Compare Medical Loans from 50+ Australian Lenders

Cover procedures, treatment gaps, dental, fertility, cosmetic, rehab and more—with clear, fixed repayments.

5.0 rating

Care Without the Cash Crunch

Finance health costs with fast decisions, fair terms and repayments that fit your budget.

Borrowing Range

Typical amounts $2,000 to $50,000+

Fixed Repayments

1 to 7 year terms for certainty

Fast Approvals

Same-day outcomes possible for complete files

Secured or Unsecured

Choose flexibility or sharper pricing with security

Direct-to-Provider

Pay clinics or specialists at settlement if needed

Any Medical Purpose

Elective or essential care, dental, fertility, rehab

How it works

We match your profile to lenders that fund medical and dental procedures—quickly and fairly.

Apply online in 3 minutes

Share your details, treatment type and budget. No lengthy forms.

See matched options

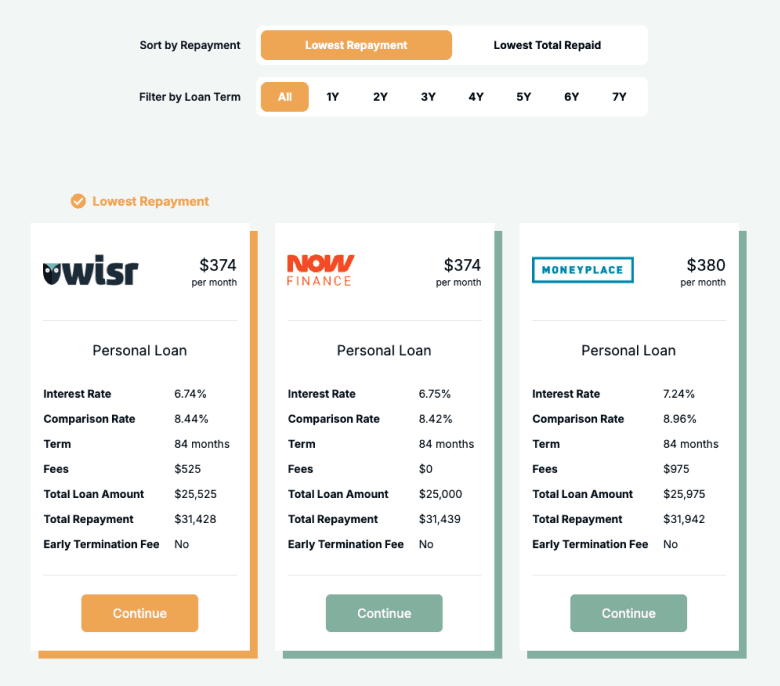

Compare secured vs unsecured, terms, fees and comparison rates.

Upload documents

Provide ID, income evidence and bank statements for assessment.

Settle & pay providers

Funds to you or directly to clinics, dentists or specialists.

A quick guide to medical loans

Medical loans are personal loans used to cover out-of-pocket healthcare costs—whether essential or elective. They spread expenses for surgery, dental work, fertility treatments, vision care, rehabilitation and more into predictable repayments. Pricing is risk-based and depends on your credit profile, income and requested amount.

You can opt for unsecured loans for speed and flexibility, or secured loans (e.g., using a car) to access sharper pricing or higher limits. Comparing offers and checking the comparison rate ensures you understand total cost before committing.

Want to skip ahead?

Jump to the section that best fits what you need.

Types of medical loans

Pick a structure that suits your treatment timing and budget:

What can I use a medical loan for?

Medical loans cover a wide range of healthcare needs in Australia, from essentials to elective procedures:

Surgery & Hospital Gaps

Pay hospital excesses and procedure gaps not fully covered by Medicare or private health. Keep treatment timelines on track without draining savings.

Dental & Orthodontics

Finance implants, crowns, root canal, wisdom teeth removal, Invisalign and veneers. Bundle multiple treatments into one fixed repayment.

Fertility & IVF

Cover IVF cycles, egg freezing, genetic testing and related medications. Predictable repayments help plan for multiple stages of treatment.

Cosmetic & Reconstructive

From rhinoplasty to breast reconstruction or liposuction, fund procedures that improve confidence or follow medical recommendations.

Vision & Hearing

LASIK, cataract gaps, specialty lenses, hearing aids and audiology support—financed with clear terms and fixed instalments.

Rehab, Physio & Mental Health

Support ongoing therapy after injury or surgery, psychology and psychiatry services, or intensive outpatient programs with steady repayments.

Medications & Devices

High-cost prescriptions, injectables, CPAP machines, mobility aids and at-home medical equipment can be included in one facility.

Travel & Accommodation for Treatment

When you need to travel for specialist care, include flights and stays so access to treatment isn’t delayed.

Case Study

Alana & Chris

IVF funded without delaying care

Challenge: Facing upfront IVF costs not fully covered by insurance.

Solution: Unsecured medical loan over 4 years with direct clinic payments.

Alana and Chris in Melbourne needed to begin IVF quickly but were short on up-front funds for medications and the first cycle. Through Emu Money, they compared matched options and chose an unsecured medical loan with fixed repayments and no monthly fee. Funds were paid directly to their clinic and pharmacy, letting them start immediately while keeping a predictable budget.

How much can I borrow with a medical loan?

Typical loan sizes range from $2,000 to $50,000+, depending on the procedure, income stability and overall commitments. Secured loans may allow higher limits and sharper pricing; unsecured prioritises speed and flexibility. Lenders review recent bank-statement conduct and serviceability to set a suitable maximum so repayments remain manageable.

Medical Loan Repayment Calculator

Estimate repayments before you apply. Adjust amount, term and rate to see how it fits your budget.

Balance over time

Am I eligible for a medical loan?

Eligibility focuses on affordability, income stability and a clear plan for the funds (e.g., quotes or treatment plans). Stronger profiles and secured options can unlock sharper pricing. Clean recent bank-statement conduct improves approval odds.

You may be eligible if you are:

An Australian resident aged 18+

Employed, self-employed or receiving acceptable income

Able to demonstrate serviceability via bank statements

Meeting minimum credit criteria (score/history)

Borrowing for a legitimate medical or dental purpose

How to apply for a medical loan?

Complete a quick online application and upload documents. We’ll compare offers across secured vs unsecured and coordinate settlement to you or directly to your provider so treatment isn’t delayed.

Documents you may need:

Photo ID (driver’s licence or passport)

Recent bank statements (3–6 months)

Payslips or income evidence (or tax returns if self-employed)

Quotes, treatment plan or invoices

Asset details if offering security

How to save money on a medical loan

Compare more than just the headline rate—fees and the comparison rate influence the true cost. Shorter terms reduce total interest, while longer terms lower monthly outgoings. If your provider allows staged payments, draw down only what you need. Consider secured options for sharper pricing if appropriate, and check early-repayment policies so you can pay it off faster without penalty.

Example: Term impact — $15,000 at 12.49% p.a. (approx.):

| Term | Approx. Monthly Repayment | Total Interest (approx.) |

|---|---|---|

3 years (36 mths) | $501 | $3,036 |

4 years (48 mths) | $397 | $3,996 |

5 years (60 mths) | $336 | $5,160 |

Understanding medical loan options

Structure and features affect flexibility and cost. Here are key options to consider:

Secured vs Unsecured Loans

Secured loans (often against a car) may allow larger amounts and sharper rates but put the asset at risk if repayments are missed. Unsecured loans are faster and more flexible, usually at higher rates.

Fixed vs Variable Rates

Fixed rates provide certainty over the whole term. Variable rates can change with the market and may save money if rates fall—but could rise.

Direct-to-Provider Payment

Some lenders pay clinics or pharmacies directly at settlement. This prevents delays and ensures funds are used for treatment as intended.

Staged Drawdowns

For multi-step treatments, staged drawdowns let you access funds as invoices arise, helping reduce interest on unused amounts.

Early Repayment Flexibility

Look for extra repayments and early payout with low or no penalty so you can clear the balance sooner and save on interest.

Rate-for-Risk Pricing

Sharper pricing is offered to stronger profiles. Improving bank-statement conduct and reducing other debts before applying can help.

Testimonials

Verified Review

Brad was great, honest, responsive and on the ball, thanks for your help :)

Chantelle F.

Verified Review

I would like to highly recommend Eujin from Emu Money for the excellent service provided during my loan process. His guidance, professionalism, and clear communication made the entire experience smooth and stress-free. I truly appreciate his support and would confidently recommend Emu Money to anyone seeking loan assistance.

Chathushka H.

Verified Review

Peter was very quick, responsive and easy to deal with. Great experience, and we're picking up our new car tomorrow!

Olivia F.

Verified Review

⭐️⭐️⭐️⭐️⭐️ Evette is amazing. As a sole trader I struggled to get finance for a car, but she worked tirelessly to make it happen and got me a great loan. Even when delays came up with the sellers bank, she kept on top of everything until it was resolved. I am so grateful and would 100% recommend her to anyone!

Sarah S.

Verified Review

I applied for a car loan with the help of Emu Money a week ago, and the process was very fast and easy. There was no stress at all, as everything was taken care of by Krish, who managed my application from start to finish. He was very easy to communicate with and clearly explained the entire process and what was required from me. He was also quick to provide updates throughout. I would definitely recommend Emu Money to anyone looking for a smooth and hassle-free loan experience.. Thank you Krish.

Saritha A.

Verified Review

Robyn was very professional in her mannerism in organising us our loan . Robyn was always polite .. She kept us up to date and informed on the development of our loan even after hours as it was hard for us to speak to her during work hours . Very helpful when your not tec savy I would highly recommend Robyn to anyone needing to deal with Emu Loans and will definitely recommend her to friends and family . Keep up the great work Robyn You are a true inspiration to you job Karen Grimston

karen c.

Frequently Asked Questions

Medical Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.