Compare Debt Consolidation Loans from 50+ Australian Lenders

Roll multiple debts into one simple loan with a clear repayment schedule and potentially lower interest rates.

5.0 rating

Simplify Your Finances

Combine multiple debts into one predictable repayment and reduce financial stress.

Borrowing Range

Typical amounts $2,000 to $100,000+

Fixed Repayments

1 to 7 year terms available

Fast Approvals

Same-day decisions possible for eligible profiles

Secured or Unsecured

Choose depending on loan size and rate needs

Direct Creditor Payouts

Lenders can pay off old accounts directly

Path to Debt-Free

One clear repayment with an end date

How it works

We match your application to lenders who specialise in consolidating multiple debts into one loan.

Apply online in 3 minutes

Share your income, debt balances and repayment goals.

See matched options

Compare offers with direct-to-creditor payout features.

Upload documents

Provide ID, income proof and liability statements for assessment.

Settle & simplify

Old accounts are paid out, leaving you with one manageable repayment.

A quick guide to debt consolidation loans

Debt consolidation loans allow Australians to combine multiple debts—like credit cards, personal loans and payday advances—into one facility with a single repayment. This simplifies budgeting, can lower your total interest cost and sets a clear end date.

These loans may be secured (e.g. against a car) for higher amounts or unsecured for speed and flexibility. The best option depends on your debt size, credit profile and affordability. Direct creditor payouts at settlement ensure old accounts are closed and interest stops accruing.

Want to skip ahead?

Jump to the section that’s most relevant for you.

Types of debt consolidation loans

Choose the structure that fits your situation and repayment goals:

What debts can I consolidate?

Debt consolidation loans can roll many kinds of balances into one facility:

Credit Card Balances

One of the most common uses. Replace multiple high-interest card repayments with one fixed instalment loan, reducing interest drag.

Personal Loans

Combine multiple small personal loans into one repayment to simplify budgeting and potentially lower your overall cost.

Medical Bills

Bundle outstanding healthcare expenses into one predictable repayment instead of juggling multiple payment plans.

Auto or Consumer Loans

If you’re struggling with existing vehicle or appliance loans, consolidation can bring them together into one manageable structure.

Payday & Short-Term Loans

Escape high-interest payday cycles by rolling them into one lower-rate consolidation facility with a clear finish line.

Overdue Bills & Utilities

Prevent service disconnections by including outstanding utility bills in your consolidation loan, then paying them off over time.

Case Study

Sam P

From juggling cards to one repayment

Challenge: Five credit cards with staggered due dates and rising interest.

Solution: Unsecured debt consolidation loan over 5 years with creditor payouts.

Sam in Adelaide was overwhelmed with five different card repayments every month, often paying late fees on top of high interest. Through Emu Money, Sam matched with a lender offering a 5-year unsecured consolidation loan. Funds were paid directly to the card issuers, leaving Sam with one fixed monthly repayment. This structure lowered stress, cut interest costs, and set a clear timeline to become debt-free.

How much can I borrow with a debt consolidation loan?

Most lenders offer consolidation facilities between $2,000 and $75,000, with some stretching to $100,000 depending on credit profile, income and whether the loan is secured. Approval amounts are based on your total existing debts, affordability and overall commitments. Remember: larger limits can extend repayment terms and interest costs, so borrow only what you need to clear your current debts.

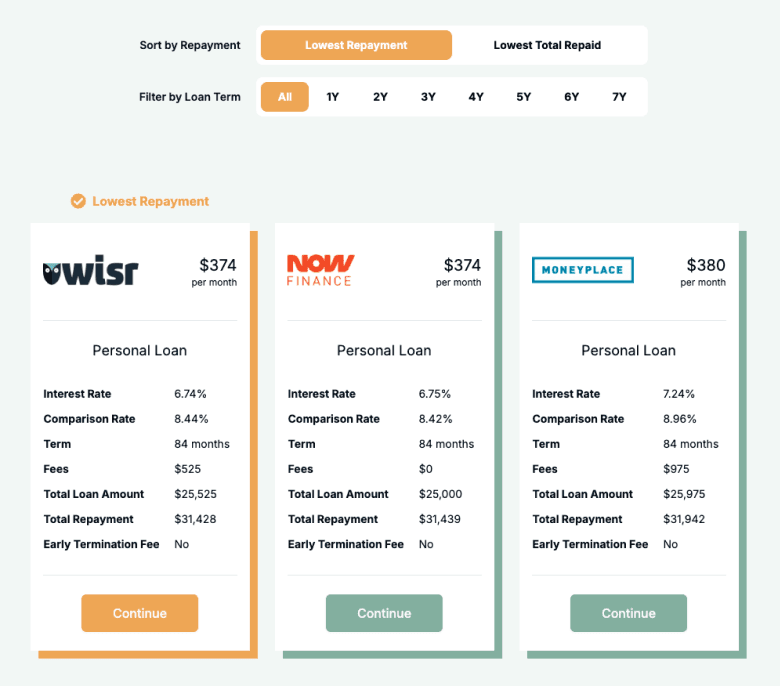

Debt Consolidation Loan Repayment Calculator

Estimate your new repayment and total cost. Adjust the amount, term and rate to see how it compares to your current outgoings.

Balance over time

Am I eligible for a debt consolidation loan?

Eligibility is based on your ability to repay and your existing debt position. Stronger credit and stable income unlock sharper pricing. Lenders will assess bank-statement health and total liability levels before approving.

You may be eligible if you are:

An Australian resident aged 18+

Employed or self-employed with regular income

Able to show affordability via bank statements

Holding multiple debts suitable for consolidation

Meeting minimum credit score requirements

How to apply for a debt consolidation loan?

Complete our quick online application and upload supporting documents. We’ll match you to lenders who can pay off your creditors directly at settlement, leaving you with one clear repayment.

Documents you may need:

Photo ID (driver’s licence or passport)

Recent bank statements (3–6 months)

Payslips or income verification

Liability statements for debts to be consolidated

Asset details if applying for secured option

How to save money on a debt consolidation loan

To maximise savings, compare both rates and fees across lenders, and check the comparison rate for a realistic cost. Ensure your old accounts are closed at settlement so interest doesn’t continue. Choosing a shorter term reduces total interest but increases monthly repayments, while longer terms ease the monthly strain but cost more overall. Avoid taking on new debt while paying off your consolidation loan to ensure long-term success.

Example: Consolidating $30,000 over 60 months at 12.99% p.a.:

| Scenario | Approx. Monthly Repayment | Total Interest (approx.) |

|---|---|---|

Keep separate cards (avg. 20%+) | $900+ | $15,000+ |

Consolidate into new loan | $684 | $11,040 |

Understanding debt consolidation loan options

Different structures and features impact cost and effectiveness. Here are the main options:

Secured vs Unsecured Loans

Secured loans allow larger limits and lower rates but require collateral such as a car. Unsecured loans are faster and flexible but may come with higher rates.

Fixed vs Variable Rates

Fixed rates offer certainty and stability; variable rates can fluctuate, sometimes offering savings but with added risk.

Direct Creditor Payout

Many lenders pay creditors directly at settlement to ensure debts are cleared. This prevents misuse of funds and ensures interest stops accruing.

Early Repayment Flexibility

Some lenders allow early payout or extra repayments without penalty, saving on interest. Others charge fees—check before you commit.

Rate-for-Risk Pricing

Better credit and income stability unlock sharper rates. Improving your profile before applying can save significantly.

Debt Consolidation Alternatives

Sometimes a balance transfer or refinancing mortgage may be a cheaper alternative. Compare all options before committing.

Testimonials

Verified Review

Great boutique provider of finance services. Emu were very helpful in improving my financial situation, despite the fact they had to do most of it remotely. Highly regarded and completely trusted. A+++

Thomas M.

Verified Review

Brad was great, honest, responsive and on the ball, thanks for your help :)

Chantelle F.

Verified Review

Eujine made the process of getting a loan swift and easy, he's very trustable, I would highly recommend

Amila L.

Verified Review

We recently had the pleasure of working with Eujin to secure a car loan, and we couldn't be more grateful for his assistance. Eujin went above and beyond to ensure we got the best possible terms. His professionalism, dedication, and willingness to help were evident throughout the entire process. Thank you, Eujin, for making this experience smooth and stress-free. Highly recommend his services!

Bstl 1.

Verified Review

Great to work with good communication and made things nice and easy

Benjamin B.

Verified Review

I was completely impressed with their professionalism and customer service.. highly recommend. Special Mention to Ray thank you for assisting me in this journey

David A.

Frequently Asked Questions

Debt Consolidation Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.