Compare Asset Finance from 50+ Australian Lenders

Acquire vehicles, machinery, equipment and more without tying up capital. Compare real quotes in minutes with no impact on your credit score.

5.0 rating

Asset Finance Made Simple

Finance a wide range of assets — from vehicles to IT infrastructure — with tailored solutions that help Australian businesses grow without draining cash flow.

Borrow With Confidence

Amounts from $10,000 to several million

Flexible Terms

Loan terms from 1 to 10 years

Fast Approval

Funding often within 24–72 hours

Secured by Asset

The asset itself acts as collateral

Industry Coverage

Transport, agriculture, construction, IT, medical and more

Tax Benefits

Interest and depreciation may be deductible

How Asset Finance Works

We connect you with lenders offering tailored asset finance so you can fund essential purchases quickly and confidently.

Apply online in minutes

Tell us about your business and the asset you need.

Get matched offers

Receive tailored quotes from multiple lenders across Australia.

Choose your loan

Compare interest rates, fees and repayment terms to find the best fit.

Get approved & funded

Approval and settlement often within 24–72 hours.

A quick guide to asset finance

Asset finance helps Australian businesses acquire critical equipment and infrastructure without large upfront costs. Repayments are spread over time, freeing cash for working capital and growth.

Loans are usually secured against the asset, reducing lender risk and delivering sharper pricing compared to unsecured products. Terms typically range from 1 to 10 years, with repayment structures tailored to cash flow.

Assets that can be financed include vehicles, construction machinery, IT systems, medical technology, manufacturing equipment, renewable energy installations and even commercial property. Whether you’re modernising infrastructure, upgrading vehicles, or expanding operations, asset finance ensures you have access to the resources you need.

The advantage is flexibility: you gain immediate use of the asset, while repayments align with the income it generates. This keeps cash flow predictable and allows businesses of all sizes to remain competitive and agile.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of asset finance

The main types of asset finance available to Australian businesses are:

What can I use asset finance for?

Asset finance is versatile and can be used for many business needs:

Vehicles

Fund cars, vans, trucks and specialised vehicles for business operations.

Machinery & Equipment

Purchase essential tools and equipment for construction, agriculture or manufacturing.

Technology & IT

Finance computers, servers, software, and communication systems.

Office Furniture

Acquire desks, chairs, shelving, fixtures and fittings for your workplace.

Construction Equipment

Fund excavators, cranes, loaders, bulldozers and other heavy machinery.

Commercial Property

Acquire or develop warehouses, retail spaces, or office buildings.

Manufacturing Equipment

Finance specialised production lines, tools or CNC machinery.

Medical Equipment

Fund diagnostic devices, surgical tools and patient care systems.

Hospitality Equipment

Acquire commercial kitchens, refrigeration and fit-out equipment.

Renewable Energy

Invest in solar panels, wind turbines and sustainable energy solutions.

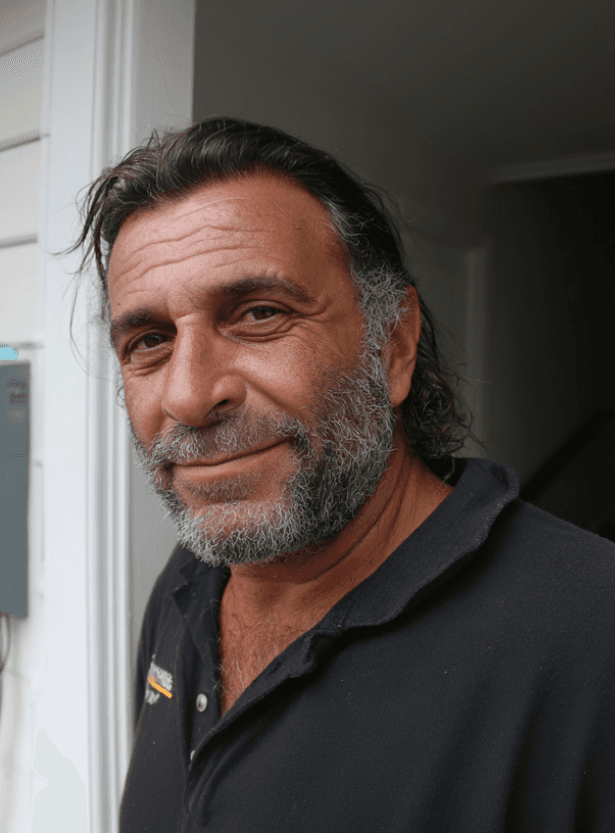

Case Study

David Harris, Northern Freight Solutions

Growing a Transport Fleet with Asset Finance

Industry: Transport & Logistics

Challenge: Limited fleet size meant turning down contracts and missing growth opportunities.

Solution: A 5-year chattel mortgage secured against three prime movers and trailers.

David runs a freight company in South Australia. Demand was growing, but he lacked the fleet capacity to service new contracts. Through Emu Money, he secured asset finance for three prime movers and trailers under a 5-year chattel mortgage. Repayments were structured monthly, aligned with invoicing cycles. The new fleet allowed him to take on major clients, expand routes, and double turnover within 18 months — all while maintaining predictable repayments.

How much can I borrow with asset finance?

In Australia, asset finance typically ranges from $10,000 for smaller purchases up to several million dollars for large-scale projects. The borrowing amount depends on the type, value and expected life of the asset, as well as your business’s financial position.

Lenders usually consider the resale value and income-generating potential of the asset when deciding limits. Because the loan is secured against the asset itself, approval is often simpler and pricing more competitive compared to unsecured loans.

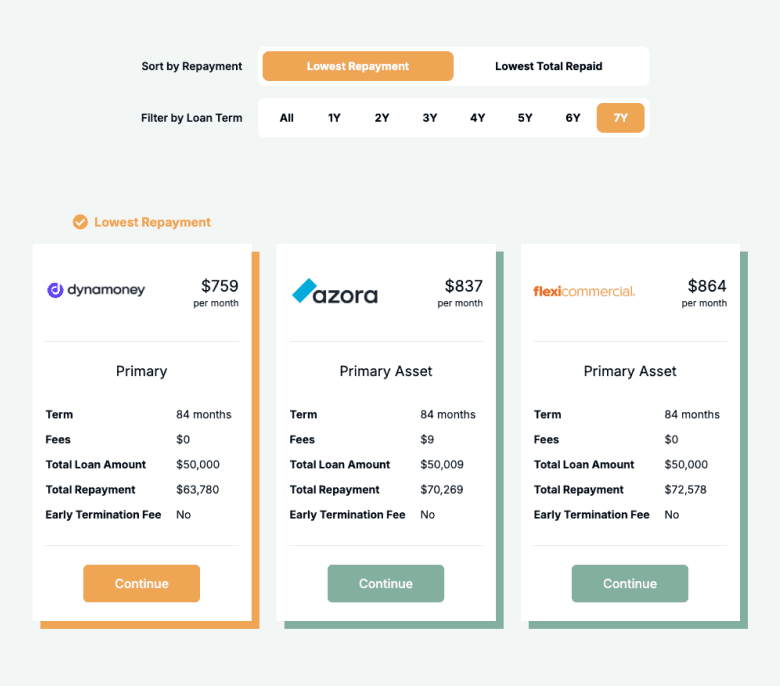

Asset Finance Repayment Calculator

Estimate repayments and total cost. Adjust the loan amount, term and rate to plan your budget before you apply.

Balance over time

Am I eligible for asset finance?

Eligibility is generally straightforward, as the asset provides collateral. Lenders assess turnover, bank statements and repayment history when reviewing applications.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Operating a registered business

Able to provide recent financials or bank statements

Hold an ABN (and GST registration if required)

How to apply for asset finance

Apply online in minutes and get instant quotes from our panel of lenders. Choose the best option, submit documents, and funding can often be arranged within 24–72 hours.

Documents you may need:

ABN and GST registration details

Photo ID (passport or driver’s licence)

Recent bank statements

Tax returns or financials (for larger loans)

How to save money on asset finance

The total cost of asset finance depends on loan term, rate, and repayment frequency. Shorter terms reduce overall interest but increase monthly outgoings, while longer terms ease cash flow but increase total costs.

Compare multiple lenders to secure the sharpest deal. Watch for hidden costs like establishment, documentation, or early termination fees. Align repayment schedules with revenue cycles to reduce stress and late fees. Where possible, make additional repayments to cut down interest.

Understanding asset finance options

Asset finance products can differ significantly in structure. Here are key features to understand before choosing:

Security: Asset-backed

Most asset finance loans are secured against the asset itself. This reduces lender risk, supports higher borrowing limits, and allows for more competitive interest rates compared to unsecured facilities.

Personal Guarantee

Directors or owners may be asked to provide a personal guarantee. This makes you personally responsible if repayments aren’t met, reducing lender risk but enabling access to sharper terms.

Term & Balloon

Asset finance terms generally run 1–10 years. A balloon or residual payment can reduce regular instalments, but you’ll need to pay or refinance the lump sum at the end of term.

Interest Structure

Most facilities use fixed interest rates, offering repayment certainty. Some lenders also provide variable options, which may start lower but can fluctuate. Compare carefully to match risk tolerance.

Fees & Charges

Fees can include establishment, documentation, ongoing service and early payout charges. Always calculate the true cost of borrowing, not just the interest rate, to avoid unexpected expenses.

Repayment Frequency

Repayments can be scheduled weekly, fortnightly, monthly or seasonally. Choosing a structure that aligns with your business’s revenue cycle ensures smoother cash flow management and fewer late fees.

Testimonials

Verified Review

Gabe H.

Verified Review

I got my car loan approved within very short period of time , Bindia is very cooperative and friendly, and always gives right financial advice. Highly recommended.

ankur p.

Verified Review

I found Erin through facebook and I would recommend her to everyone she's professional, Erin was very knowledgeable about different lander's and helped me secure a great rate for my car loan, Erin was always available to answer my questions and kept me updated throughout the entire process and she's honest and reliable I would give her more than 5 stars if I could I highly recommend Erin

Nasratullah

Verified Review

I had Baron as my broker for a car loan, and the entire process was incredibly smooth and straightforward. All I had to do was answer a few questions and provide the necessary documents — Baron handled the rest. Before I knew it, I was finalizing the paperwork for my new car. Highly recommend — really appreciate all your help, Baron!

Donna C.

Verified Review

Fantastic experience. Very seamless process, all done online and settlement was exactly when required. Highly recommend Adam. He was a pleasure to do business with on our first loan with Emu Money.

Vicki

Verified Review

Theodore G.

Frequently Asked Questions

Asset Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.