Compare Heavy Vehicle Finance from 50+ Australian Lenders

Finance prime movers, rigids, tippers and buses with flexible structures like chattel mortgage, hire purchase or finance lease. Sharp rates, fast approvals.

5.0 rating

Heavy Vehicle Finance Made Simple

From linehaul to civil works, the right truck or bus keeps contracts moving. Finance tailored to cash flow, utilisation and asset life.

Borrow With Confidence

From $30,000 up to $1,000,000+ depending on profile and asset

Flexible Terms

1 to 7 year terms with optional balloons/residuals

Fast Approvals

Same-day decisions possible for eligible applications

New or Used

Dealer, auction or private sales supported

Tax-Smart Structures

Chattel mortgage, hire purchase, finance lease

Fit-outs & Bodies

Finance bodies, cranes, fridges, hydraulics and telemetry

How it works

We match your application to lenders that specialise in heavy vehicles so you can compare options with confidence.

Apply online in 3 minutes

Share business details, vehicle specs and budget.

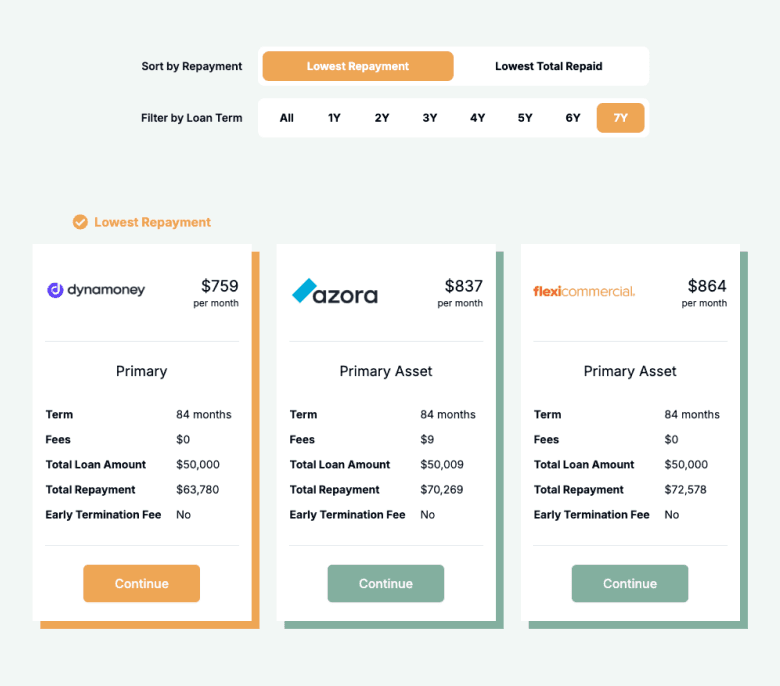

See matched options

Our Lender Match compares structures, rates and terms side-by-side.

Upload documents

Provide ID, ABN/GST and bank statements (financials for higher limits).

Settle & collect

We coordinate with the seller/body builder so you can get on the road sooner.

A quick guide to heavy vehicle finance

Heavy vehicle finance helps Australian transport, civil and resources businesses acquire trucks and buses without draining working capital. Common structures include chattel mortgage (ownership from day one), commercial hire purchase (ownership transfers at the end) and finance lease (use during the term with a residual). Pricing and limits depend on turnover, time in business, credit health and asset specs (age, kilometres/hours, body and purpose). Balloons/residuals can lower repayments to match asset life and contract cash flow. Whether you’re adding a prime mover for interstate work or fitting a tipper for quarry runs, the right structure keeps cash flow predictable.

Want to skip ahead?

This guide is broken down into the following sections. Click a link if you want to skip ahead.

Types of heavy vehicle finance

Choose a structure aligned to ownership, tax treatment and cash flow:

What can I use heavy vehicle finance for?

Finance can cover the base vehicle and many specialist bodies or attachments.

Prime Movers & Linehaul

Add or upgrade prime movers for interstate and B-double work; finance telematics and aero kits.

Tippers & Dump Trucks

Rigid tippers and dog trailers for quarry, civil and aggregate runs; include hydraulics and bodies.

Crane & Hook-Lift Trucks

Install cranes, hook-lifts or tail-lifters for construction and waste applications.

Refrigerated Rigids

Chill/freezer bodies for food and pharma logistics with compliant insulation and refrigeration units.

Waste, Vacuum & Tankers

Compactors, vacuum trucks and water carts configured for councils, mining and site services.

Bus & Coach

Route buses, school buses and coaches, including seat fit-outs and accessibility options.

Case Study

Renee P, North-South Linehaul Pty Ltd

Lower repayments with a well-sized residual

Industry: Linehaul Transport

Challenge: Needed a late-model prime mover without stretching monthly cash flow during shoulder seasons.

Solution: Finance lease, 60-month term with a 30% residual aligned to expected resale value.

A Brisbane transport operator financed a Euro 6 prime mover. By choosing a finance lease with a 30% residual, monthly repayments stayed lean while the business kept capital for fuel and tyres. Based on historical resale, the residual is expected to be largely cleared at term end, simplifying upgrades.

How much can I borrow with heavy vehicle finance?

Typical facilities range from $30,000 to $1,000,000+ per asset. Limits depend on turnover, trading history, contract pipeline, and the vehicle’s age/specs. Many lenders fund up to 100% of purchase price for newer assets (plus body/fit-out); older or highly specialised units may have lower LVRs and shorter terms.

Heavy Vehicle Finance Repayment Calculator

Estimate repayments and total cost. Adjust the amount, term, rate and balloon to plan cash flow before you apply.

Balance over time

Am I eligible for heavy vehicle finance?

Lenders focus on serviceability, trading stability and asset suitability. Newer, lower-kilometre vehicles and reputable body builders usually attract sharper pricing. Contracted work and healthy bank statements improve approval odds.

You may be eligible if you are:

An Australian business with active ABN (GST preferred for larger limits)

Over 18 years old

Trading for 12+ months (start-ups considered case-by-case with evidence of contracts)

Consistent monthly turnover and clean credit history

Purchasing an eligible asset (prime mover, rigid, tipper, tanker, bus/coach)

How to apply for heavy vehicle finance?

Apply online in minutes. We’ll compare offers across chattel mortgage, hire purchase and lease options, then coordinate settlement with the dealer or body builder.

Documents you may need:

ABN and GST details

Photo ID (driver’s licence or passport)

Business bank statements (3–6 months)

Tax returns/BAS for larger limits

Vehicle specs (VIN, rego, build sheet/quote) and any contract evidence

How to save money on heavy vehicle finance

Compare structures—not just rates—as tax treatment and cash-flow outcomes differ. Size the residual/balloon to match realistic resale values and kilometres/hours. Bundle bodies and fit-outs (cranes, fridges, hydraulics, telemetry) at settlement so they’re financed at the same rate. Newer, fuel-efficient models often qualify for sharper pricing and lower whole-of-life costs.

Example: Residual impact — $180,000 over 60 months at 8.49% p.a.:

| Residual/Balloon | Approx. Monthly Repayment | Notes |

|---|---|---|

$0 | $3,692 | Highest monthly cost |

10% ($18,000) | $3,450 | Lower monthly cost |

20% ($36,000) | $3,208 | Balanced cost vs cash flow |

30% ($54,000) | $2,967 | Lowest monthly cost; plan resale/refinance at term end |

Understanding heavy vehicle finance options

Set up finance to suit ownership goals, upgrade cycles and budgeting certainty.

Secured vs Unsecured

Most heavy vehicle loans are secured against the asset for sharper rates; unsecured options cost more and have lower limits.

Residual/Balloon Payments

Lower monthly costs by deferring a lump sum to the end—payout, refinance or trade at term.

Fixed vs Variable Rates

Fixed gives certainty for budgets; variable may save if market rates fall, but adds rate risk.

Early Repayment Flexibility

Some lenders allow early payout or extra repayments; others charge break fees—check before you sign.

Fit-outs at Settlement

Bodies, cranes, fridges and hydraulics can often be financed alongside the base vehicle.

Testimonials

Verified Review

Brad was great, honest, responsive and on the ball, thanks for your help :)

Chantelle F.

Verified Review

I got my car loan approved within very short period of time , Bindia is very cooperative and friendly, and always gives right financial advice. Highly recommended.

ankur p.

Verified Review

I've worked with Brad from Emu Money a few times now, and I highly recommend. Brad is very responsive to emails (even when on holiday in Fiji), keeps me up to date and gets everything organised very quickly. Brad spoke directly with my supplier and they figured everything out. I won't hesitate to work with Brad again.

Christine F.

Verified Review

We recently purchased a vehicle. Peter was very helpful, with clear instructions and real outcomes. Within 48 hrs the deal was done, only 3-5 emails, a couple of phone calls. That was a super efficient experience. We would go back!

Kishan K.

Verified Review

I had such a great experience with Evette when sorting out my car loan. She made the whole process really easy and stress-free, was always quick to answer any questions, and genuinely cared about getting me the best outcome. Super friendly and professional. I'd happily recommend Evette to anyone looking for a car loan!

Dillon F.

Verified Review

Very humble and respectful

Kazim A.

Frequently Asked Questions

Heavy Vehicle Finance FAQs

These helpful FAQs will help you find the answers you need. If you can't find what you're looking for, you can request a callback below.