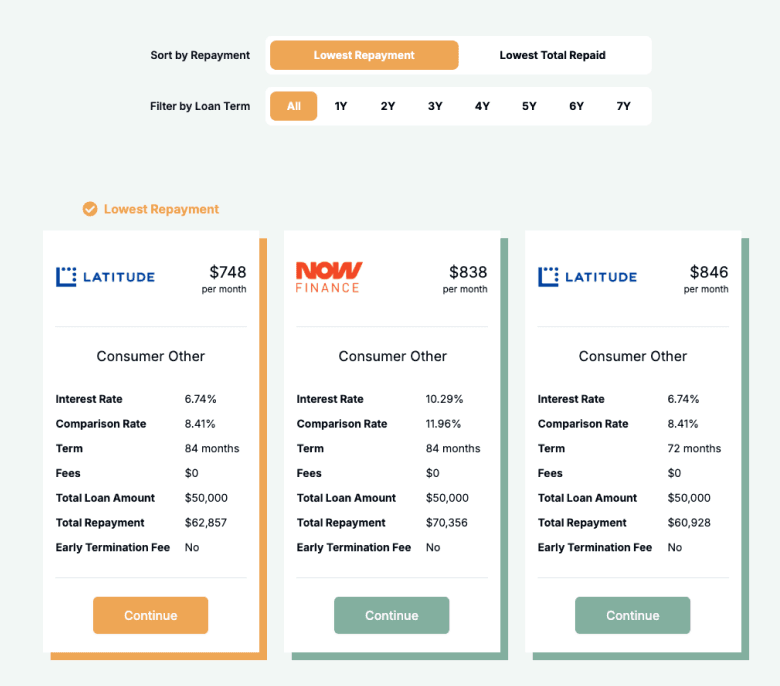

We’ll show you lenders side-by-side so you know what’s available.

Upload your documents

ID, proof of income and recent bank statements are usually all that’s needed.

Settle & tow away

We arrange payment to the seller so you can collect your trailer sooner.

A quick guide to trailer finance

A trailer can open up new possibilities — whether that’s making weekend adventures easier, moving goods, or transporting animals safely. With trailer finance, you don’t have to wait until you’ve saved the full amount. Instead, you can borrow the funds now and spread repayments over 1 to 7 years.

Lenders consider your income, credit history and the type of trailer you’re buying. Newer trailers and well-maintained assets may qualify for sharper rates, while older models can still be financed with slightly different terms. By choosing the right structure, you get the trailer you need today without draining your savings.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of trailer finance

The way your loan is structured changes how you repay and what it costs:

What can you use trailer finance for?

Trailer finance can cover a wide range of uses — from work to play, practical needs to outdoor adventures.

Transport Goods

Finance a box or enclosed trailer for everyday hauling, moving equipment, or transporting items securely.

Camping & Outdoor

Get a camper trailer and enjoy road trips or camping holidays without needing to pay upfront.

Boat Trailers

Make trips to and from the water easier by financing a boat trailer that’s safe and reliable.

Motorcycle & ATV Trailers

Secure trailers designed for bikes, quads or ATVs so you can tow them safely to tracks and trails.

Horse Floats

Spread the cost of a horse float to ensure your animals are transported safely and comfortably.

Furniture & Household Moves

Finance a trailer that helps with relocations, downsizing or regular DIY projects.

Landscaping & Gardening Equipment

Choose a trailer that’s fit for carrying landscaping tools, garden machinery or building materials.

Car Carriers

Tow your car securely for motorsport, restoration projects or relocations with a financed trailer.

Case Study

James & Kelly

James & Kelly tow a camper trailer without touching the rainy-day fund

Challenge: James and Kelly wanted a family camper trailer for school-holiday trips but didn’t want to raid their savings to get moving.

Solution: A secured, fixed-rate 5-year loan covered 90% of the trailer, with the awning and brake controller bundled at settlement for one simple repayment.

Emu Money lined up several lenders and they chose a low, predictable monthly cost that fit their budget. With the trailer, extras and on-roads wrapped into the same facility, the first getaway was booked for the next long weekend—savings intact and no bill shock.

How much can you borrow with trailer finance?

Most trailer loans range from $5,000 to $80,000+, depending on the trailer type and your financial profile. New trailers and camper models may be eligible for higher limits, while older or specialist trailers can still be financed with slightly different conditions.

Loan terms typically run 1 to 7 years, giving you the choice between higher repayments with less interest overall, or lower monthly costs stretched out longer.

Trailer Finance Repayment Calculator

Work out what your trailer loan repayments might look like. Adjust the loan amount, rate, term and balloon to plan ahead.

Balance over time

Are you eligible for trailer finance?

Lenders want to be confident you can manage repayments comfortably. They’ll check your income, employment stability, credit history and bank statements. The type of trailer matters too — newer trailers often unlock sharper pricing, while older ones may come with shorter terms or lower maximum borrowing.

If your credit isn’t perfect, don’t stress. Specialist lenders may still approve your loan with slightly different terms, helping you get the trailer you need.

You may be eligible if you are:

An Australian resident over 18

Earning a regular income

Able to show recent bank statements or payslips

Looking to finance a new or used trailer from a dealer or private seller

How to apply for trailer finance

The process is quick and straightforward. Fill out a short online form, upload your documents, and we’ll match you with lenders. Once you’ve chosen the right offer, we take care of settlement so you can collect your trailer without delays.

Documents you may need:

Driver’s licence or passport

Recent payslips or bank statements

Employment details

Trailer details (invoice, rego, VIN or quote)

How to save money on trailer finance

A few smart choices can make your trailer loan more affordable. Secured loans usually come with lower rates, while unsecured loans provide flexibility if you don’t want the trailer tied to the loan. Balloon payments can reduce monthly instalments but leave a lump sum at the end — plan ahead so it doesn’t catch you out.

Always compare more than just the rate. Look at fees, early repayment options and whether extras like registration or accessories can be bundled into the loan so you only pay one competitive rate.

Example: Balloon impact — $25,000 over 60 months at 8.49% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $513 | Highest monthly cost |

10% ($2,500) | $462 | Lower monthly cost |

20% ($5,000) | $410 | Balance of cost vs cash flow |

30% ($7,500) | $359 | Lowest monthly cost; plan for resale or refinance |

Trailer finance options explained

The right loan features can change how affordable your repayments feel:

Secured vs Unsecured Loans

A secured loan uses the trailer as collateral, usually lowering your rate. An unsecured loan may be quicker but often comes with higher interest.

Fixed vs Variable Rates

Fixed rates keep repayments steady, making budgeting simple. Variable rates can move up or down with the market.

Balloon Payments

You can reduce your monthly instalments by choosing a balloon payment at the end, but you’ll need a plan to cover it.

Early Repayment Flexibility

Some lenders let you pay your loan off sooner or make extra repayments without penalty, saving on interest.

Fees & Charges

Check for establishment fees, monthly service fees or exit costs — they affect the true cost of your loan.

Testimonials

Verified Review

Great boutique provider of finance services. Emu were very helpful in improving my financial situation, despite the fact they had to do most of it remotely. Highly regarded and completely trusted. A+++

Thomas M.

Verified Review

Gabe H.

Verified Review

What a great bloke to deal with... Thank you Brad for all your help and making our dream a reality. We will be contacting you again shortly.

John Z.

Verified Review

I've got the best service at Emu Money and their willingness to help you out. Evette went out of her way to help assist for the desired results. I will highly recommend them to anyone. Evette's industry knowledge & service was exceptional! I highly recommend her & will definitely reach out should we need any financial services in the future. Thank you

Mazhar A.

Verified Review

Erin was amazing. Nothing was too much trouble for her to help a less than tech savvy guy navigate the application. Fast and simple process with a great outcome. And she sounds nice on the phone. Haha.

Chris S.

Verified Review

I've worked with Brad from Emu Money a few times now, and I highly recommend. Brad is very responsive to emails (even when on holiday in Fiji), keeps me up to date and gets everything organised very quickly. Brad spoke directly with my supplier and they figured everything out. I won't hesitate to work with Brad again.

Christine F.

Frequently Asked Questions

Trailer Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.