Compare Jet Ski Finance from 50+ Australian Lenders

Sea-Doo, Yamaha WaveRunner or Kawasaki—line up sharp rates and repayments that fit your budget and hit the water sooner.

5.0 rating

Jet Ski Finance Made Simple

Get the PWC you want now—spread the cost with clear, predictable repayments and a lender that suits your profile.

Borrow What You Need

Typical loan sizes from $3,000 to $50,000+

Flexible Terms

1 to 7-year terms so repayments fit your budget

Quick Approvals

Eligible applications can be decided fast

New or Used

Dealer, auction or private sale supported

Fixed Repayments

Lock in consistency month to month

Bundle Extras

Trailer, safety gear and insurance can often be included

How it works

No run-around. Compare lenders, choose your offer, and get on the water faster.

Apply online in minutes

Tell us about you, the jet ski and your budget.

See matched options

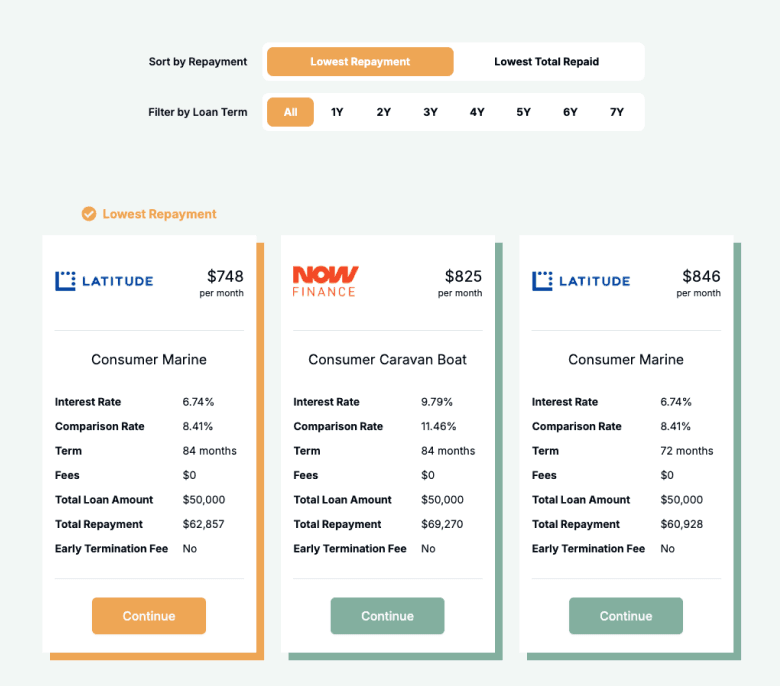

Compare secured vs unsecured and fixed vs variable side by side.

Upload documents

ID, proof of income and recent bank statements are usually enough.

Settle & launch

We coordinate settlement with the seller so pickup is smooth.

A quick guide to jet ski finance

A jet ski loan lets you buy now and spread the cost into manageable repayments over 1–7 years. Whether it’s a Sea-Doo, WaveRunner or Kawasaki stand-up, you keep savings intact and still get out on the water.

Lenders look at your income, credit history and the PWC’s age/value to set your limit and rate. Newer models often unlock sharper pricing and longer terms; used skis are still financeable with slightly different limits. With the right structure, you can tow home your ski without the financial splash.

Want to skip ahead?

Jump to the section you need.

Types of jet ski loans

Pick the structure that suits how you buy and how you want to repay:

What can you use a jet ski loan for?

Finance the craft itself—and the gear that makes it safer and easier to own.

New Jet Ski Purchase

Buy a brand-new PWC from the dealership and spread the cost over time.

Used Jet Ski Purchase

Pick up a pre-owned ski from a dealer or private seller with terms to match age and value.

Trailer & Tow Setup

Include a trailer, tow bar and straps so you’re launch-ready from day one.

Safety Gear

Bundle PFDs, VHF, EPIRB/PLB and covers into one easy repayment.

Upgrades & Accessories

Financing can extend to storage racks, sound systems and performance kits.

Insurance & On-Roads

Some lenders allow rego, insurance and delivery to be included.

Maintenance & Repairs

Spread the cost of major servicing or unexpected repairs without raiding savings.

Training or Licence

Cover licensing or PWC training so you’re legal and confident on the water.

Case Study

Lauren

Lauren turns a wish list into a launch-ready setup

Challenge: Lauren wanted a new WaveRunner plus the trailer and safety gear, but didn’t want to empty her savings to get on the water.

Solution: A secured, fixed-rate 4-year loan funded 95% of the package, with the trailer and PFDs added at settlement.

Emu Money lined up the options and Lauren chose a low, fixed monthly repayment that wrapped everything into one facility. Paperwork midweek, handover Saturday—no surprise costs, just fuel and a grin.

How much can you borrow?

Loan sizes typically range from $3,000 to $50,000+. Limits depend on your income, credit profile and the ski’s age/value. New PWCs may qualify for higher LVRs; older models can still be financed with slightly shorter terms or lower caps.

Terms usually run 1–7 years. Shorter terms mean higher monthly repayments but less interest overall; longer terms keep repayments lower but increase the total interest paid. We’ll help you find the balance that fits your budget.

Jet Ski Loan Repayment Calculator

Estimate repayments before you commit. Adjust amount, term, rate and balloon to plan with confidence.

Balance over time

Are you eligible for jet ski finance?

Lenders want to see that repayments fit comfortably alongside your other bills. They’ll review your income, employment stability, credit history and recent bank statements. The craft matters too—newer skis often unlock sharper pricing and longer terms, while older models are still financeable with different limits. If your credit isn’t perfect, specialist lenders may still work with you.

You may be eligible if you are:

An Australian resident aged 18+

Earning a regular income (PAYG or self-employed)

Able to provide payslips or bank statements

Buying an eligible new or used jet ski from a dealer or private seller

How to apply for jet ski finance

Complete a short online application, upload your documents, and we’ll match you with lenders. Choose your offer and we’ll handle settlement with the seller so pickup and registration are seamless.

Documents you may need:

Driver’s licence or passport

Recent payslips or bank statements

Employment/ABN details

PWC details (HIN/VIN, invoice/quote) + trailer details if included

How to save money on a jet ski loan

Compare more than just the rate. Secured loans usually price sharper than unsecured. A balloon can lower monthly cost but leaves a lump sum at the end—set it to a level you can comfortably clear. Newer skis typically attract better pricing. Bundle essentials (trailer, PFDs, covers) at settlement so they’re financed at the same competitive rate, and check fees plus early-repayment policies so there are no surprises.

Example: Balloon impact — $18,000 over 48 months at 8.99% p.a.:

| Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $449 | Highest monthly cost |

10% ($1,800) | $404 | Lower monthly cost |

20% ($3,600) | $361 | Balance of cost vs flexibility |

30% ($5,400) | $318 | Lowest monthly cost; plan to clear balloon |

Jet ski loan options explained

These features change cost, flexibility and risk—pick what suits how you ride and repay:

Secured vs Unsecured

Secured uses the PWC as collateral for sharper pricing. Unsecured may be quicker but usually costs more.

Fixed vs Variable

Fixed locks in steady repayments. Variable can fall—or rise—with market rates.

Balloon Payments

Push a lump sum to the end to reduce monthly cost—have a plan to pay, refinance or sell.

Early Repayment Flexibility

Some lenders let you pay extra or finish early with little/no penalty, saving interest.

Fees & Charges

Check establishment, monthly and exit fees—the real cost is rate + fees + time.

Testimonials

Verified Review

Eujin was extremely easy to work with. He was respectful, clear in communication and persuasive. He works to get the best deal for his clients.

Chetan P.

Verified Review

We recently purchased a vehicle. Peter was very helpful, with clear instructions and real outcomes. Within 48 hrs the deal was done, only 3-5 emails, a couple of phone calls. That was a super efficient experience. We would go back!

Kishan K.

Verified Review

Brad provided excellent guidance throughout the entire loan process, making it much easier for me to achieve my financial goals. His expertise and support were invaluable, and I'd highly recommend him to anyone looking for a reliable finance broker.

Marlon

Verified Review

Theodore G.

Verified Review

Robyn was very professional in her mannerism in organising us our loan . Robyn was always polite .. She kept us up to date and informed on the development of our loan even after hours as it was hard for us to speak to her during work hours . Very helpful when your not tec savy I would highly recommend Robyn to anyone needing to deal with Emu Loans and will definitely recommend her to friends and family . Keep up the great work Robyn You are a true inspiration to you job Karen Grimston

karen c.

Verified Review

Brad and the team at Emu money are fantastic. Highly recommend.

Liam H.

Frequently Asked Questions

Jet Ski Loan FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.