Compare Car Loans from 50+ Australian Lenders

Get on the road sooner with flexible car finance. Choose sharp rates, repayment terms that fit your budget, and a lender that works for you.

5.0 rating

Car Loans Made Simple

Buying new or used? Dealer or private sale? We’ll help you line up a car loan that matches your lifestyle and budget.

Borrow What You Need

Typical amounts from $5,000 to $100,000+

Set Your Term

Repay over 1 to 7 years — whatever fits your plan

Fast Approvals

Same-day decisions are possible when you’re ready to go

New or Used

Finance from a dealership, auction or private seller

Predictable Payments

Lock in fixed repayments so you always know what’s due

Your Choice of Car

From family SUVs to first cars and 4WDs for adventure

How it works

We make car finance easy — no endless forms, just quick comparisons and clear results.

Apply online in 3 minutes

Tell us about yourself, your car and your budget.

Get matched options

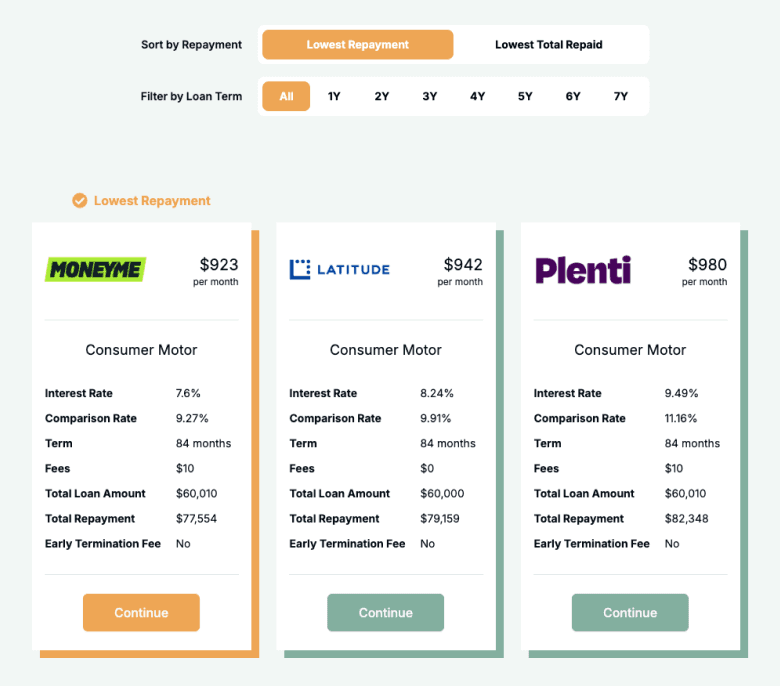

See loan offers side by side — secured, unsecured, fixed or variable.

Upload your documents

Proof of income, ID and bank statements are usually all you’ll need.

Settle & drive away

We handle the lender and seller so you can pick up your car sooner.

A quick guide to car loans

A car loan gives you the freedom to buy now and spread the cost into manageable repayments. Instead of draining your savings, you can choose a loan that fits your budget and timeframe.

Lenders will look at your income, credit history and the car’s age to decide how much you can borrow and the rate you’ll pay. For new cars, it’s often possible to borrow up to 100% of the price, meaning you can drive away without a big upfront deposit.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of car loans

Choose the loan style that matches your needs and repayment preferences:

What can you use a car loan for?

Your car loan can be tailored to the way you live, travel and move around Australia.

Buy a New Car

Drive away in a brand-new model with finance that covers up to 100% of the cost.

Upgrade to Used

Pick up a quality used vehicle from a dealer, auction or private seller with loan terms to match.

Family Upgrade

Make room for the kids with a safe, spacious SUV or people-mover financed on terms that suit you.

Daily Commuter

Get a reliable runabout for work and errands, with predictable repayments you can budget around.

Adventure Vehicle

Finance a 4WD or camper and head off-road — repayment plans can match your lifestyle.

Replacement Ride

Say goodbye to unreliable cars and get into something newer, safer and more efficient.

Case Study

Sophie & Daniel

Upgrading to a safer family car without blowing the budget

Challenge: Sophie and Daniel needed a newer, safer car for family trips but didn’t want repayments to stretch their budget.

Solution: A secured, fixed-rate car loan over 5 years covering 90% of the purchase price.

After comparing offers through Emu Money, Sophie and Daniel chose a fixed-rate loan with predictable monthly repayments. With no large deposit required, they upgraded quickly and drove away in a safer family car—confident their budget would stay on track.

How much can you borrow?

Most car loans range from $5,000 to $100,000+. If you’re buying new, you may be able to borrow up to the full price. For used cars, loans usually cover 80–90% of value. The exact amount depends on your income, credit profile and the age of the car. Terms run from 1 to 7 years, so you can set repayments that fit your budget.

Car Loan Repayment Calculator

Work out what your repayments might look like before you commit. Adjust the loan amount, rate, term and balloon to plan with confidence.

Balance over time

Are you eligible for a car loan?

Lenders want to see that you can manage the loan without putting your budget under pressure. They’ll look at your income, employment stability, and existing financial commitments to make sure the repayments are affordable. The car itself also plays a role — newer vehicles usually qualify for sharper rates and longer terms, while older cars may have stricter limits.

Having steady income, a clean credit history, and healthy bank statements will all improve your chances of approval. Even if your profile isn’t perfect, there are options available — from specialist lenders to flexible structures that can still get you on the road.

You may be eligible if you are:

An Australian resident

Over 18 years old

Earning a regular income

Able to provide bank statements or payslips

Buying an eligible vehicle (dealer, auction or private sale)

How to apply for a car loan

Applying is simple. Fill out a short form, upload your documents, and we’ll match you with lenders. Once you choose your loan, we take care of settlement so you can pick up the keys.

Documents you may need:

Driver’s licence or passport

Recent payslips or bank statements

Employment details

Vehicle details (VIN, rego, invoice or quote)

How to save money on your car loan

The right structure can save you thousands. Secured loans usually come with lower rates, while unsecured loans offer more freedom. Adding a balloon payment can cut your monthly costs, but you’ll need a plan for the final lump sum. Choosing a newer car often means sharper pricing. Always check for fees, and consider rolling extras like rego, insurance or accessories into the loan so you pay one competitive rate.

Example: Balloon impact — $30,000 over 60 months at 7.99% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $615 | Highest monthly cost |

10% ($3,000) | $554 | Lower monthly cost |

20% ($6,000) | $492 | Balance of cost vs cash flow |

30% ($9,000) | $431 | Lowest monthly cost; plan for resale or refinance |

Car loan options explained

Different loan features can change how much you pay and how much flexibility you get:

Secured vs Unsecured Loans

A secured loan uses your car as collateral, usually giving you a lower rate. An unsecured loan doesn’t, which means faster access but higher costs.

Fixed vs Variable Rates

A fixed rate keeps repayments the same every month. A variable rate can save money if rates drop, but repayments may rise.

Balloon Payments

Lower your monthly repayments by pushing a lump sum to the end — just make sure you can cover it later.

Early Repayment Flexibility

Want the freedom to pay off your loan early? Some lenders allow it without penalty, others don’t.

Fees & Charges

Look beyond the rate — establishment, monthly and exit fees all add to the true cost of your loan.

Testimonials

Verified Review

We had an excellent experience working with Stevette Gelavis from Emu Money. She was absolutely outstanding—providing clear and comprehensive information from the very beginning and demonstrating professionalism, fairness, and genuine helpfulness throughout the process. After having disappointing experiences with other loan providers who quoted us unreasonably high rates, Stevette secured us a much better rate. Thank you, Stevette, for your exceptional service and for restoring our confidence in loan providers. You’re doing a fantastic job!

Indu

Verified Review

I was completely impressed with their professionalism and customer service.. highly recommend. Special Mention to Ray thank you for assisting me in this journey

David A.

Verified Review

I would like to highly recommend Eujin from Emu Money for the excellent service provided during my loan process. His guidance, professionalism, and clear communication made the entire experience smooth and stress-free. I truly appreciate his support and would confidently recommend Emu Money to anyone seeking loan assistance.

Chathushka H.

Verified Review

Brad provided excellent guidance throughout the entire loan process, making it much easier for me to achieve my financial goals. His expertise and support were invaluable, and I'd highly recommend him to anyone looking for a reliable finance broker.

Marlon

Verified Review

It's nice, quick and easy to get a new equipments through Emu Money. Big thanks to Brad for his great assistance.

Marvin Y.

Verified Review

evette was very helpful, quick, punctual and got the job done fast as well as it being a good deal. absolute gem

Kristian J.

Frequently Asked Questions

Car Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.