Compare Education Loans from 50+ Australian Lenders

Cover tuition, textbooks, laptops and living costs with clear, fixed repayments that fit your study plan.

5.0 rating

Study Without the Stress

Finance course fees and essentials with fast decisions and repayments you can plan around.

Borrowing Range

Typical amounts $3,000 to $50,000+

Fixed Repayments

1 to 7 year terms for certainty

Fast Approvals

Same-day decisions possible for complete applications

Secured or Unsecured

Choose flexibility or sharper pricing with security

Direct-to-Provider

Pay universities, TAFE or course providers at settlement

Covers Study Essentials

Tuition, textbooks, devices, travel and more

How it works

We match your profile to lenders who fund uni, TAFE and professional courses—quickly and fairly.

Apply online in 3 minutes

Share your details, course info and budget. No lengthy forms.

See matched options

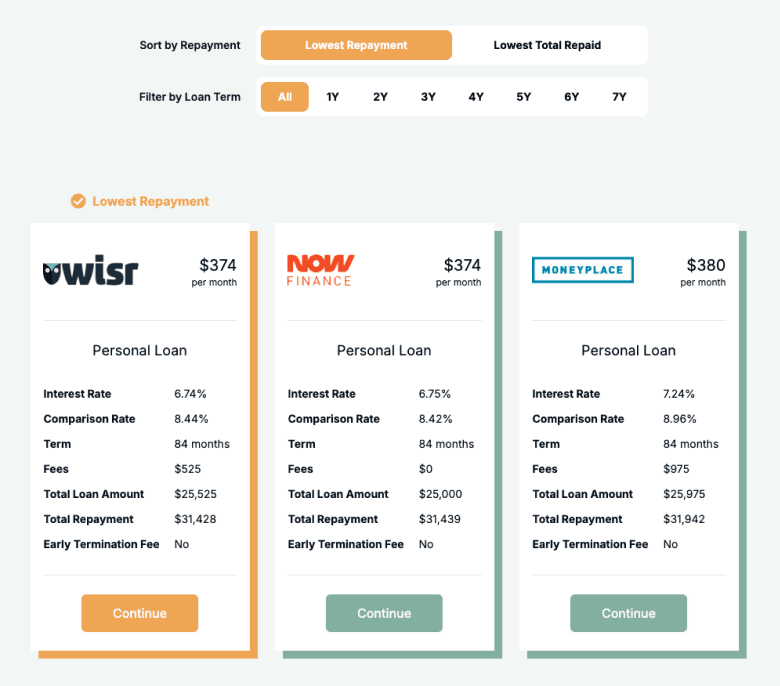

Compare secured vs unsecured, terms, fees and comparison rates.

Upload documents

Provide ID, income evidence and bank statements for assessment.

Settle & start studying

Funds to you or directly to the education provider for fees.

A quick guide to education loans

Education loans help Australians spread the cost of study—covering tuition, textbooks, devices and related living costs—into predictable repayments. They’re commonly used for university, TAFE, professional certificates and short courses, including online programs.

You can opt for unsecured loans for speed and flexibility, or secured loans (e.g., using a car) for sharper pricing or higher limits. Compare interest and the comparison rate to understand true cost, and align the term to your study timeline so repayments stay manageable.

Want to skip ahead?

Jump to the section that best fits what you need.

Types of education loans

Pick a structure that suits your course timing and budget:

What can I use an education loan for?

Education loans can cover a wide range of study-related costs in Australia:

Tuition & Course Fees

Pay university, TAFE or private provider fees on time—often with the option to pay the provider directly at settlement.

Textbooks & Materials

Fund textbooks, software licences, lab fees and other course materials without draining savings at census or exam time.

Devices & Equipment

Purchase laptops, tablets, specialist tools or cameras required by your course and bundle them into one repayment.

Living Costs While Studying

Cover accommodation, transport and childcare during intensive study periods so you can focus on results.

Professional Exams & Registrations

Finance exam fees, accreditation costs and compulsory memberships for fields like accounting, IT or healthcare.

Study Abroad & Intensives

Include flights, visas and short-term accommodation for exchange programs or residential intensives.

Case Study

Maya K

Postgrad made manageable

Challenge: Upfront fees for a 12-month graduate diploma plus a new laptop.

Solution: Unsecured education loan over 4 years with staged drawdowns.

Maya in Brisbane wanted to upskill with a graduate diploma while working part-time. Through Emu Money she compared matched options and chose an unsecured education loan with fixed repayments and staged drawdowns—paying the provider at census dates and funding a new laptop. This kept cash flow steady and aligned repayments with her study schedule.

How much can I borrow with an education loan?

Typical loan sizes range from $3,000 to $50,000+, depending on course costs, income stability and overall commitments. Secured loans may allow higher limits and sharper pricing; unsecured options prioritise speed and flexibility. Lenders assess recent bank-statement conduct and serviceability to set a suitable maximum so repayments remain manageable throughout your study.

Education Loan Repayment Calculator

Estimate repayments before you apply. Adjust amount, term and rate to see how it fits your budget.

Balance over time

Am I eligible for an education loan?

Eligibility focuses on affordability, income stability and a clear plan for funds (e.g., offer letter, invoice or course outline). Stronger profiles and secured options can unlock sharper pricing. Clean recent bank-statement conduct improves approval odds.

You may be eligible if you are:

An Australian resident aged 18+

Employed, self-employed or receiving acceptable income

Able to demonstrate serviceability via bank statements

Meeting minimum credit criteria (score/history)

Borrowing for bona fide study purposes

How to apply for an education loan?

Complete a quick online application and upload documents. We’ll compare offers across secured vs unsecured and coordinate settlement to you or directly to the provider so enrolment isn’t delayed.

Documents you may need:

Photo ID (driver’s licence or passport)

Recent bank statements (3–6 months)

Payslips or income evidence (or tax returns if self-employed)

Course offer/fees invoice or study plan

Asset details if offering security

How to save money on an education loan

Compare more than the headline rate—the comparison rate reflects interest plus most fees. Shorter terms cut total interest, while longer terms reduce monthly outgoings; choose the balance that fits your cash flow during study. If your provider bills by term, consider staged drawdowns so you only accrue interest on what you use. Check early-repayment policies so you can pay it off faster without penalty.

Example: Term impact — $20,000 at 10.99% p.a. (approx.):

| Term | Approx. Monthly Repayment | Total Interest (approx.) |

|---|---|---|

3 years (36 mths) | $654 | $3,522 |

5 years (60 mths) | $436 | $6,160 |

7 years (84 mths) | $361 | $10,324 |

Understanding education loan options

Structure and features affect flexibility and cost. Here are key options to consider:

Secured vs Unsecured Loans

Secured loans (often against a car) can allow larger amounts and sharper rates but put the asset at risk if repayments are missed. Unsecured loans are faster and more flexible, usually at higher rates.

Fixed vs Variable Rates

Fixed rates provide certainty over the whole term. Variable rates can change with the market and may save money if rates fall—but could rise.

Direct-to-Provider Payment

Some lenders pay tuition invoices directly at settlement. This can secure enrolment quickly and ensure funds are used as intended.

Staged Drawdowns

For multi-term programs, staged drawdowns let you access funds as invoices arise, reducing interest on unused amounts.

Early Repayment Flexibility

Look for extra repayments and early payout with low or no penalty so you can clear the balance sooner and save on interest.

Rate-for-Risk Pricing

Sharper pricing is offered to stronger profiles. Improving bank-statement conduct and reducing other debts before applying can help.

Testimonials

Verified Review

We had an excellent experience working with Stevette Gelavis from Emu Money. She was absolutely outstanding—providing clear and comprehensive information from the very beginning and demonstrating professionalism, fairness, and genuine helpfulness throughout the process. After having disappointing experiences with other loan providers who quoted us unreasonably high rates, Stevette secured us a much better rate. Thank you, Stevette, for your exceptional service and for restoring our confidence in loan providers. You’re doing a fantastic job!

Indu

Verified Review

I found Erin through facebook and I would recommend her to everyone she's professional, Erin was very knowledgeable about different lander's and helped me secure a great rate for my car loan, Erin was always available to answer my questions and kept me updated throughout the entire process and she's honest and reliable I would give her more than 5 stars if I could I highly recommend Erin

Nasratullah

Verified Review

I was so lucky to have had Evette as my broker through emu money, from the very first phone call Evette was amazing, so prompt and professional keeping me updated on the whole process of the application for finance for my new car, I highly recommend Evette!!!

Kaila B.

Verified Review

Robyn was amazing the way she went through each step made it so easy to understand and having a joke along the way it was like chatting to a mate well done Robyn winner

Steve G.

Verified Review

S. B.

Verified Review

Peter was very quick, responsive and easy to deal with. Great experience, and we're picking up our new car tomorrow!

Olivia F.

Frequently Asked Questions

Education Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.