Compare Truck Finance Options from 50+ Australian Lenders

Upgrade, expand or replace your trucks with tailored finance solutions. Access competitive rates and flexible terms designed for transport, logistics and construction businesses.

5.0 rating

Truck Finance Made Simple

Finance heavy vehicles for business growth. Choose from chattel mortgage, lease or hire purchase with repayments matched to your cash flow and fleet needs.

High Borrowing Power

From $20,000 to several million

Flexible Terms

1 to 7 years, tailored to truck life cycle

New or Used

Dealer, private sale or auction supported

Specialised Vehicles

Prime movers, tippers, refrigerated and more

Competitive Rates

Secured finance with sharp pricing

Any Industry

Logistics, construction, agriculture, rental

How it works

We match your truck finance application to Australia’s leading lenders so you get competitive options fast.

Apply online

Tell us about your business and the truck you’re buying.

See matched options

We’ll compare chattel mortgage, lease and hire purchase from 50+ lenders.

Provide documents

Upload ID, ABN and financials if required for higher loan amounts.

Settle & collect

We liaise with the seller to finalise payment so you can put your new truck to work.

A quick guide to truck finance

Truck finance helps Australian businesses acquire heavy vehicles without tying up large amounts of cash. Options include chattel mortgage, finance lease and hire purchase, all secured against the vehicle itself.

Funding typically covers 100% of the purchase price plus extras like fit-outs, registration and insurance. Terms are flexible and can be aligned with the expected working life of the truck. Whether you’re buying a single prime mover, replacing ageing tippers, or scaling an entire fleet, truck finance provides structured repayments that protect working capital while keeping your business moving.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of truck finance

Choose a structure aligned to tax benefits, cash flow and ownership goals:

What can I use truck finance for?

Truck finance can fund almost any heavy vehicle requirement across industries:

Expanding Fleet Capacity

Add new trucks to your fleet to meet growing customer demand and expand delivery or service areas. Finance options make it easier to scale without draining working capital, keeping cash available for fuel, staff and maintenance while still growing capacity.

Upgrading Vehicles

Replace older trucks with modern models that are more fuel-efficient, reliable and compliant with the latest safety standards. Newer trucks reduce downtime, lower running costs, and provide drivers with safer, more comfortable vehicles.

Replacing Ageing Assets

Avoid costly breakdowns and constant repairs by financing the replacement of ageing or underperforming trucks. With predictable repayments, you can improve operational reliability and reduce the financial uncertainty of unexpected maintenance.

Specialised Trucks

Acquire trucks tailored for specific industries, such as refrigerated units for food transport, cement mixers for construction, or tippers for earthmoving. Financing enables you to spread the cost of these high-value assets while keeping operations competitive.

Expanding into New Markets

Support growth into new locations or service lines by acquiring trucks suited to the new demand. Whether it’s regional deliveries or interstate haulage, financing provides the assets needed to enter new markets with confidence.

Meeting Seasonal Demand

Finance additional trucks to handle seasonal peaks in industries like agriculture, retail and logistics. Flexible loan options can help you add capacity when needed, ensuring your business remains responsive without long-term strain.

Rental & Leasing Businesses

If you operate in the rental or leasing sector, truck finance can fund new vehicles to expand your fleet and attract new customers. Structured repayments allow you to align financing costs with ongoing rental income streams.

Diversifying Services

Expand your service offering by financing trucks that allow you to deliver additional solutions to clients. From bulk haulage to refrigerated transport, adding new vehicle types can help win more contracts and increase revenue potential.

Improving Productivity

Invest in trucks with better fuel efficiency, payload capacity, and technology integrations to boost productivity. Financing ensures you stay up to date with the latest equipment that helps lower costs and maximise output.

Sustainability & Compliance

Access trucks that meet stricter emissions standards or use alternative fuels, positioning your business as environmentally responsible. Finance can help fund the transition to a greener fleet, keeping you compliant and competitive.

Case Study

Michael Grant, LogiTrans Freight

Scaling a Logistics Fleet with Truck Finance

Industry: Logistics

Challenge: High demand for interstate freight required additional trucks to keep up with contracts.

Solution: A multi-vehicle truck finance package including prime movers and trailers with staggered terms.

LogiTrans had secured several new contracts but needed additional trucks quickly. Through Emu Money, they accessed a multi-vehicle truck finance facility covering both prime movers and trailers. Structured repayments and staggered loan terms helped the company balance cash flow, maintain profitability and service new clients on time.

How much can I borrow with truck finance?

Truck finance in Australia typically starts from $20,000 and can extend to several million depending on the vehicles and your financials. Lenders usually fund up to 100% of the purchase price for newer trucks, with LVRs between 70% and 90% depending on credit and collateral. Your borrowing power depends on turnover, trading history, bank statements, and repayment capacity.

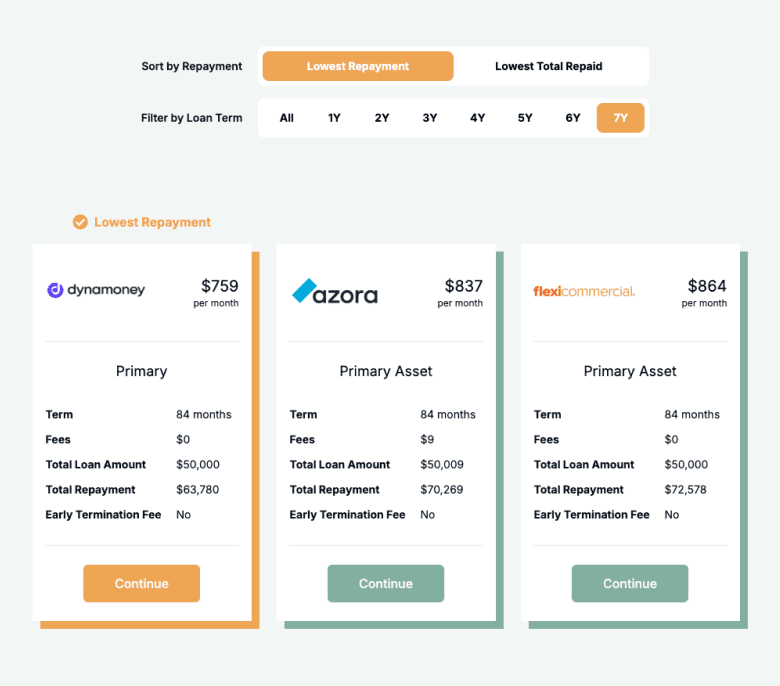

Truck Finance Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term and rate to plan cash flow before you apply.

Balance over time

Am I eligible for truck finance?

Eligibility depends on your business’s financial health, the type of truck being financed, and lender criteria. Stronger businesses with steady turnover, healthy bank statements and newer vehicles generally secure sharper pricing and higher limits.

You may be eligible if you are:

An Australian business with an active ABN

GST registered (in most cases)

Trading for at least 12 months (start-ups may be considered)

Minimum monthly turnover of $10,000

Purchasing a truck for business or commercial use

How to apply for truck finance?

Apply online with details of your business and the truck you want to finance. We’ll compare lenders across chattel mortgage, lease and hire purchase, then guide you through documentation and settlement. Finance can often be arranged within days once valuation and credit checks are complete.

Documents you may need:

ABN and GST registration details

Photo ID (driver’s licence or passport)

Business bank statements (6 months+)

Tax returns or BAS (for higher amounts)

Truck details (VIN, rego, purchase invoice/quote)

How to save money on truck finance

Truck finance is a major investment, so structuring it well reduces long-term costs. Compare lenders not only on rates but also fees and flexibility. Consider balloons or residuals to reduce monthly repayments but ensure they align with resale value. Bundling insurance, rego and fit-outs at settlement can be financed at the same rate, keeping costs predictable. Extra repayments or early payout options can also save money if managed carefully.

Understanding truck finance options

Truck finance isn’t one-size-fits-all. The right loan structure depends on your cash flow, risk profile, and how you plan to use the vehicle. Here are key options and features to consider:

Secured Loans

A secured loan uses the truck itself—or another asset—as collateral, which lowers the lender’s risk. This typically results in sharper interest rates and higher borrowing limits. Secured loans suit businesses looking for predictable repayments and confidence that they can cover the obligation through ongoing contracts or freight work.

Unsecured Loans

For businesses without collateral or those wanting faster approvals, unsecured truck loans can provide access to funds. They usually carry higher rates and lower limits, but offer flexibility if you need to get on the road quickly. Lenders assess your credit, turnover, and trading history more heavily in these cases.

Balloon & Residual Payments

Some lenders allow a balloon or residual at the end of the loan, reducing monthly repayments during the term. This option frees up cash flow but requires planning for the lump-sum settlement or refinancing later. It’s popular when trucks are expected to retain strong resale or trade-in value.

Early Termination & Extra Repayments

Not all truck loans are locked in. Certain lenders allow early termination or extra repayments without heavy penalties, giving businesses flexibility to clear debt ahead of schedule. This feature is valuable if you expect higher income periods, asset sales, or want to cut interest costs by paying down faster.

Flexible Loan Terms

Truck finance can stretch from short 12-month contracts to longer 7-year arrangements. Shorter terms suit businesses seeking to minimise interest, while longer terms reduce monthly commitments and better align with vehicle lifespan. The right term depends on your cash flow stability and how long you plan to keep the truck.

Testimonials

Verified Review

I applied for a car loan with the help of Emu Money a week ago, and the process was very fast and easy. There was no stress at all, as everything was taken care of by Krish, who managed my application from start to finish. He was very easy to communicate with and clearly explained the entire process and what was required from me. He was also quick to provide updates throughout. I would definitely recommend Emu Money to anyone looking for a smooth and hassle-free loan experience.. Thank you Krish.

Saritha A.

Verified Review

I've worked with Brad from Emu Money a few times now, and I highly recommend. Brad is very responsive to emails (even when on holiday in Fiji), keeps me up to date and gets everything organised very quickly. Brad spoke directly with my supplier and they figured everything out. I won't hesitate to work with Brad again.

Christine F.

Verified Review

We have received a tremendous service from Geetu and team they have helped us smoothly in getting the loan approved. I will definitely recommend to my friends and family.

Kiranjit K.

Verified Review

What an amazing experience I had with Baron from Emu Money. He provided efficient and reliable advice and services.

Kayla H.

Verified Review

I would like to highly recommend Eujin from Emu Money for the excellent service provided during my loan process. His guidance, professionalism, and clear communication made the entire experience smooth and stress-free. I truly appreciate his support and would confidently recommend Emu Money to anyone seeking loan assistance.

Chathushka H.

Verified Review

Robyn was amazing the way she went through each step made it so easy to understand and having a joke along the way it was like chatting to a mate well done Robyn winner

Steve G.

Frequently Asked Questions

Truck Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.