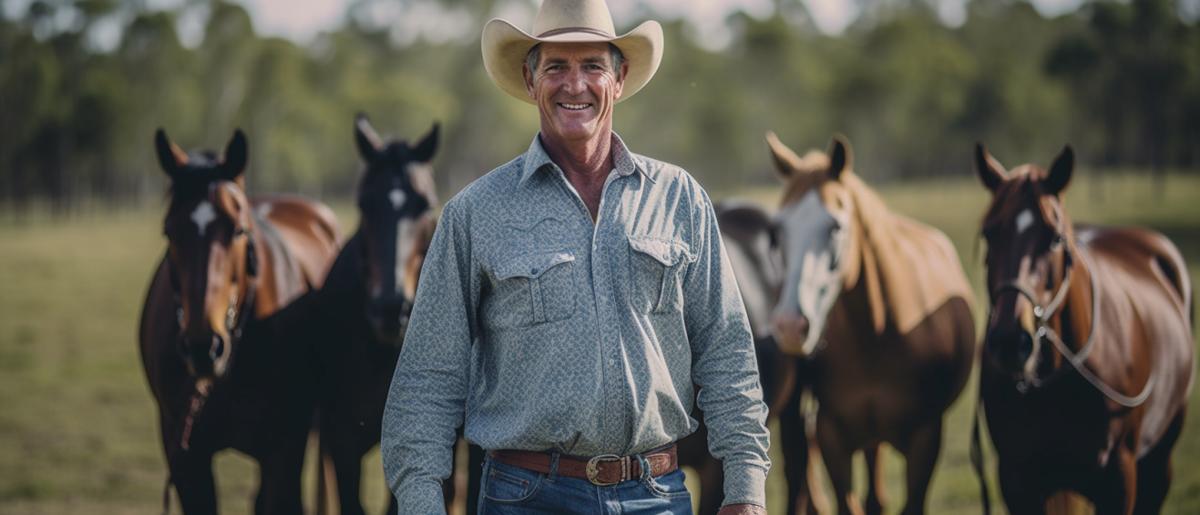

In Australia's robust equine industry, horse breeding establishments play a pivotal role. These businesses breathe life into the industry, maintaining the country's horse racing prestige and substantially contributing to the economy. However, as foundational as these enterprises are, their pursuit of excellence often comes with considerable expenses. Ensuring strong bloodlines, providing optimal care, and managing day-to-day operations can require financial backing beyond what conventional revenue streams might cover. That's where business loans enter the scene. These financial instruments can become indispensable tools for horse breeders. Whether it's for sprucing up the facilities, procuring top-notch equipment, elevating breeding programmes, or simply adjusting to unplanned costs, a business loan can provide a flexible and immediate financial solution. In essence, they can act as a steadying hand, enabling breeders to run smoother operations and achieve their organisational vision more efficiently. This serves not only the individual businesses but also strengthens Australia's equine industry as a whole.

Compare over 50+ lenders with one application.

Horse breeders play an integral role in Australia's diverse and dynamic economy. The horse breeding industry links rural and metropolitan Australia, significantly supporting both the agricultural and sporting sectors. This industry thrives in our vast landscape, fostering employment, tourism, and preserving our nation's rich equine heritage. Horse breeding is an art that requires resilience, knowledge and patience. Breeders tyrelessly endeavour to improve the equine gene pool, contributing to the enhancement of horse sport performance, thus solidifying Australia's status on the global equestian stage. Australia boasts a prolific output of high-quality Thoroughbreds and Standardbreds, sought after by international buyers. Further, the horse breeding sector enhances domestic and international tourism. Facilities such as breeding barns, horse training centres and stud farms are prime attractions, contributing positively to Australia's reputation as a leading equine destination. In the socio-cultural context, horse breeders uphold a time-honoured tradition, maintaining the legacy that dates back centuries. The Melbourne Cup, for instance, is a manifestation of this rich tradition, kindling national pride and unity. The horse breeding industry also plays a critical role in regional Australia's growth and socio-economic sustainability. The sector bolsters rural employment and contributes significantly to regional economies through support services like feed supplies, veterinary care and transport.

Learn about eligibility and how to apply.

Horse breeding in Australia, a country renowned for its champion thoroughbreds, is far from a straightforward business. There are numerous challenges horse breeders must negotiate, some of which can seriously compromise their operations or, in worst-case scenarios, see them fold entyrely. Raising horses is a high-cost venture, one of the biggest challenges faced by Australian horse breeders. Facilities, feed, veterinary care, and training all come with hefty price tags. And while some stud farms benefit from lucrative servicing fees generated by proven stallions, breeders focusing primarily on raising foals for sale often find their profit margins incredibly slim. Drought and extreme weather events, unfortunately all too common in Australia, can severely impact profitability. Drought raises the cost of feed and, in some instances, water. Conversely, flooding or significant bushfire events can lead to losses of stock and damage to properties and infrastructure, leading to extensive recovery costs. Biosecurity risks, such as equine influenza, are another significant threat. Outbreaks can lead to costly quarantines, cancelled events, and a significant loss of income. Lastly, market volatility presents another challenge. The equine industry, like many others, is subject to the ebbs and flows of the economy. Breeders must navigate unpredictable market shifts, which affect prices fetched at sales and stud fees. These ongoing challenges illustrate the precarious nature of the horse breeding industry and underline why many breeders might look towards business loans as a lifeline.

Calculate your repayment estimates and more.

In the dynamic industry of horse breeding, obtaining a business loan can serve as a lifeline that propels operations to the next level. For breeders, costs can quickly accumulate as they cover breeding stock purchases, property and equipment maintenance and upgrades, veterinary fees, and feed. A business loan specifically tailored for horse breeders is designed to cater to these unique requirements, turning seemingly insurmountable challenges into manageable aspects of daily operations. The flexibility of a business loan enables horse breeders to effectively respond to fluctuating market conditions and unexpected costs. With easy access to capital, breeders are equipped to seize lucrative opportunities as they arise, be it investing in high-value mares or stallions, or improving their facilities to boost productivity and profitability. Similarly, during downtimes such as the off-breeding season, a business loan can ensure the continuity of operations, providing a cushion against potential financial hitches. Additionally, a targeted business loan plays an integral role in accelerating the growth of the horse breeding business. From expanding stables to employing experienced colleagues, the injected capital can be channelled into diverse profit-boosting areas. More than just providing financial support, these business loans aim to bolster the sustainability of horse breeders, reaffirming their crucial role in Australia's economy.

In Australia, Horse Breeders have a myriad of business loan options at their disposal. They can opt for a term loan to manage long-term investments, a line of credit for flexible borrowing, or equipment finance for acquiring breeding and racing related machinery. These offerings cater to various financial needs, enabling breeders to operate smoothly and efficiently.

There are several types of business loans in Australia that can benefit Horse Breeders. Each of these loan types has its unique features, advantages, and potential disadvantages. Here are some of the most common types of business loans for Horse Breeders:

Business Line of Credit

A line of credit provides flexibility allowing horse breeders to borrow funds when needed, up to a predetermined limit. This is particularly beneficial for unexpected expenses or seasonal costs.

Short-Term Loans

These are ideal for resolving immediate financial concerns, such as sudden equipment repair or unplanned health expenses for horses. Repayment terms are on a shorter timeframe, usually within a year.

Long-Term Loans

These are suitable for long-term investments like purchasing high-quality breeding stock or improving pasture. Long-term loans typically have repayment terms extending beyond a year.

Equipment Finance

This type of loan is specifically for the purchase of new or upgraded equipment, such as ultrasound machines or horse trailers. Equipment finance eases the financial burden of large purchases which are crucial for operational efficiency.

Overdraft Facility

An overdraft provides a safety net for horse breeders, allowing the business checking account to go negative up to a certain limit. This is especially useful for bridging cash flow gaps during the breeding off-season.

Invoice Factoring

A form of short-term borrowing, invoice factoring allows horse breeders to borrow against their unpaid invoices to maintain steady cash flow. It's beneficial when clients are late on payments.

Chattel Mortgage

A chattel mortgage allows horse breeders to buy a costly asset, like a new stable or horse transporter, while using that asset as security for the loan. The breeder owns the asset from day one.

Commercial Property Loan

This type of loan is used for purchasing, extending, or renovating business premises like a stud farm or training facility.

Unsecured Business Loan

An unsecured business loan doesn't require collateral, allowing horse breeders to borrow without risking their assets. This could be valuable for start-ups or small-scale breeders.

Merchant Cash Advance

This is an advance based on projected future sales, ideally suited for horse breeders with fluctuating income. Repayments are made by withholding a percentage of daily credit and debit card sales.

Australian Horse Breeders can utilise business loans to streamline operations, fostering growth potential. This funding could facilitate purchasing superior breeding stock, upgrading facilities, or investing in the development of staff. Capital can, thus, be strategically directed towards enhancing breeding and training outcomes.

Here are some common reasons Horse Breeders use business loans:

Purchasing Breeding Stock

Acquiring high-quality horses can be a significant expense. Business loans facilitate breeders in expanding and diversifying their breeding stock to increase the genetic variability in their herds.

Upgrading Facilities

Equestrian facilities often require specific improvements such as fencing, barns, and shelters. Business loans can help horse breeders in financing these enhancements to ensure the safety, health, and productivity of their horses.

Technology Improvements

The use of modern technologies can drastically enhance the efficiency of breeding operations. With a business loan, horse breeders can invest in cutting-edge software for pedigrees analysis, tracking mare cycles, and managing their business.

Construction of Training Facilities

Building training arenas, tracks and obstacle courses are vital for producing competitive and marketable horses. A business loan can fund such construction projects.

Marketing and Promotion

Enhancing brand visibility is key to attracting clients. Business loans can be used to upgrade digital and print marketing efforts, website development, participation in trade shows, and more.

Equipment Purchase

From tractors for farm maintenance to state-of-the-art veterinary diagnostic equipment, business loans can assist breeders in buying necessary operational equipment.

Repaying Debts

Consolidating various debts into a single business loan can result in reduced interest rates, thus easing financial pressure.

Veterinary Care

Horses require quality healthcare for optimum performance. Business loans can be used to provide regular cheques, vaccinations, dental care, and treating injuries or illnesses.

Financing Horse Shows

Organising and participating in horse shows or competitions can be expensive. Business loans can be used to cover these costs, offering opportunities for breeders to showcase their horses and gain industry recognition.

Payroll and Staff Benefits

Hiring and retaining high-quality staff is instrumental for horse breeders. Business loans allow breeders to offer competitive wages, training opportunities and other benefits to enhance employee satisfaction and productivity.

To estimate your monthly repayments and the total cost of the loan, input the loan amount, loan term and interest rate into the calculator below. This helps you plan your budget and choose the most suitable loan terms.

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.