Compare Farm Equipment Finance from 50+ Australian Lenders

Get tractors, harvesters and essential farm machinery without large upfront costs. Compare tailored quotes in minutes with no impact on your credit score.

5.0 rating

Farm Equipment Finance Made Simple

Finance the machinery and tools your farm needs to thrive. Designed for Australian farmers and agribusinesses looking for affordable, flexible funding.

Borrow With Confidence

Typical amounts from $10,000 to $2 million+

Flexible Terms

Loan terms from 1 to 7 years

Fast Approval

Funding often within 24–48 hours

Secured by Equipment

The asset serves as collateral for lower rates

Seasonal Repayments

Match repayments to harvest or livestock income cycles

Any Farm Purpose

From tractors to irrigation, storage and fencing

How Farm Equipment Finance Works

We connect you with lenders offering tailored farm finance so you can invest in equipment with confidence.

Apply online in minutes

Enter details about your farm and the equipment you need.

Get matched offers

Receive quotes from lenders who specialise in agricultural finance.

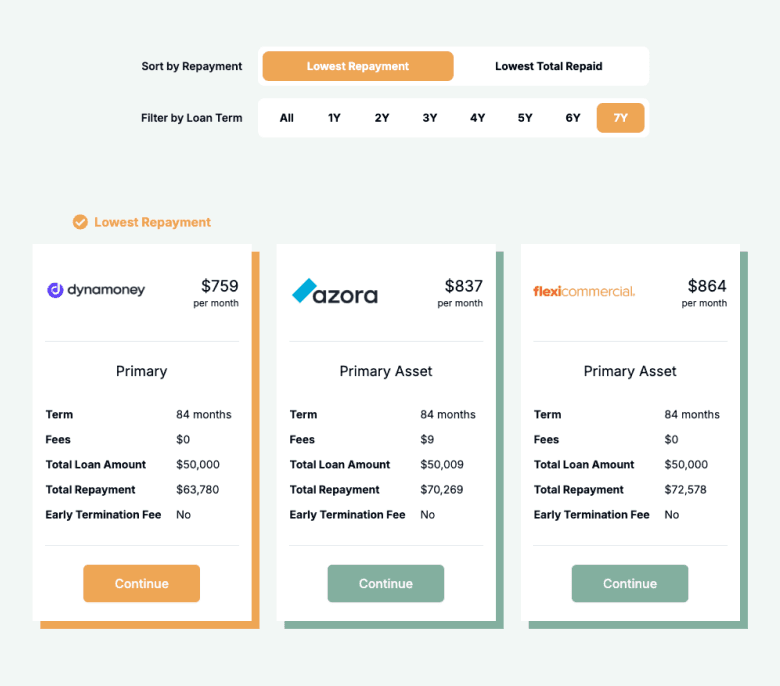

Choose your loan

Compare terms, rates and repayment structures to pick the right option.

Get approved & funded

Approval and funding often within 24–48 hours.

A quick guide to farm equipment finance

Farm equipment finance provides Australian farmers with the ability to purchase essential machinery without the burden of upfront costs. Instead of depleting working capital, repayments are spread over time, preserving cash for wages, feed, seed and day-to-day running expenses.

Most loans are secured against the equipment, which lowers risk for lenders and helps secure competitive interest rates. Terms typically range from 1 to 7 years, and many lenders offer seasonal repayment structures to match harvest and livestock income cycles.

Farm equipment finance can cover almost any agricultural need — from tractors and harvesters to irrigation, fencing, storage, or milking systems. Whether you’re modernising equipment, expanding production, or improving efficiency, tailored finance ensures you stay competitive.

For many Australian farmers, this finance is essential: it provides access to the latest technology, supports productivity and ensures farms remain sustainable and profitable in an industry with high capital costs.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of farm equipment finance

Here are the most common finance products farmers use to acquire equipment:

What can I use farm equipment finance for?

Farm equipment finance covers a wide range of agricultural machinery and infrastructure:

Tractors

Essential for ploughing, planting and harvesting across farms of all sizes.

Harvesters

Improve efficiency with modern harvesters for wheat, corn, soybeans and more.

Planting & Seeding

Finance precision seeders and planting equipment to boost yields.

Sprayers

Purchase fertiliser and pesticide sprayers to improve crop health and output.

Hay & Forage

Fund equipment for harvesting and storing hay and silage for livestock.

Livestock Handling

Invest in handling systems like chutes, gates and pens for safety and efficiency.

Irrigation Systems

Install or upgrade irrigation to secure reliable water supply for crops.

Grain Storage

Construct or expand grain storage facilities for post-harvest management.

Milking Equipment

Finance milking machines and tanks to support dairy operations.

Fencing & Containment

Build or upgrade fencing to keep livestock safe and secure.

Case Study

Claire Williams, Williams Family Farms

Boosting Yields with Farm Equipment Finance

Industry: Agriculture

Challenge: Outdated machinery leading to inefficiency and reduced crop yields.

Solution: A 6-year chattel mortgage secured against a new harvester and irrigation system.

Claire runs a mixed-crop farm in regional Victoria. With ageing machinery, she faced delays at harvest and uneven irrigation that reduced yields. Through Emu Money, she compared farm equipment finance options and secured a 6-year chattel mortgage for a modern harvester and irrigation upgrade. Repayments were structured to align with seasonal cash flow. The new equipment increased efficiency, boosted yields, and allowed her to expand into new crops — with predictable repayments that supported long-term planning.

How much can I borrow with farm equipment finance?

Farm equipment finance in Australia typically ranges from $10,000 for small machinery to several million dollars for specialist equipment or infrastructure. Borrowing limits depend on the equipment’s cost, age and expected life, as well as your farm’s financial profile.

Because loans are secured against the equipment, lenders can often provide higher borrowing amounts and more competitive interest rates than unsecured loans.

Farm Equipment Finance Repayment Calculator

Estimate repayments and total cost. Adjust the loan amount, term and interest rate to plan your cash flow.

Balance over time

Am I eligible for farm equipment finance?

Eligibility is generally straightforward since farm equipment is an income-producing asset. Lenders assess turnover, bank statements and repayment history when reviewing applications.

You may be eligible if you are:

An Australian citizen or permanent resident

Over 18 years old

Operating a registered farm or agribusiness

Able to provide recent bank statements

Hold an ABN (and GST registration if required)

How to apply for farm equipment finance

Apply online in minutes and get instant quotes from multiple lenders. Select your preferred option, upload documents, and funding can often be arranged within 24–48 hours.

Documents you may need:

ABN and GST registration details

Photo ID (driver’s licence or passport)

Recent business bank statements

Tax returns or financials (for larger loans)

How to save money on farm equipment finance

Saving money on farm equipment finance comes down to comparing offers and structuring terms correctly. A shorter term reduces total interest but increases repayments, while a longer term eases cash flow but costs more overall.

Many lenders offer seasonal repayment schedules that align with harvest income, reducing stress during slower months. Watch for establishment or early repayment fees, which can add up.

If your farm has strong revenue, making extra repayments can reduce interest costs over time. Aligning repayment frequency with your income cycle also helps manage cash flow effectively.

Example: $350,000 financed at 7.75% p.a.:

| Term | Repayment Amount | Total Amount to Repay |

|---|---|---|

24 months | $15,811 | $379,464 |

36 months | $10,957 | $394,452 |

48 months | $8,580 | $411,840 |

60 months | $7,079 | $424,740 |

Understanding farm equipment finance options

Farm equipment finance products differ in structure. Here are the key features to consider before applying:

Security: Asset-backed

Loans are secured against the equipment, lowering risk for lenders and improving access to better rates.

Personal Guarantee

Some lenders request a personal guarantee from the farmer or business owner.

Term: Fixed vs Seasonal

Loans usually run 1–7 years, with options for seasonal repayment schedules.

Interest Structure

Fixed rates are most common, giving predictable repayments. Variable rates are less common but available.

Fees & Charges

Establishment fees, ongoing account fees, and early termination charges may apply.

Repayment Frequency

Repayments may be weekly, monthly, or seasonal — align with your farm’s cash flow cycle.

Testimonials

Verified Review

We just got our truck loan they are very supportive and Eujin guide us in really good way we are happy with service really appreciate EUJIN cheers

Lky 2.

Verified Review

I was completely impressed with their professionalism and customer service.. highly recommend. Special Mention to Ray thank you for assisting me in this journey

David A.

Verified Review

What a great bloke to deal with... Thank you Brad for all your help and making our dream a reality. We will be contacting you again shortly.

John Z.

Verified Review

I've worked with Brad for quite some time, and after 25+ years in business across Australia, I can say with confidence: professionals like him are rare, in his case, unique in the industry. Brad understands business, printers, people, and lenders better than anyone I've worked with. The advice he's given, the care he's shown, and the way he's gone above and beyond to make sure my customers get the best deal possible has made a real impact. Some of my customers haven't just grown, they have exceeded expectations. For me, that's the proof in the pudding.

Gus A.

Verified Review

I would like to highly recommend Eujin from Emu Money for the excellent service provided during my loan process. His guidance, professionalism, and clear communication made the entire experience smooth and stress-free. I truly appreciate his support and would confidently recommend Emu Money to anyone seeking loan assistance.

Chathushka H.

Verified Review

I applied for a car loan with the help of Emu Money a week ago, and the process was very fast and easy. There was no stress at all, as everything was taken care of by Krish, who managed my application from start to finish. He was very easy to communicate with and clearly explained the entire process and what was required from me. He was also quick to provide updates throughout. I would definitely recommend Emu Money to anyone looking for a smooth and hassle-free loan experience.. Thank you Krish.

Saritha A.

Frequently Asked Questions

Farm Equipment Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.